New research from CoreLogic has predicted what to expect for the Australian housing market in 2025.

The report from Eliza Owen, head of Research at CoreLogic Australia, examines how the economic layout of the housing market will be influenced by unemployment being set to rise, construction for houses facing difficulties, high inflation and overseas migration moving away from their pandemic booms and the possibility of a drop in the Reserve Bank cash rate.

Inflation battle

The start of this year may see a cut in interest rates, with inflation continuing to drop.

Annual core inflation fell below the RBA forecast for December, landing at 3.2% the month before. Two of Australia's four big banks expect a rate cut in February.

A rate of 3.1% by the end of 2025 is higher than the pre-COVID, decade-long average of 2.55%, which supported strong lending numbers in the 2010s.

However, Owen says that there is the possibility that reductions may have “little effect on home values and transaction activity” and points to the Stage 3 tax cuts from 2024 as an example of how the nation responds to high borrowing capacity.

While the cuts would have lifted borrowing capacity through higher net income, the housing market saw a minimal response, with values growth slowing from June 2024.

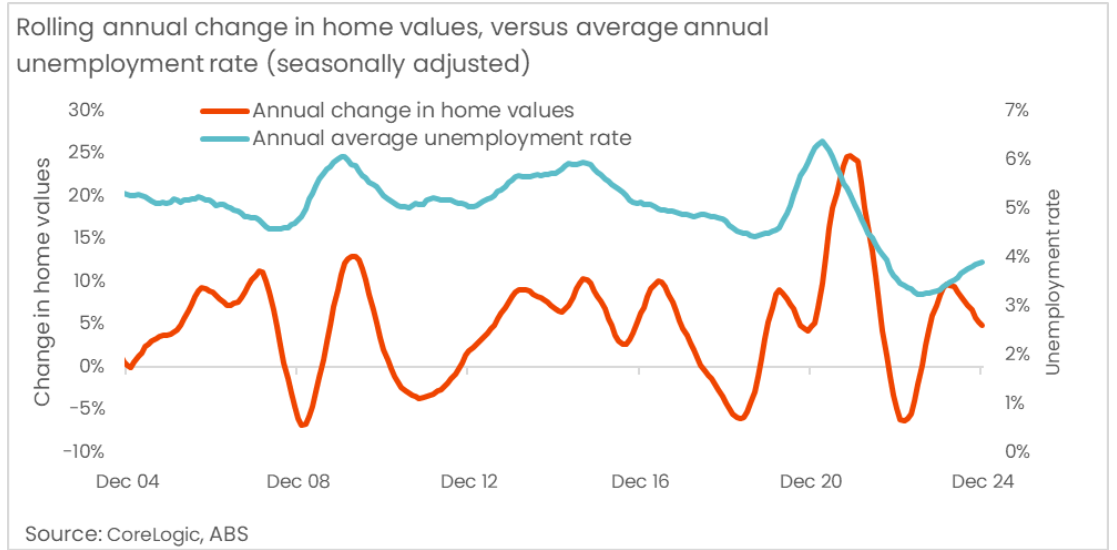

The job market

Unemployment is predicted to rise to 4.5% by the end of 2025, according to the RBA. However, the start of the year saw a strong labour market, with the unemployment rate being just 4.0%.

The decade average before COVID was 5.5%.

Higher unemployment historically affects younger Australians who are more likely to be in the rental market than home ownership. This has more of an impact on rental demand specifically, not the broader housing market.

The migration effect

The rental market will likely face other changes, with overseas migration finally settling in a post-COVID world.

Net overseas migration peaked at 556,000 in the year to September 2023, falling to 446,000 by June 2024.

It is expected to fall even further by mid-2025 as more short-term migrants leave, according to the Centre for Population.

Historically, significant changes in migration patterns have impacted the rental market. Areas with high migration saw rent increases during 2022 as COVID border restrictions eased.

In these same rental markets, demand is reducing rapidly post-pandemic.

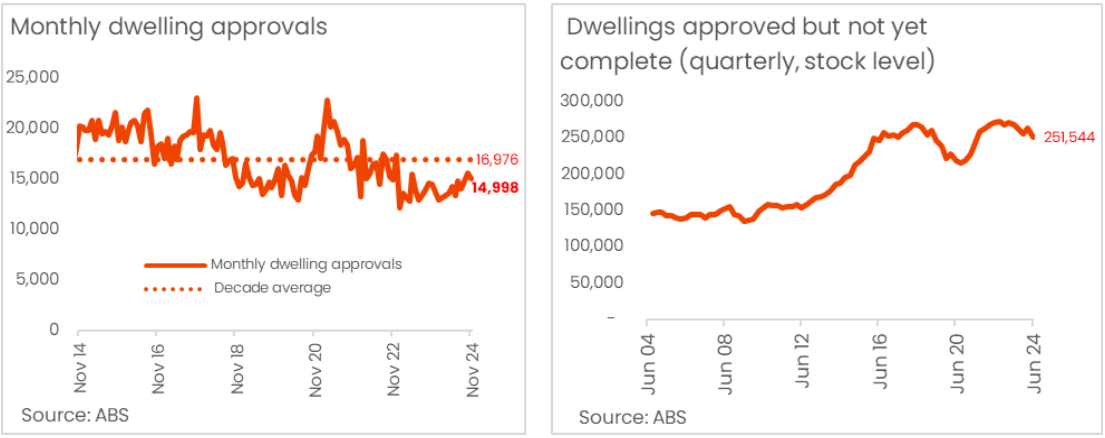

Building difficulties

New home approvals are low, following a multi-year decline.

Just 169,000 newly constructed dwellings were approved in November 2024, marking a 24% drop from the decade average.

This also fell 30% below the Housing Accord's average annual target of 240,000, with high construction costs, land costs, and interest rates to blame.

Additionally, about 250,000 approved dwellings are still incomplete. Owen writes that ongoing government support and business investment is an “essential" factor in the success of the residential construction industry.

With the sum of all these parts the 2025 Australian housing market is expected to see less value growth and smaller sales numbers than the year before.