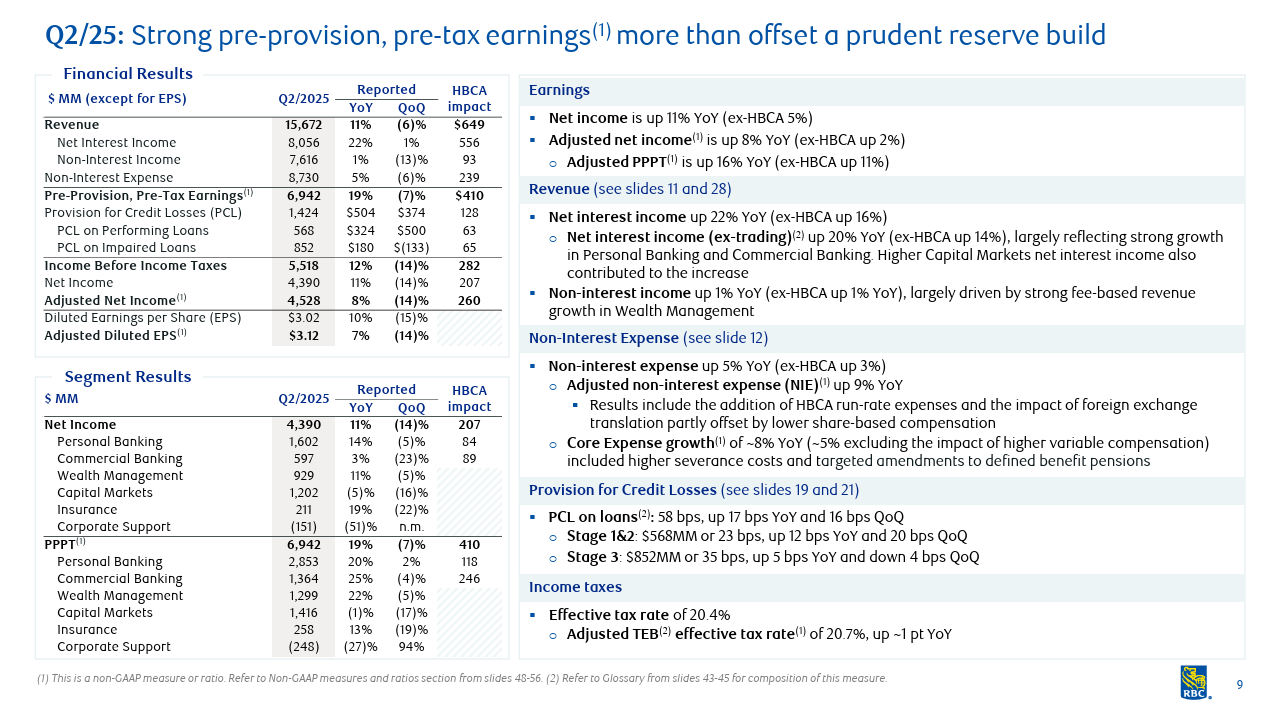

Royal Bank of Canada (RBC) reported net income of CA$4.4 billion (A$4.95 billion) for the quarter ended April 30, 2025, reflecting an 11% year-on-year increase.

Diluted earnings per share (EPS) rose 10% to $3.02, supported by strong performance in Personal Banking, Wealth Management, and Insurance, alongside improved results in Commercial Banking.

However, Capital Markets posted weaker earnings.

The inclusion of HSBC Canada contributed $258 million to net income.

Adjusted net income reached $4.5 billion, marking 8% growth, while adjusted diluted EPS came in at $3.12, up 7% but missing market estimates of $3.18.

Dave McKay, President and Chief Executive Officer of Royal Bank of Canada said, "We saw the strength of our diversified business model reflected across our largest segments in Q2, underpinned by our robust capital position, balance sheet strength and prudent, through-the-cycle approach to risk management.

"Importantly, in a quarter hallmarked by macroeconomic uncertainty and market volatility, Team RBC continued to step up for our clients with the advice, insights and experiences they expect from us. We also hosted an Investor Day, detailing how we are accelerating our ambitions to extend our leadership in Canada, grow in global fee pools, including in the United States – our second home market, leverage our data scale and artificial intelligence investments to create more value for clients and deliver on our medium-term objectives for our shareholders."

Provisions for credit losses (PCL) increased $504 million year-over-year, driven by a $324 million rise in PCL on performing loans.

The PCL on loans ratio climbed 17 basis points (bps) to 58 bps, reflecting macroeconomic uncertainties, including trade disruptions and tariffs.

Pre-provision, pre-tax earnings rose 19% to $6.9 billion, with HSBC Canada contributing $264 million. Excluding HSBC Canada, pre-provision, pre-tax earnings grew 15%, supported by higher net interest income, strong volume growth in Personal and Commercial Banking, and higher fixed-income trading revenue.

Quarter-over-quarter, net income declined 14%, with adjusted net income mirroring the drop. Pre-provision, pre-tax earnings fell 7% to $6.4 billion, primarily due to seasonally lower trading revenue, partially offset by lower variable compensation and higher net interest income.

The PCL on loans ratio increased 16 bps, driven by higher provisions in Commercial and Personal Banking.

The PCL on impaired loans ratio fell 4 bps to 35 bps, while the PCL on performing loans ratio rose 20 bps to 23 bps, reflecting deteriorating macroeconomic forecasts.

RBC maintains a strong capital position, with a Common Equity Tier 1 (CET1) ratio of 13.2%, supporting solid volume growth and $2.6 billion in shareholder returns through dividends and share buybacks.

The bank declared a quarterly dividend of $1.54 per share, a 4% increase, and announced plans to repurchase up to 35 million common shares, pending regulatory approval.

Earnings Overview

- Net income of $4.4 billion, up 11% YoY.

- Diluted EPS of $3.02, up 10% YoY.

- Adjusted net income of $4.5 billion was up 8% YoY.

- Total PCL of $1.4 billion, PCL on loans ratio up 16 bps QoQ.

- ROE of 14.2%, down 30 bps YoY.

Business Segment Performance

Personal Banking

Net income of $1.6 billion, up 14% YoY. Higher net interest income due to 7% deposit and 4% loan growth. PCL increased due to higher provisions for performance loans.

Commercial Banking

Net income of $597 million is up 3% YoY. Excluding HSBC Canada, net income decreased by 19%. Higher PCL largely due to performance loans.

Wealth Management

Net income of $929 million, up 11% YoY. Driven by higher fees-based client assets and market appreciation.

Insurance

Net income of $211 million, up 19% YoY. Improved claims experience and higher investment results contributed to growth.

Capital Markets

Net income of $1.2 billion, down 5% YoY. Growth in total revenue was offset by higher non-interest expenses and taxes.

Capital and Liquidity

CET1 ratio of 13.2%, above regulatory requirements. LCR of 131%, up from 128% last quarter. NSFR of 116%, indicating a strong liquidity position.

Credit Quality

Total PCL of $1.4 billion, up 55% YoY. PCL on loans ratio of 58 bps, up 17 bps YoY. PCL on performing loans increased due to macroeconomic forecast changes.

At the time of writing, Royal Bank of Canada's share price (TSE: RY) was CA$172.40, down $6.20 (3.47%) today. It has a market cap of around $243.83 billion.

Related content