Oil prices may decrease once again as eight members of the OPEC+ alliance weigh up another increase in production of up to 411,000 barrels per day (bpd) in July, according to unnamed sources familiar with the matter.

The potential adjustment would be the third month in a row of unwinding the oil producing group's two voluntary supply cuts introduced last year.

One cut, totalling 1.66 million barrels per day, is set to remain in place through 2025 and a second, shorter-term tranche saw an additional 2.2Mbpd held back through Q1 of this year.

Since April, those OPEC+ members (accounting for 90% of group production) have been phasing out those temporary reductions, committing to a gradual return of one million barrels per day over three months.

Increases of 411,000 bpd have already been pencilled in for May and June so far.

Key OPEC+ producers Saudi Arabia, Russia, the UAE, Kuwait, Oman, Kazakhstan, Iraq and Algeria are due to align on their next moves, with a third bump on the same scale for July under consideration.

As seasonal consumption patterns begin to increase energy use, mid-year, oil demand tends to climb; driven by higher use of jet fuel, gasoline, and power generation.

It's particularly increased in Middle Eastern economies coping with peak electricity loads due to air-conditioner use during the summer.

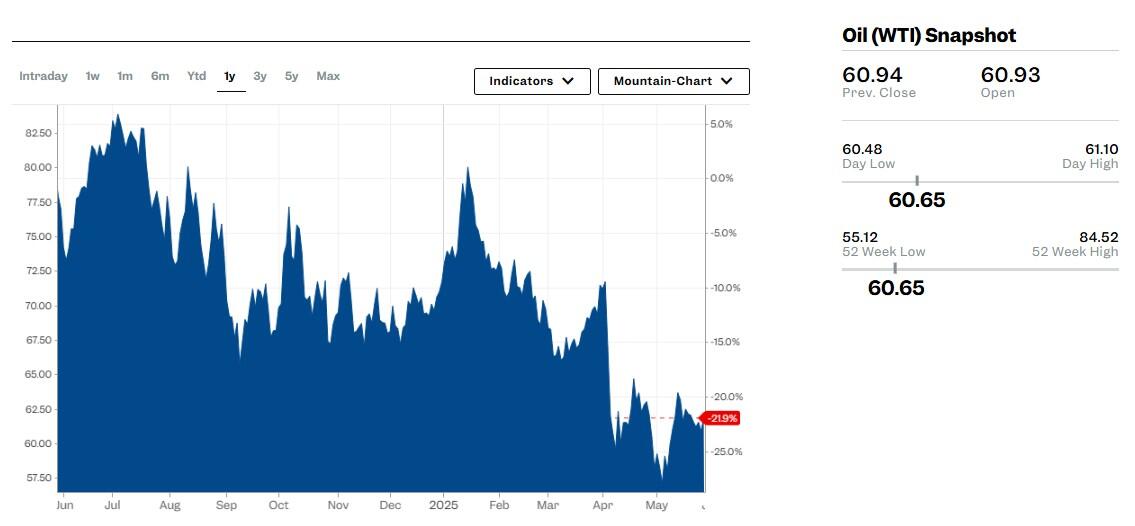

Oil prices have dropped significantly - down almost 22% this past year - with the West Texas Intermediate trading at just US$60.67 per barrel at time of writing.

Arguments for

The proposed extra 411,000bpd adjustment reflects OPEC+'s bullish stand on the underlying demand, publicly justifying the big increase with “healthy market fundamentals, as reflected in the low oil inventories”.

“A slowdown in drilling activities in the largest American shale oil production region should provide some underlying support to the price of crude oil,” Goldman Sachs said in a note earlier this week.

GS said its latest industry data showed total U.S. rig and frac spread counts (including the Permian Basin) decreased by 14% and 22% from a year ago respectively - a sign tight oil production in the region continues its decline.

Another justification is that commercial oil stocks in OECD countries fell by over 900,000 bpd in January-February, according to the International Energy Agency.

…and against

However, some broader macro signals paint a different picture, says Argus Media research.

“OECD inventories have become less relevant to the oil market balance this century as demand growth has shifted to the industrialising economies of Asia-Pacific and the global south,” Argus wrote.

Its figures don't count China’s heavy stockpiling program that has drawn in nearly 60Mbl of crude to storage, including likely Beijing’s strategic reserve, over the past three months.

“It also misses the increasingly important role of oil in transit - inflated over the past two years by sanctions forcing Russian oil to Asia-Pacific and detours around troubled waterways in Panama and the Red Sea,” Argus says.

“A seasonal rise in oil at sea, mostly products, adds another 80Mbl build since the end of last year.”

That means global inventories have risen by 600,000bpd this year and, on top of the tariffs saga, explains the $20 per barrel drop in oil prices since the start of the year.

GS expects OPEC+ to boost supply again in July because “the expected demand slowdown is unlikely to be visible” for the group when it meets to decide July targets.

It anticipates steady monthly gains of roughly 130,000 barrels per day through late Q3, building a supply overhang substantial enough that output quotas are expected to level off by October.