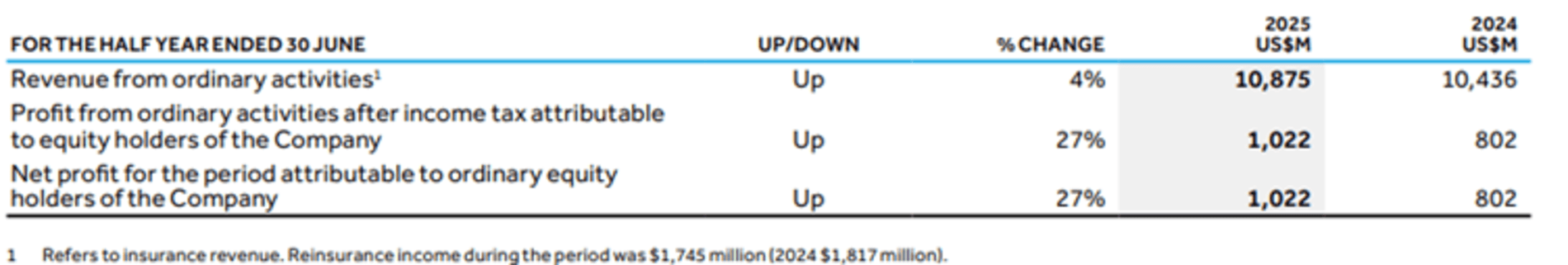

Global insurer QBE Insurance has announced a 27% increase in net profit after tax (NPAT) to US$1.02 billion (A$1.57 billion) for the first half of the 2025 financial year (H1 FY25).

The company, which offers property, casualty, health and life insurance for businesses, individuals and institutions, said revenue increased by 4% to $10.875 billion in the six months to 30 June 2025.

Group CEO Andrew Horton said QBE delivered a solid first-half result and was on track to achieve its full-year outlook.

The board declared a 25% franked interim dividend of 31 Australian cents per share to be paid on 26 September to shareholders registered on 20 August, compared with 24 cents in the previous corresponding period.

“We are executing well against a clear strategy, with efforts to reshape our portfolio and stabilise performance underpinning improved results,” Horton said in an ASX announcement.

“We have strong momentum in the business and are motivated to deliver another year of excellent returns in 2025.”

The company cited the outlook as mid‑single digit percentage growth in gross written premiums on 2025 constant currency, a combined operating ratio of about 92.5% and a 1H FY25 exit core fixed income yield of 3.8%.

QBE said the statutory insurance operating result increased 19% to $988 million.

The 6% gross written premium growth highlighted ongoing momentum, driven by strong International and North America organic growth and a lower strain from exited lines.

The result was also supported by a favourable central estimate development.

Catastrophe costs during the period remained below allowance, and included the California wildfires and storms and floods in Australia and North America.

Net investment income surged 85% to $929 million, or 8% to $788 million when excluding the impacts of risk-free rates, underpinned by supportive interest rates and strong risk asset returns.

Profit for the period also included a gain on sale of $18 million associated with the exit of the North American homeowners portfolio.

QBE (ASX: QBE) shares had closed 15 cents (0.64%) higher at $23.45 on Thursday, capitalising the company at $35.41 billion.