Oil prices declined during Monday's Asian deals, after the United States and Iran agreed to continue negotiations over Tehran’s nuclear programme, easing immediate concerns about a potential conflict that could disrupt Middle Eastern crude supplies.

By 3:10 pm AEDT (4:10 am GMT), Brent crude futures were down 63 cents, or 0.9%, at US$67.42 per barrel. U.S. West Texas Intermediate crude fell 56 cents, or 0.9%, to $62.99 per barrel.

Crude benchmarks dropped more than 1.8% and 2.6% last week, respectively, as geopolitical tensions showed signs of easing, marking their first weekly decline in seven weeks.

Washington and Tehran pledged to continue indirect nuclear discussions following talks in Oman on Friday that both sides described as constructive, despite acknowledging ongoing differences.

The diplomatic progress helped calm fears that a breakdown in negotiations could push the region closer to military confrontation, particularly after the U.S. positioned additional forces in the area.

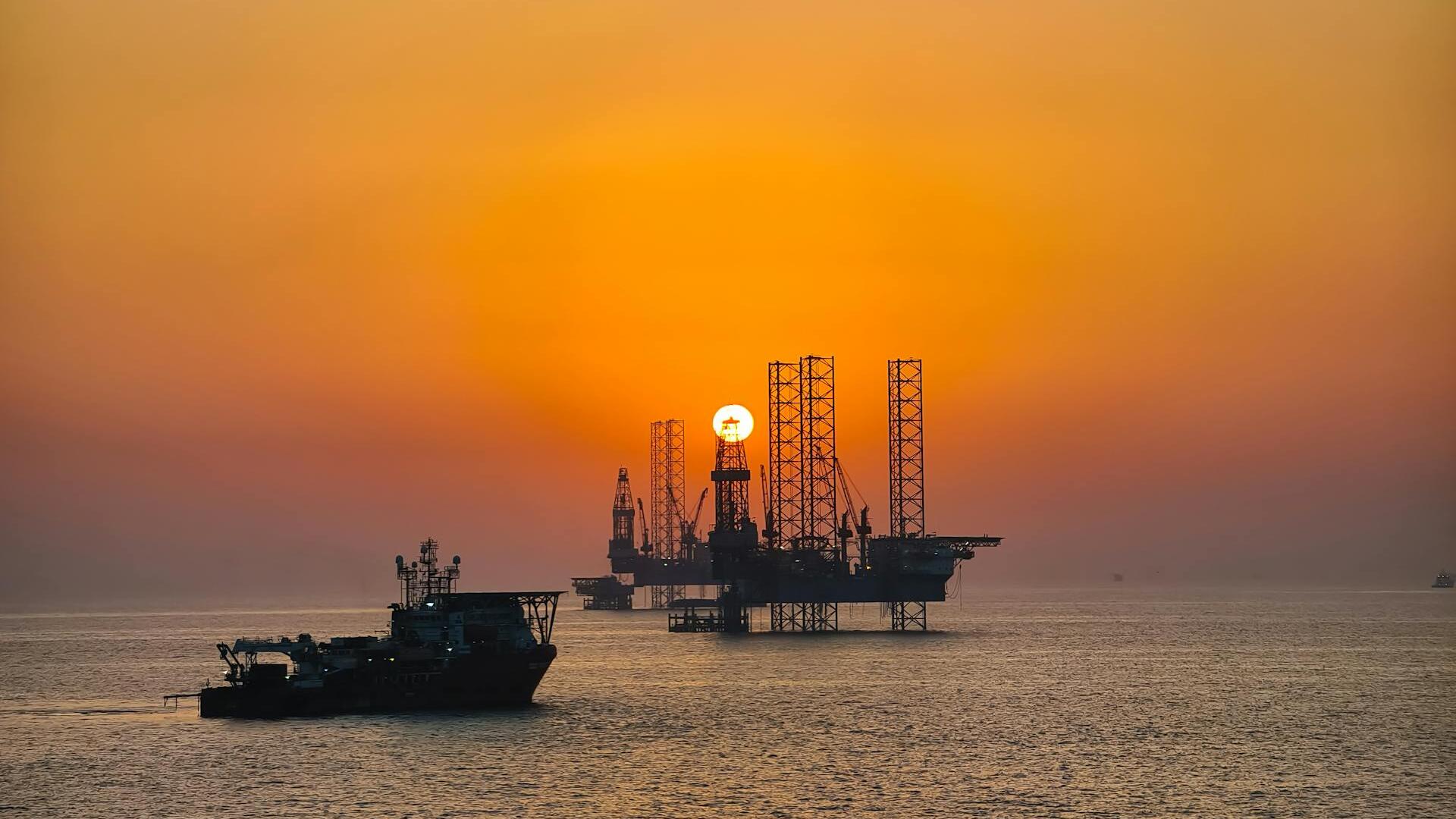

Investors remain sensitive to developments in the Gulf, where roughly one-fifth of global oil consumption passes through the Strait of Hormuz between Oman and Iran. Any disruption in the waterway would pose a significant threat to global supply.

However, tensions remain elevated. Iran’s foreign minister said on Saturday that Tehran would strike U.S. bases in the Middle East if attacked by American forces.

Markets are also weighing efforts to curtail Russian oil revenues linked to the war in Ukraine. The European Commission on Friday proposed a broad ban on services supporting Russia’s seaborne crude exports, potentially tightening restrictions on Moscow’s energy trade.

Refiners in India, previously the largest buyer of Russia’s seaborne crude, are reportedly avoiding purchases for April delivery and may continue to step back from such trades, according to Reuters.