Global toll roads operator Transurban has plunged to an A$47 million loss in the first half of the 2025 financial year (H1 FY25), down 123.3% on a year ago, despite an increase in traffic on its roads in Australia, the United States and Canada.

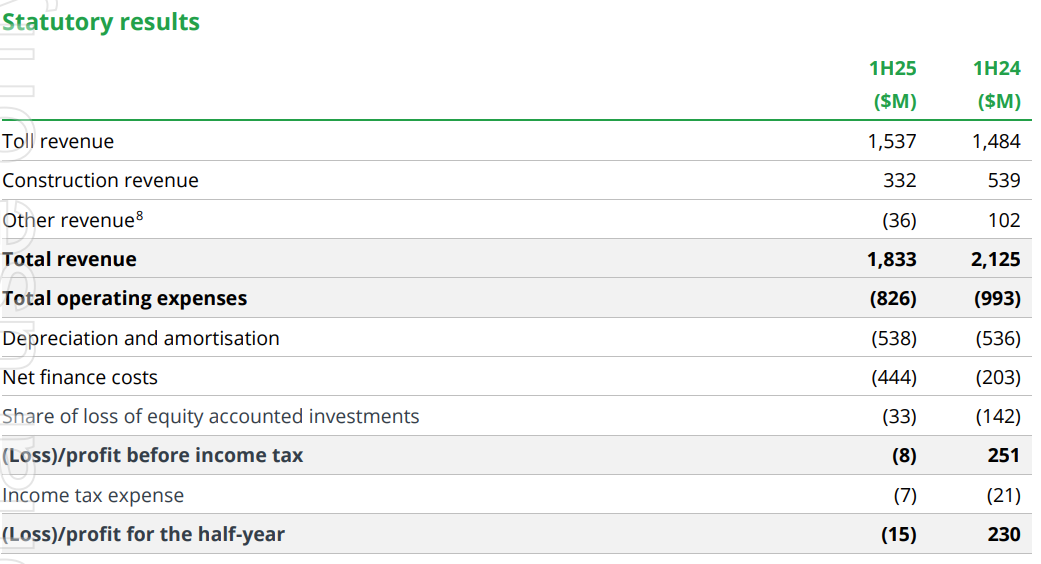

The company said the statutory net loss after tax was $15 million in the six months to 31 December 2024, a drop of 106.5% from H1 FY24, as revenue fell 13.7% to $1.833 billion, although average daily traffic rose 2.4% to 2.5 million trips.

Transurban also reported ‘proportional’ results, which adjust for major maintenance spending, mark-to-market movements in power purchase agreements and other accounting charges, which is more aligned to operational performance.

Proportional operating earnings before interest, tax, depreciation and amortisation (EBITDA) increased 9.4% to $1.452 billion, supported by growth in proportional toll revenue of 6.2% to $1.872 billion and improved cost control.

The company announced an interim distribution of 32 cents per stapled security, up from 30 cents a year earlier, to be paid on 25 February to security holders registered on 31 December 2024, and reaffirmed FY25 distribution guidance of 65 cents per security, up from 62 cents in FY24.

Chief Executive Officer Michelle Jablko said the result reflected the hard work undertaken to unlock the operational performance of the business.

She said the performance of the underlying business was robust with traffic growing 3.6% growth in the second-quarter traffic.

“We’ve achieved strong momentum in the first half of 2025. Traffic is up across all markets and costs have been well managed, driving a 10% increase in free cash for the half,” Jablko said in an ASX announcement.

“In addition to operating performance, Transurban remains focused on strengthening government partnerships, investment in customer value and laying the foundations for long-term growth.”

Transurban (ASX: TCL) securities closed at $13.20 on Wednesday, down one cent (0.75%), capitalising the company at $40.9 billion.