Qantas Airways shares soared to a record high on Thursday after it announced a 28% increase in net profit and a special dividend for the 2025 financial year (FY25) and announced a new aircraft order worth more than US$1.5 billion (A$2.39 billion).

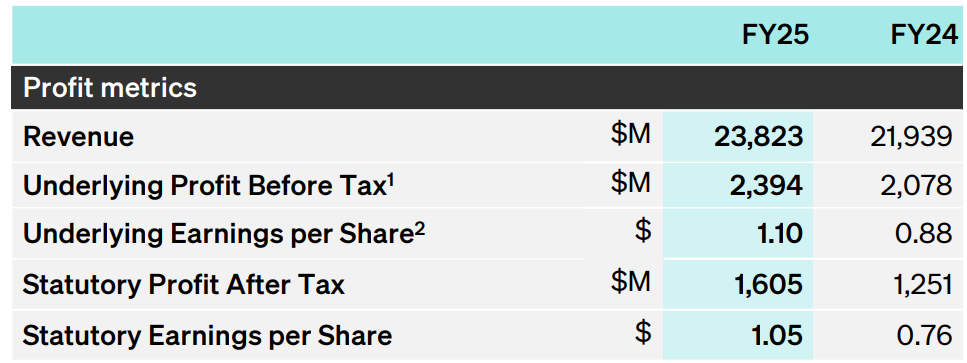

Australia’s largest airline said statutory profit after tax jumped to A$1.605 billion (US$1.04 billion) in the 12 months ended 30 June 2025 from $1.251 billion in FY24.

Underlying profit before tax increased 15% to $2.394 billion on revenue, which rose 9% to $23.823 billion.

Qantas said it had ordered 20 A321XLR aircraft, 16 of which would have lie-flat Business seats, with the first two expected to enter service on its domestic network in September, making it the first airline in the Asia Pacific to operate the new aircraft type.

The airline did not specify the cost, but it is expected to be at least US$1.5 billion and potentially more than $2 billion, based on previous orders and listing prices.

At the time of writing, Qantas shares (ASX: QAN) were trading 99 cents (8.91%) higher at $12.10, capitalising the company at $18.3 billion, after earlier touching a record high of $12.62 as the result was slightly above expectations.

The shares have risen 93% over the last year and more than 200% from the lows at the height of the COVID-19 pandemic in 2020 as its financial position has improved.

The Board approved a final fully franked dividend of 16.5 cents per share and a fully franked special dividend of 9.9 cents per share, to be paid on 15 October 2025 to shareholders registered on 17 September, bringing the full year payment to 42.9 cents.

Prior to this year, the company had not paid dividends since 2019 due to the impact of the -19 pandemic.

CEO Vanessa Hudson said continuing strong demand in all market segments and the airline’s dual brand strategy helped the group grow earnings.

She said Qantas and budget subsidiary Jetstar carried four million more customers in FY25, while the Loyalty business grew as frequent flyers engaged with the program more than ever before.

“While we are pleased with the progress we are making, we remain focused on further improving our performance and continuing to deliver for our customers, people and shareholders,” Hudson said in an ASX announcement.

Qantas said domestic unit revenue was expected to increase by 3-5% in the first half of FY26 compared to the previous year, international unit revenue was expected to rise 2-3% and Qantas Loyalty was expected to grow underlying EBIT by 10-12% in FY26.

“The Group expects ongoing strong travel demand into 1H26,” Qantas said.