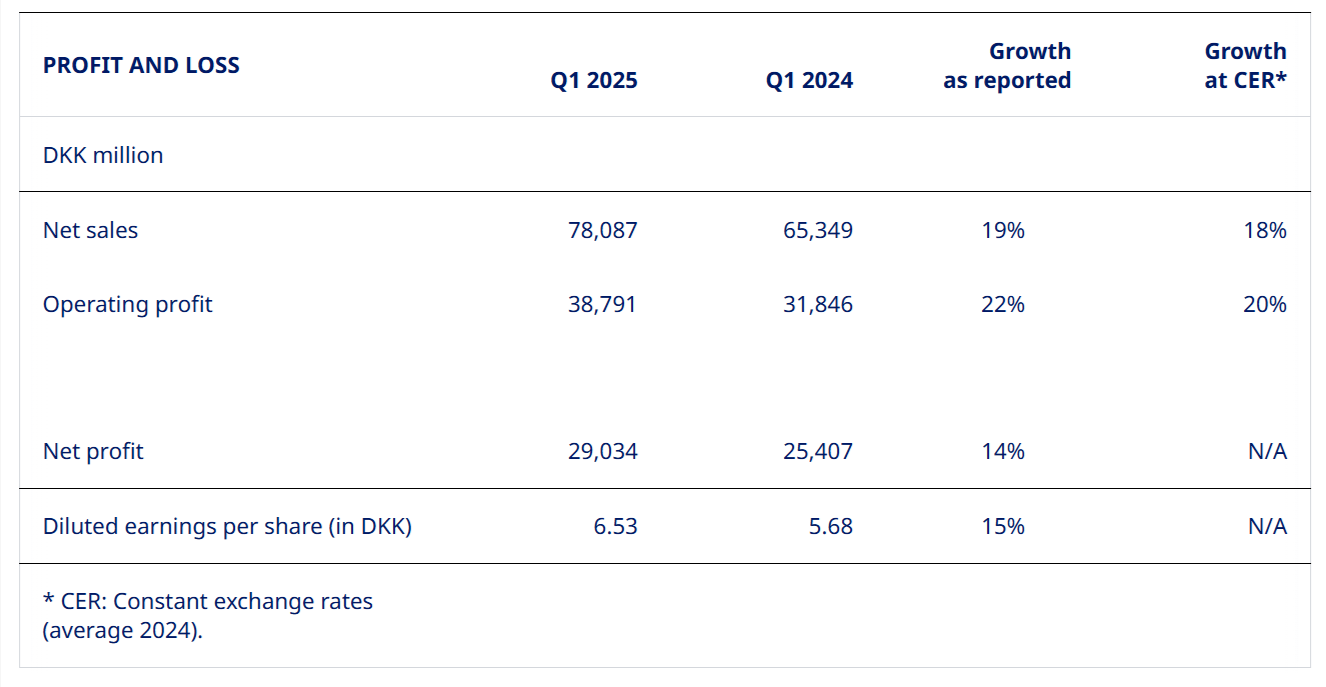

Novo Nordisk has delivered robust first-quarter 2025 financial results, with sales rising 19% in Danish kroner (DKK) to DKK 78.1 billion (A$18.351 billion) and operating profit climbing 22% to DKK 38.8 billion.

Growth was driven by surging demand for obesity treatments, with sales for obesity care soaring 67% to DKK 18.4 billion. Diabetes treatment also remained solid, with GLP-1 diabetes drug sales increasing by 13%, reinforcing Novo Nordisk's dominance in the expanding global market for metabolic disorder therapies.

The company’s US operations saw sales climb 20%, while international markets posted an 18% increase, underscoring strong global momentum. Novo Nordisk’s rare disease portfolio grew modestly by 5%, highlighting steady progress across diversified treatment areas. Investor focus remains on Novo’s high-growth obesity segment, where increasing awareness and regulatory acceptance have fueled rapid market expansion.

Net profit came in at DKK29.03 billion for the three-month period to the end of March, ahead of the DKK27.8 billion forecast by analysts in an LSEG poll.

R&D remains a critical pillar of Novo Nordisk’s strategy, with the company completing the REDEFINE 2 trial for CagriSema, demonstrating superior 15.7% weight loss results in patients with obesity or type 2 diabetes. Regulatory filings for oral semaglutide 25 mg for obesity have been submitted to the US FDA, while once-weekly semaglutide 2.4 mg for MASH has secured priority review status in the US, accelerating its path to approval. These developments reinforce Novo’s leadership in next-generation metabolic treatments.

Despite strong performance, Novo Nordisk has adjusted its 2025 outlook, forecasting 13-21% sales growth and 16-24% operating profit growth at constant exchange rates. The revised guidance reflects lower-than-expected penetration of branded GLP-1 treatments in the US, impacted by competition from compounded versions. The company remains focused on preventing unlawful compounding practices and expanding patient access through strategic initiatives.

Looking ahead, Novo Nordisk’s global rollout of Wegovy® continues, tapping into an underpenetrated market with over 1 billion obesity patients worldwide. With only a fraction of eligible patients currently receiving treatment, the company is well-positioned to capitalise on rising healthcare investment in chronic disease management, reinforcing its long-term growth trajectory in metabolic care.

Lars Fruergaard Jørgensen, president and CEO: "In the first quarter of 2025, we delivered 18% sales growth and continued to expand the reach of our innovative GLP-1 treatments. However, we have reduced our full-year outlook due to lower-than-planned branded GLP-1 penetration, which is impacted by the rapid expansion of compounding in the US. We are actively focused on preventing unlawful and unsafe compounding and on efforts to expand patient access to our GLP-1 treatments. Within R&D, we are pleased to have completed the last pivotal trial for our next-generation obesity treatment, CagriSema, and to have filed for US approval of oral semaglutide 25 mg, with the potential to be the first oral GLP-1 treatment for obesity."

At the time of writing, the Novo Nordisk A/S (CPH: NOVO-B) share price was DKK441.05 down 18.05 (3.93%) today. The company has a market cap of approximately 1.56 trillion (A$366.67 billion).