Due to ongoing affordability constraints, especially in capital cities, where the escalating prices of detached houses have left a large portion of the population priced out of the market, unit prices (4.6%) are expected to modestly outpace house price growth (3.3%) over the next two years, KPMG’s latest Property Report says.

Given their relatively lower entry points than houses, there will be growing demand for units. This is as a more affordable housing option for a larger pool of buyers, the report finds.

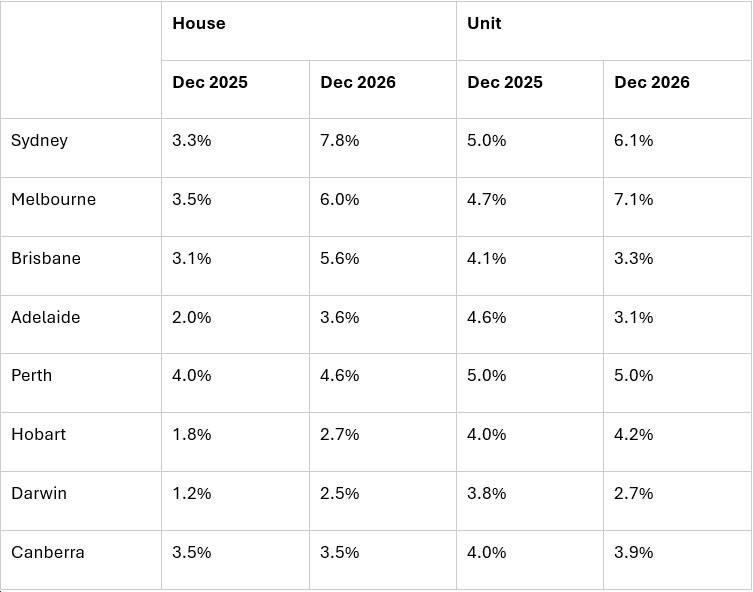

Overall, unit (apartments and townhouses) prices will gain 4.6% in 2025 and 5.5% the following year. Predicted increases for units in 2025 range from Sydney and Perth’s 5% growth to Darwin’s 3.8%, while in 2026, Melbourne at 7.1% and Sydney at 6.1% are forecast to witness the strongest growth.

While construction costs are also starting to moderate, Brendan Rynne, KPMG Chief Economist believes the time lag inherent in the [building] process will staunch the translation of increased approvals into actual housing completions in 2025 and 2026.

“Despite affordability and availability issues and a delayed interest rate cut, increased investor sentiment, and anticipated relaxed lending conditions will help support modest price growth in 2025, and then stronger growth next year,” said Rynne.

Houses

Overall, KPMG expects house price growth this year to be down on 2024, which saw an average 5.1% rise nationally.

While house prices are expected to rise nationally by 3.3% this year, KMPG expects price growth to be more pronounced in the second half of 2025, as interest rate cuts begin in the second quarter — with growth in 2026 doubling that figure at around 6%.

KPMG expects Perth house prices to again outperform in 2025, rising by 4%, while Darwin expects only 1.2% growth.

Canberra and Melbourne are expected to be solid performers at 3.5% growth each; Sydney and Brisbane are more restrained at 3.3% and 3.1% respectively, while Adelaide and Hobart are expected to be lower at 2% and 1.8%.

However, a year later in 2026, Sydney is expected to reclaim the top spot with 7.8% growth. This is followed by Melbourne and Adelaide at 6.0% and 5.6% respectively.

Rentals

Reflecting low vacancy rates and a tight rental market, KPMG expects annual rent growth of around 3.5–4.5% over the next two years.

Rynne believes the increased number of renters looking to buy [instead of rent] will contribute to a more balanced and sustainable rate of price growth over the next one to two years.

“But the lower rates established by the end of 2025 will see improved sentiment among buyers and investors, maintaining market confidence and seeing prices rise again in 2026.”