Nasdaq has announced a strong increase in full year operating earnings with profits surging in the final quarter of the 2024 financial year (FY24).

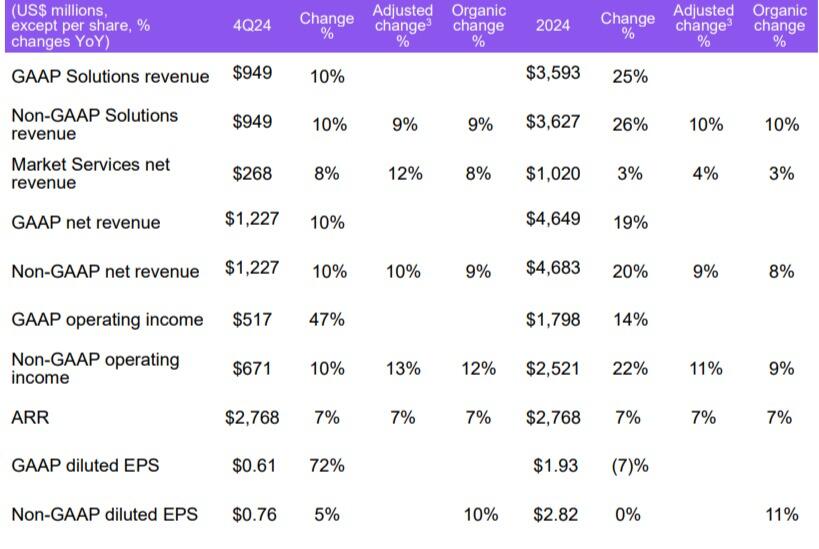

The United States technology market operator said operating income jumped 14% to US$1.798 billion in the 12 months to 31 December on net revenue which increased 19% to $4.649 billion.

In the fourth quarter operating income soared 47% to $517 million as net revenue rose 10% to $1.227 billion.

Diluted EPS soared 72% to 61 cents in the fourth quarter of 2024 but fell 7% to $1.93 over the full year.

Executive Vice President and Chief Financial Officer Sarah Youngwood said the company’s achievements reflected a relentless focus on clients and an ability to deliver outsized, long-term growth within a large and expanding market opportunity.

“After setting ambitious targets, Nasdaq delivered strong revenue growth and profitability across 2024 and is tracking ahead of schedule against our deleveraging and cost synergy targets,” Youngwood said in a news release.

Solutions revenue increased 25% to $3.593 billion over the full year and 10% to $949 million in Q4, while annualised recurring revenue increased 7% to of $2.8 billion in the quarter and 2024.

Chair and CEO Adena Friedman said 2024 was a transformative year for Nasdaq, and with the integration of financial technology (fintech) AxiomSL and Calypso largely complete, it had made substantial progress as a scalable platform company.

“We are executing well across our strategic priorities, including driving cross-sell opportunities, innovating across our solutions, and expanding client relationships with our One Nasdaq strategy,” Friedman said.

“Looking to 2025, we are well positioned to provide more value to our clients while driving profitable and durable growth as the trusted fabric of the world’s financial system."

Nasdaq has been expanding outside of its core exchange operator business into sectors such as fintech, trading platforms and data analytics.

Nasdaq (Nasdaq: NDAQ) shares ended 54 cents or 0.67% higher at $81.73 before easing in after-market trading to $81.00 as the Q4 result fell short of some analysts' expectations.