National Australia Bank (NAB) disclosed a A$130 million charge (US$85 million) for underpaying staff as it handed out a mixed earnings report for the third quarter of the 2025 financial year (Q3 FY25).

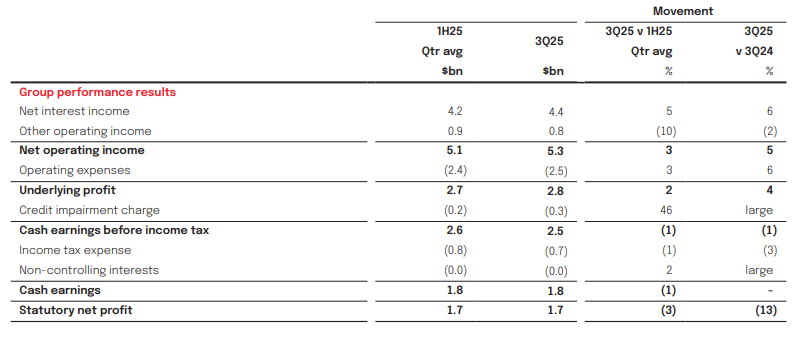

The Big Four bank said statutory net profit fell 13% to $1.7 billion and cash earnings were flat at $1.8 billion in the three months ended 30 June 2025, compared with the previous corresponding period (pcp).

However, underlying profit grew 4% to $2.8 billion on net operating income, which rose 5% to $5.3 billion.

CEO Andrew Irvine NAB said it expected operating expenses to grow about 4.5% in FY25, including about $130 million of costs associated with a program to identify, rectify and remediate payroll issues, “which is disappointing and must be fixed”.

“Paying our colleagues correctly is an absolute priority. We are sorry and apologise to our colleagues that this has happened and have commenced remediating those impacted,” Group Executive People and Culture Sarah White said in another ASX announcement.

But the figure could rise because NAB said the payroll review and remediation was ongoing and total costs remained uncertain.

This follows a payroll review, which commenced in 2019 with costs of $250 million incurred between FY20 and FY22.

Irvin said in an ASX announcement that the execution of NAB’s strategy and a focus on key priorities had supported the lift in underlying profit.

He said business and private banking business lending grew 4%, Australian home lending rose 2% and deposits were broadly stable in Q3.

Cash earnings were 1% lower than the 1H25 quarterly average as underlying profit growth of 2% was offset by higher credit impairment charges.

Key drivers of underlying profit growth were a 3% lift in revenue, an eight basis point increase in the net interest margin and a 3% rise in expenses, due mostly to higher personnel-related costs, including payroll remediation costs.

These costs were partly offset by productivity benefits and lower costs relating to customer remediation and the banks’ Group's enforceable undertaking with the Australian Transaction Reports and Analysis Centre (AUSTRAC).

NAB (ASX: NAB) shares rose 91 cents (2.31%) to $40.10 at the time of writing, capitalising the bank at $121.79 billion.