Australian women are underrepresented in the investment market according to CoreLogic’s 2025 Women & Property Report.

The report released in the lead-up to International Women’s Day surveyed home ownership status, motivations, barriers and attitudes towards dwelling ownership between Australian men and women.

Overall, the report found that 40% of women said they didn’t own any investments, compared to 27.8% of men.

“The presence of a ‘gender investment gap’ for women is an established concept, and various studies identified factors such as having less income, more risk aversion, being less comfortable with maths or lower rates of financial literacy as contributors,” CoreLogic head of research and report author, Eliza Owen said.

One of the starkest differences was the ownership of cryptocurrencies, with 24.1% owning them in comparison to 8% of women.

There was also a gender gap in ownership of investment properties, with 14.2% of men owning them and 11.4% of women.

The survey also found a significant gap in shares and superannuation ownership, with 15.6% more men owning shares and 11.5% owning more men owning superannuation.

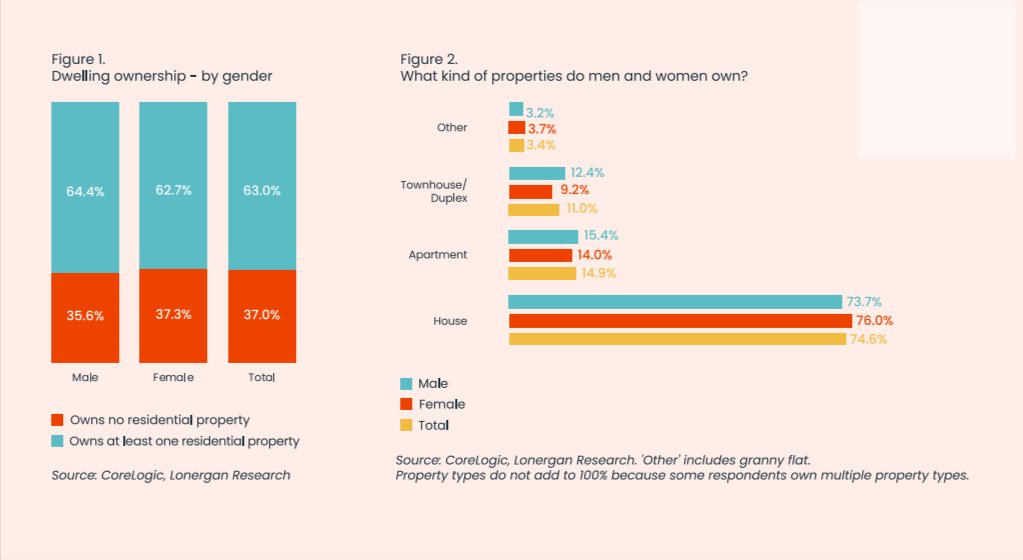

Despite the differences in investment ownership, the report found that a similar amount of men and women owned at least one dwelling.

“That's likely because of affordability drivers, leading to the formation of dual-income households as Australians become older and attain ownership of a family home,” Owen said.

There was also a discrepancy in ownership in investment and age, with Gen Z respondents being the least likely to own properties.

The research results found that only 13.8% of Gen Z men and 6.4% of women owned an investment property.

More than half of both Gen Z and Millenial women cited affordability as their greatest challenge in the home buying process in comparison to 16.8% of baby boomer women.

“It’s unsurprising to learn that younger generations identified affordability as more of a challenge in accessing the housing market,” Owen said.

“Affordability pressures have only become worse in the housing market over time, and younger people are generally on lower incomes because they have not had as much time in the workforce.”

While many women regarded property ownership with great importance, Owen said the gender pay gap still poses a persistent challenge.

“While the pay gap has been declining over time in Australia, this survey still finds a greater portion of women than men report challenges of accessing the housing market related to saving a deposit, high prices, and being approved for a loan due to financial conditions,” Owen said.