Weak underlying demand from China amid an economic slowdown and rising costs contributed to a 1% fall in Rio Tinto’s (ASX: RIO) fourth-quarter Pilbara iron ore operations.

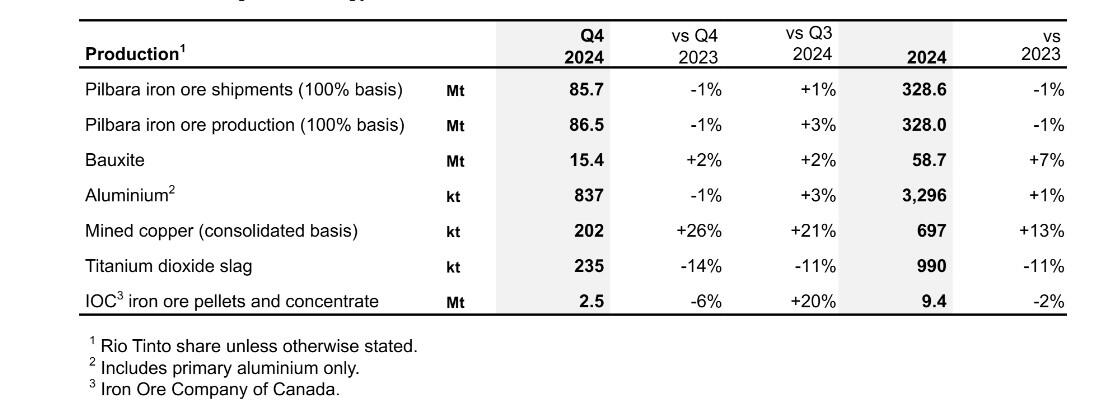

The miner exported 85.7 million tons of iron ore for the three months to Dec 31 - taking total annual shipments to 328.6 million tonnes - in line with 2025 production guidance of between 323 to 338 million tonnes which remains unchanged.

Due to inflation being at the higher end of the miner’s expectations and lower production, 2024 Pilbara iron ore unit cash costs are expected to have come in at the higher range of US$21.75 - US$23.50 per tonne guidance.

Shipments of copper jumped 26% in the fourth quarter to 202,000 tonnes. Reflecting the ramp-up of its You Tolgoi underground mine and increased production from the Escondida mine, mined copper production of 697,000 tonnes (on a consolidated basis) in 2024 was 13% higher than 2023.

2024 copper unit costs are expected to be unchanged at 140 to 160 US cents/lb guidance. Meanwhile, quarterly bauxite production rose 2% from the previous year and aluminium eased 1%. Despite the flat growth in iron ore production, Rio Tinto posted a 3% increase in sales volumes in the December quarter and production growth across commodities increased 1%.

Rio Tinto Chief Executive Jakob Stausholm described the operating performance in 2024 as consistent with the ongoing commitment to strengthen the business.

“We are making strong progress in delivering organic growth from our major projects. The Oyu Tolgoi underground copper mine in Mongolia continues to successfully ramp up, while the Simandou high-grade iron ore project in Guinea and our Western Range mine in the Pilbara are on schedule for first production this year,” said Stausholm.

“Significant milestones were achieved at our Rincon project in Argentina during the quarter, with first lithium delivered and receipt of Board approval to expand the operation, demonstrating both our operational capabilities and ambition to grow in battery materials.”

Meanwhile, the miner is nearing closer to completing its $11bn merger with Arcadium Lithium with regulatory approvals having been ticked off in recent weeks.

Rio has a market cap of $44.3 billion, its share price is down 5.57% over one year.