The PEXA Group's Property Insights CY24 report highlights a record high in new loans issued in 2024, despite a significant decline in refinancing activity.

Key Points

- Record High in New Loans: 538,519 upcoming loans issued in CY24, up 11.7% from 2023.

- Decline in Refinancing Activity: Refinancing activity dropped by 17.6% from the previous year.

- VIC Leads in First-Home Buyer Activity: Increased first-home buyer activity in Victoria due to falling home prices and reduced investor interest.

- Divergence in Property Markets: Property markets showed significant divergence across states, with rising prices in Brisbane, Perth, and Adelaide, while prices stagnated or fell in Sydney and Melbourne.

Victoria saw a surge in first-home buyer activity, while property markets across Australia diverged, with some cities experiencing rising prices and others seeing stagnation or declines.

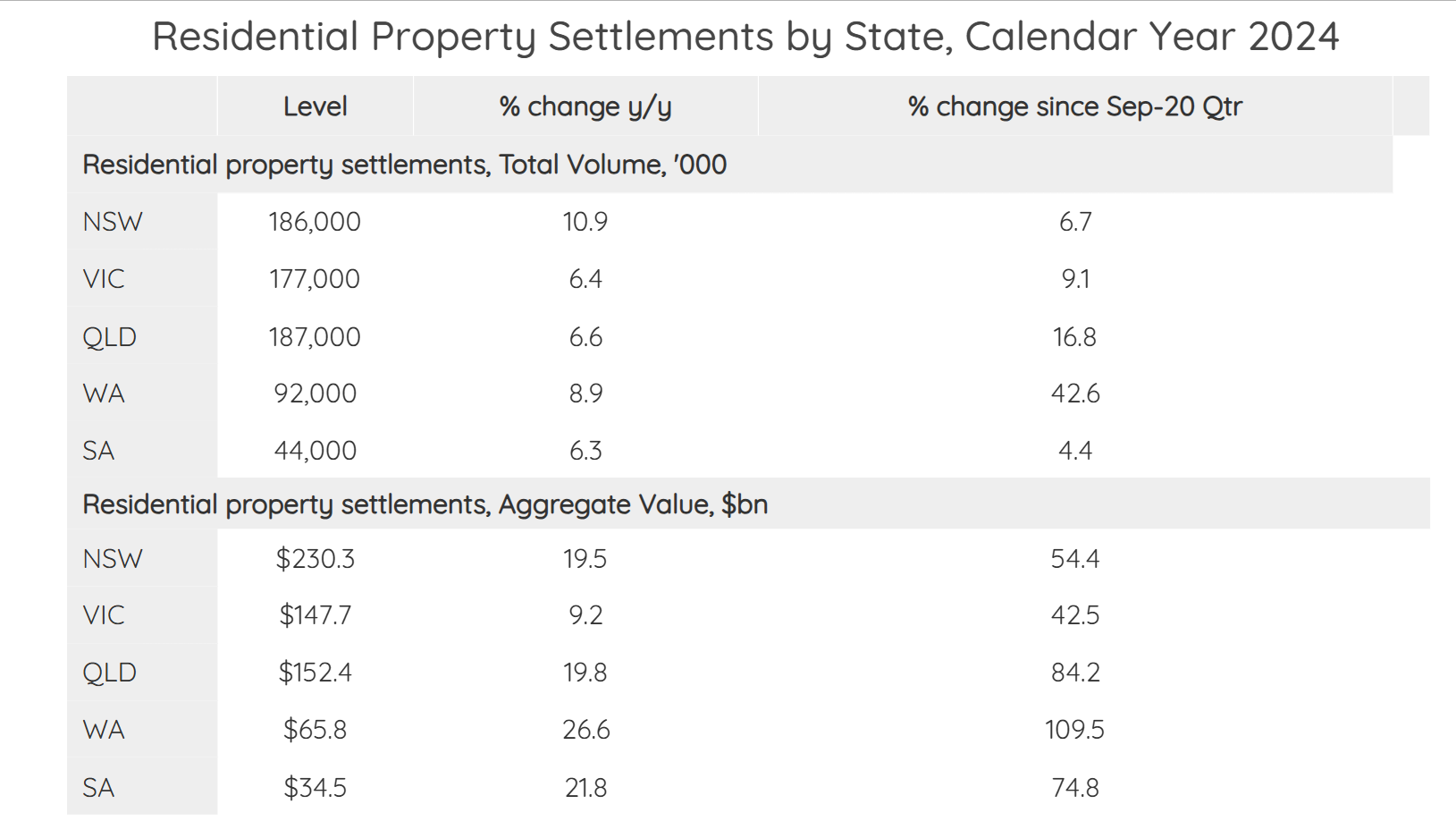

The report provides a comprehensive analysis of property settlement trends across Australia's five mainland states: New South Wales, Victoria, Queensland, Western Australia, and South Australia.

In CY24, a total of 723,312 properties were settled, marking a 7.8% increase from the previous year. The total value of property purchases reached $714.7 billion, a 17.3% increase from 2023.

The report also notes that while new loan volumes increased, refinancing activity slowed dramatically, with only 372,502 refinancings completed in CY24, a 17.6% decline from the previous year.

The report highlights the economic factors influencing the property market, including slower economic growth, income tax cuts, energy cost subsidies, and a stable interest rate environment.

Despite these factors, the property market showed resilience, with Victoria leading in first-home buyer activity due to falling home prices and reduced investor interest.

The report also notes that property markets in Brisbane, Perth, and Adelaide saw rising prices, while Sydney and Melbourne experienced stagnation or declines.

What Happens Next?

Looking ahead, the report suggests that refinancing activity may pick up again as the market stabilises.

The continued divergence in property markets across states is expected to persist, with some cities likely to see further price increases while others may experience price declines.

The report also emphasises the importance of monitoring economic factors such as interest rates, income tax policies, and government spending on public services and infrastructure, which will play a crucial role in shaping the property market in the coming years.