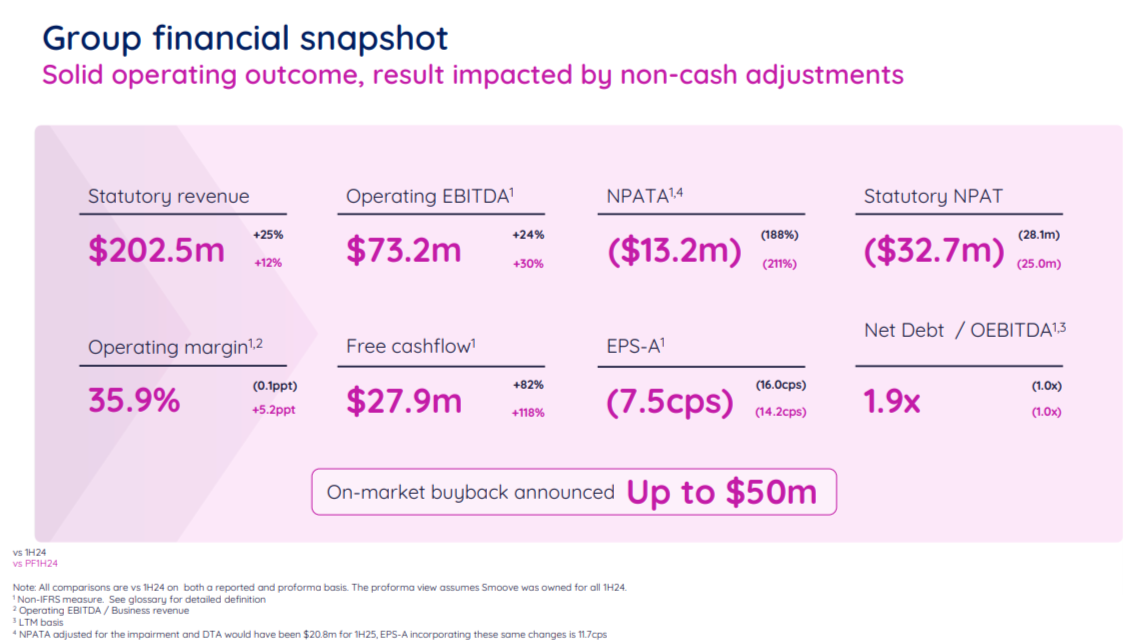

Property settlement and exchange platform The PEXA Group Limited posted a strong half-year operating result ending December 2024. Revenue increased by 25% while operating EBITDA increased by 24%.

The company reported a non-cash loss, but improved its cash flow and announced a $50 million share buyback, reflecting its confidence in its future growth.

“The group’s strategic position and operating performance improved during the half, with all businesses contributing. Although statutory profits were impacted by non-cash charges, underlying cash generation grew, supporting a stronger balance sheet,” said outgoing group executive and managing director Glenn King.

“Pleasingly, this means we can return up to $50 million to our shareholders via the on-market buyback announced today.”

Free cash flow surged 82% to $27.9 million.

Up to $50 million will be raised through cash and existing debt facilities for the on-market share buyback. The six-month buyback is scheduled to begin in mid-March 2025.

In FY25, PEXA targets revenue growth of 13-19% and an operating EBITDA margin equal to or greater than 34%.