Wall Street investment bank Morgan Stanley had a strong start to 2025, with impressive results in the first quarter.

Shares have rallied 13% in the last five sessions, however, overall the banking major's stocks have tanked 14% year-to-date.

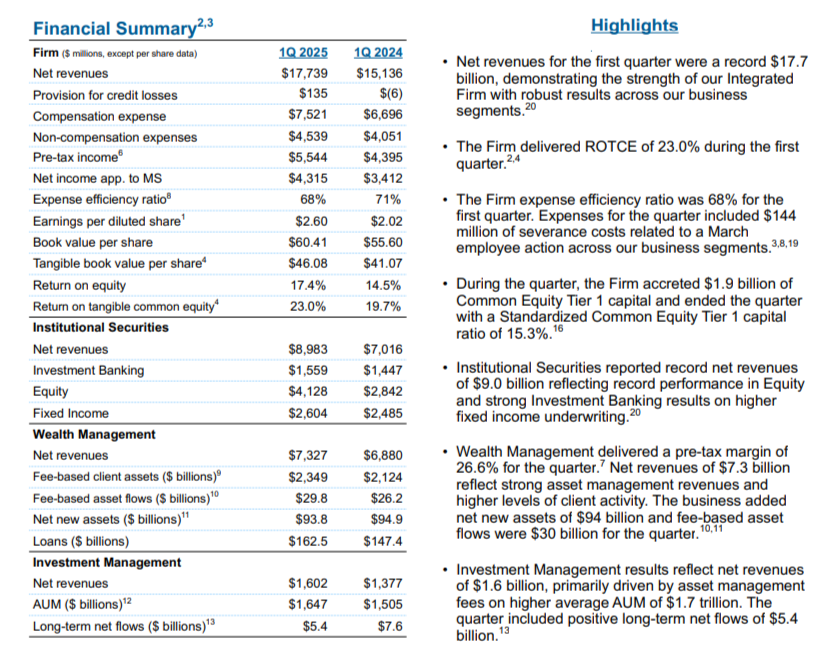

They earned a record-breaking $17.7 billion (A$28.14 billion) in revenue.

This was a big jump from $15.1 billion ($24.01 billion) last year, and significantly higher than the $16.54 billion expected.

Their net income, or profit after expenses, was $4.3 billion ($6.83 billion) or $2.60 per diluted share, up from $3.4 billion ($5.41 billion) last year and beating expectations of $2.21 per share.

One of the key highlights is their Institutional Securities division, which deals with stocks and bonds.

This division brought in $9 billion ($14.31 billion) in revenue, with a record $4.1 billion ($6.52 billion) coming from equity trading (buying and selling company shares).

Their Wealth Management division, which helps people manage their money and investments, also performed well, earning $7.3 billion ($11.61 billion).

Morgan Stanley also saw an increase in total assets managed by its clients, reaching $7.7 trillion ($12.24 trillion). This includes the money and investments people and organisations trust them to handle. They gained $94 billion ($149.46 billion) in acquired assets during the quarter. This growth reflects their strong reputation and ability to attract new clients.

The company’s efficiency improved as well, with an expense efficiency ratio of 68%. This means they spend less money to make more profit than before. They also maintained a strong return on tangible common equity (ROTCE) of 23%, which is a measure of how well they use their resources to generate profit. These numbers highlight Morgan Stanley’s ability to grow while staying financially healthy.

Ted Pick, Chairman and Chief Executive Officer, said, “The Integrated Firm delivered a very strong quarter with record net revenues of $17.7 billion and EPS of $2.60, and an ROTCE of 23.0%. Institutional Securities strong performance was led by our Markets business with Equity reporting a record $4.1 billion in revenues. Total client assets of $7.7 trillion across Wealth and Investment Management were supported by $94 billion in net new assets. These results demonstrate the consistent execution of our clear strategy to drive durable growth across our global footprint.”

At the time of writing, Morgan Stanley's (NYSE: MS) stock price was around US$108.12 (A$173.19). The market cap is around US$173.91 billion ($278.57 billion).