Novo Nordisk has lowered its full-year 2025 guidance, citing slower-than-expected growth for its flagship GLP-1 therapies Wegovy and Ozempic in the United States market.

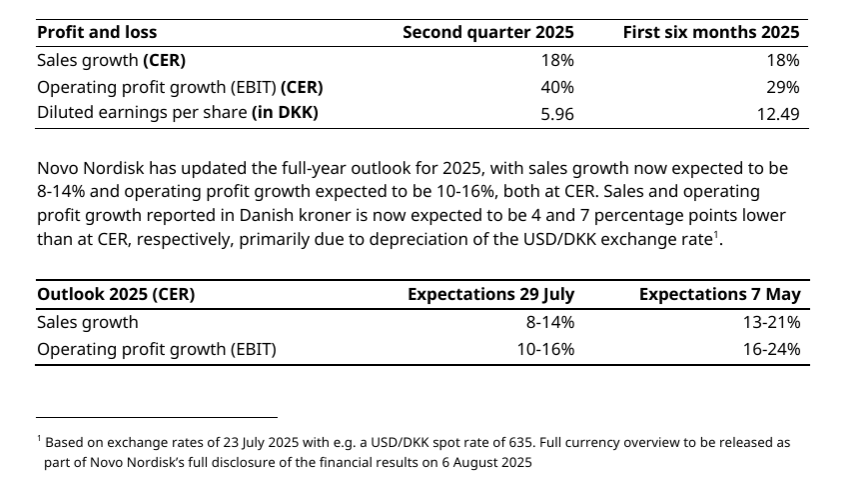

Sales growth is now forecast at 8–14%, down from 13–21%, while operating profit growth has been revised to 10–16% from 16–24%.

Despite an 18% sales increase and 29% operating profit growth in the first half of the year, compounded competition and sluggish market expansion have weighed on performance.

After falling as much as 26%, shares pared losses slightly.

Wegovy prescriptions via NovoCare Pharmacy average 11,000 weekly, with an additional 20,000 in retail cash channels.

Ozempic continues to face pressure from rival offerings, and a regulatory decision on Wegovy’s MASH indication is expected later this year.

Financial expectations have also been adjusted. Free cash flow is now projected at DKK 35–45 billion, reflecting reduced volume growth in GLP-1 treatments.

Novo Nordisk anticipates a net gain of DKK 3 billion from currency hedges, though the acquisition of three Catalent manufacturing sites is expected to have a mid-single-digit negative impact on operating profit growth.

These revisions come amid broader strategic recalibrations as the company seeks to maintain its leadership in the obesity and diabetes markets.

In a pivotal leadership transition, Maziar Mike Doustdar will assume the role of president and CEO on August 7, 2025, succeeding Lars Fruergaard Jørgensen after 34 years of service.

Doustdar, credited with doubling International Operations sales to DKK 112 billion in 2024, will lead the company through its next growth phase.

Concurrently, Novo Nordisk will consolidate its Research & Early Development and Development divisions into a unified R&D unit under newly appointed CSO Martin Holst Lange.

Emil Kongshøj Larsen will take over Doustdar’s previous role as EVP of International Operations, while outgoing CSO Marcus Schindler will assist with the transition.

At the time of writing, the Novo Nordisk A/S (CPH: NOVO-B) share price was DKK346.90, down 104.25 (23.11%) today. It has a market cap of around DKK1.53 trillion.

All monetary figures are in Danish Krone unless otherwise stated.