NVIDIA, the world’s leading AI chipmaker, has announced that it will no longer include China in its revenue forecasts. This is following strict United States export controls that limit sales of advanced chips to the country.

CEO Jensen Huang confirmed the decision, stating that NVIDIA is not counting on U.S. restrictions being lifted anytime soon.

During CNN's Anna Stewart interview in Paris, NVIDIA CEO Jensen Huang was asked whether export controls will be lifted after talks in London.

“I’m not counting on it but, if it happens, then it will be a great bonus. I’ve told all of our investors and shareholders that, going forward, our forecasts will not include the China market,” he said.

Export curbs have cost NVIDIA billions, with a $2.5 billion revenue hit in Q1 and an expected $8 billion loss in Q2.

The company previously sold $4.6 billion worth of H20 chips in China, but revised regulations have blocked future sales.

NVIDIA’s China business accounts for 12.5% of its total revenue, making this a significant shift in its strategy.

Huang has criticised U.S. export policies, arguing that restrictions are not achieving their intended goals.

He warned that the curbs could hurt American businesses more than China, as Chinese firms turn to domestic alternatives like Huawei’s AI chips.

NVIDIA’s competitors, including AMD, are also racing to fill the gap left by the company’s exit from the Chinese market.

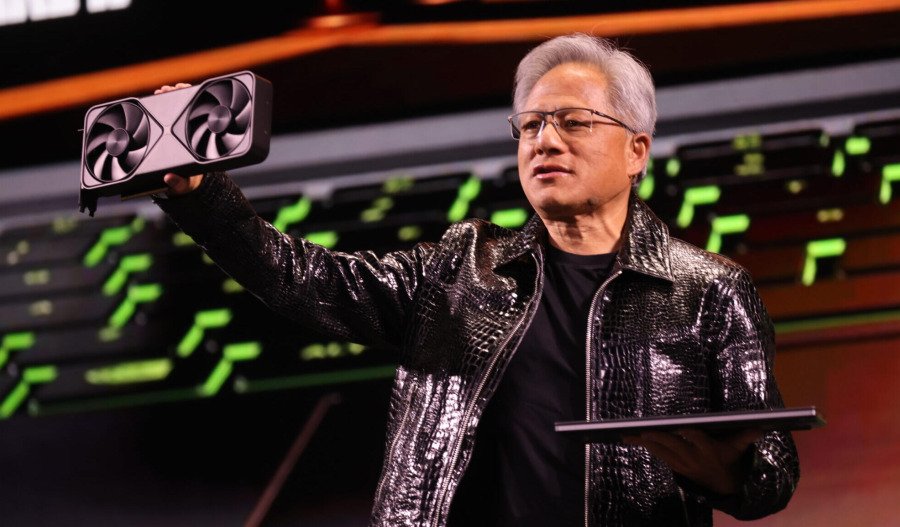

Despite the setback, NVIDIA remains dominant in the AI chip industry, recently surpassing Microsoft to become the world’s most valuable company.

The company’s Blackwell architecture and AI chips continue to drive strong demand, even as it navigates geopolitical tensions.

Investors are watching closely to see how NVIDIA adapts to Chinese sales loss and whether it can maintain its explosive growth.

This move highlights the growing tech rivalry between the U.S. and China, with Washington tightening controls to prevent Beijing from advancing its AI capabilities.

NVIDIA's decision to exclude China from forecasts signals a major shift in global semiconductor strategy, as companies adjust to new trade realities.

The impact on AI development, supply chains, and market competition will be closely monitored in the months ahead.

NVIDIA Corp (NASDAQ: NVDA) stocks were trading at $144.50 after hours, down 50 cents (0.34%). It has a market cap of around $3.54 trillion.