Transurban reported a 52.4% plunge in statutory net profit after tax for the 2025 financial year (FY25) as revenue fell and finance costs rose.

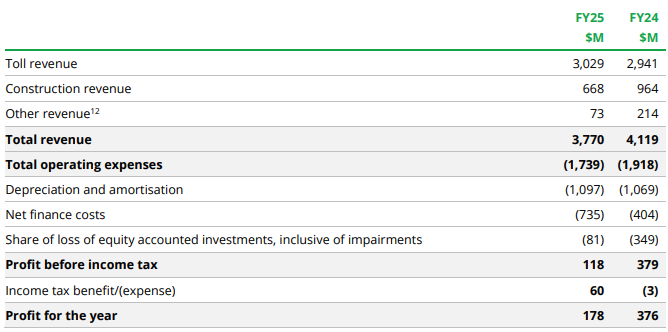

The toll road operator said profit fell to $178 million in the 12 months ended 30 June 2025 from $376 million in FY24 on revenue, which dropped 8.5% to $3.77 billion.

A 44% drop in construction revenue and a 66% fall in other revenue offset a 3% lift in toll revenue as average daily traffic volumes rose 2.2% while net finance expenses soared 45% to $735 million.

The company said proportional operating earnings before interest, tax, depreciation and amortisation (EBITDA) for FY25 rose 7.4% to $2.676 billion, supported by a proportional toll revenue increase of 5.6% to $3.732 billion.

Directors declared an unfranked final distribution of 33 cents per security to be paid on 22 August to security holders registered on 30 June 2025, bringing the full year payment to 65 cents, compared with 62 cents.

Transurban also forecast an increase in distribution to 69 cents in FY26, subject to traffic performance and macroeconomic factors.

Chief Executive Officer Michelle Jablko said the FY25 result reflected the hard work undertaken to restructure the business and lay the foundations for future growth.

“FY25 was a strong year, marked by continued progress on key strategic focus areas,” Jablko said in an ASX announcement.

She said traffic was up across all markets with North America the standout, growing it at 6.4% and delivering revenue growth of approximately 20% due to the value customers saw in its our Express Lanes.

The FY26 distribution guidance of 69 cents underscored the strong momentum built throughout FY25.

Transurban (ASX: TCL) stapled securities were trading 3% higher at $14.42 on Wednesday, capitalising the group at $43.52 billion.

Established in 1996, Transurban operates 22 toll roads in Australia, the United States and Canada.