Billionaire investment oracle Ray Dalio warns the United States is sliding toward the same debt-fueled autocracy that consumed European democracies in the 1930s.

“I think that what is happening now politically and socially is analogous to what happened around the world in the 1930-40 period,” Dalio told the Financial Times.

The Bridgewater Associates founder, worth about US$15.4 billion, pointed specifically to Trump's 10% government stake in Intel as evidence of the "strong autocratic leadership" that historically precedes democratic collapse.

Most Wall Street execs are staying quiet because, as Dalio puts it - people are "afraid of retaliation" if they criticise the current administration.

The numbers are stacking up

With current data backing his claims and European central bankers echoing his concerns, the Bridgewater founder may be onto something.

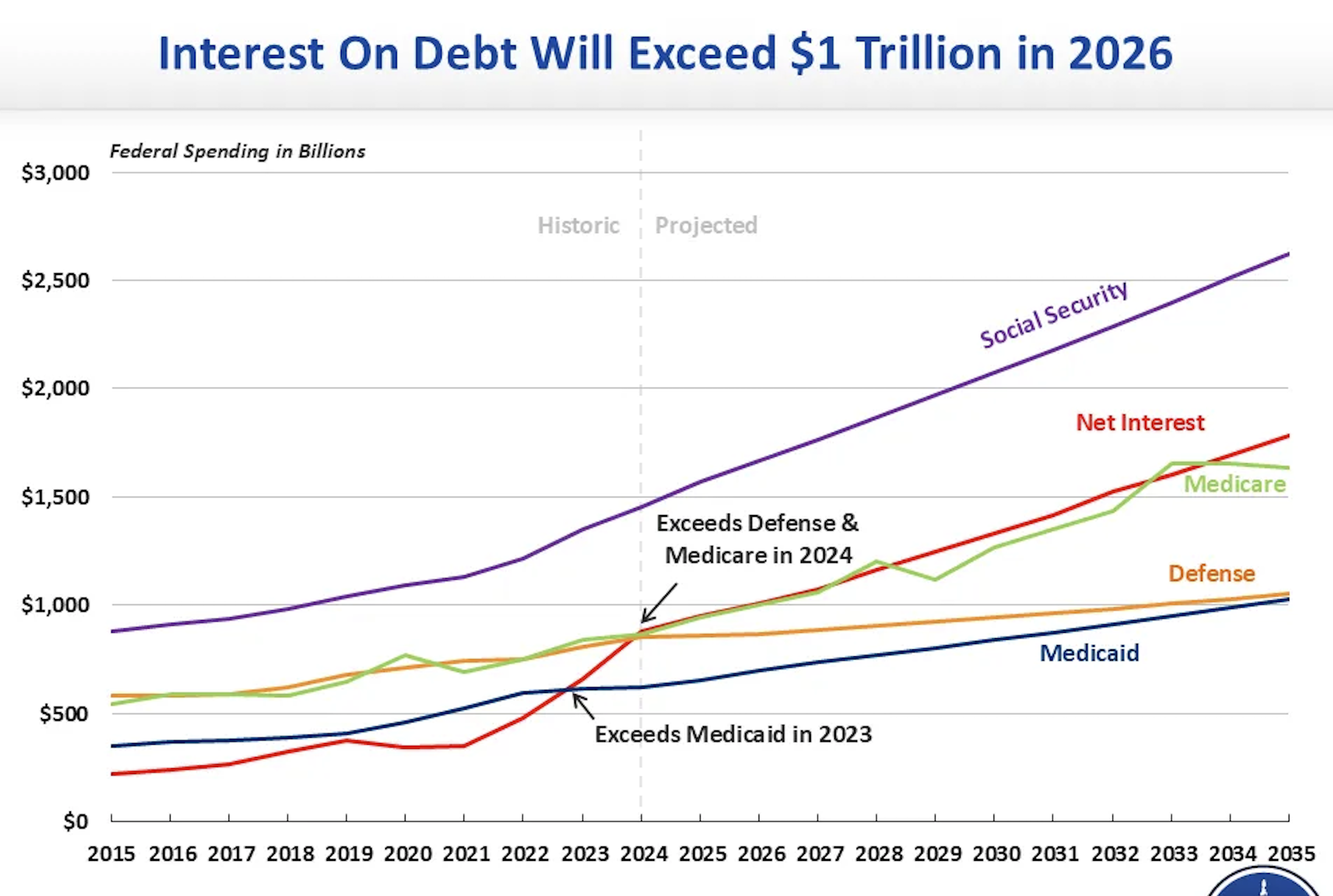

America's debt has reached $37.3 trillion, and interest payments now cost $879.9 billion annually - that's 13% of the entire federal budget.

The U.S. is now spending more on debt service than on Medicare or national defence, making interest payments the government's third-largest expense, behind Social Security and healthcare.

The Congressional Budget Office projects that interest payments will surpass $1 trillion in 2026 and climb to nearly $1.8 trillion by 2035.

Over the next decade, America is projected to spend $13.8 trillion just servicing debt - more than the entire projected defence budget over the same period.

Meanwhile, Trump has escalated his attacks on Federal Reserve independence by trying to fire Fed governor Lisa Cook over unproven mortgage fraud allegations.

Cook has hired high-profile attorney Abbe Lowell and maintains that Trump lacks the authority to remove her without proper cause under federal law.

1930s playbook

Dalio's comparison makes sense when you look at the history. As he noted in 2022, "four major democracies chose autocracies" during the interwar period.

In a remarkably consistent pattern, Germany, Italy, Spain, and Japan were all functioning democracies before economic crisis and political polarisation opened the door to authoritarian rule.

The global economic depression that began in 1929 created widespread unemployment and social unrest, while existing democratic institutions proved unable to address the crisis effectively.

Fascist movements exploited this institutional weakness, blaming economic problems on minorities and international conspiracies while promising strong leadership to restore national greatness.

Japan's transformation is particularly instructive. The country maintained a largely liberal democratic system throughout the 1920s before military elements seized control during the economic crisis of the early 1930s.

By the late 1930s, Japan had abandoned democracy entirely and joined the Axis powers.

EU echoes a similar warning

European Central Bank President Christine Lagarde gave unexpected support to Dalio's concerns about Fed independence, warning that political control over U.S. monetary policy would pose "a very serious danger" to the global economy.

"If U.S. monetary policy were no longer independent and instead dependent on the dictates of this or that person, then I believe that the effect on the balance of the American economy could, as a result of the effects this would have around the world, be very worrying, because it is the largest economy in the world," Lagarde told Radio Classique.

Her warning carries particular weight given the ECB's role in global finance and her previous experience as Managing Director of the International Monetary Fund.

Shifting response

International investors have begun shifting from U.S. Treasuries to gold, with bullion gaining 27% this year while Treasuries have struggled to maintain their traditional safe-haven status.

Commonwealth Bank analyst Vivek Dhar says this shift is unusual.

“The U.S. dollar and Treasuries have been sold‑off as safe‑haven appeal of these U.S. assets has declined,” Dhar said.

“Typically, when investors get nervous, they flee toward Treasuries and the USD, but this time they're running away from them.”

J.P. Morgan expects gold to average US$3,675/oz by Q4 2025 and reach $4,000/oz by mid-2026, driven by continued central bank purchases and investor demand amid an air of policy uncertainty.

And Dalio's prediction of a "debt-induced heart attack" within three years is also finding support within current fiscal trends.

For starters, the average interest rate on federal debt has more than doubled from 1.556% in January 2022 to 3.352% as of July 2025.

While that's still below historical peaks, it represents the highest average rate since the Great Recession.

Perhaps most concerning of all is that Wall Street is staying quiet.