National Australia Bank (NAB) has reported a small dip in net profit in the first half of the 2024/25 financial year (H1 FY25).

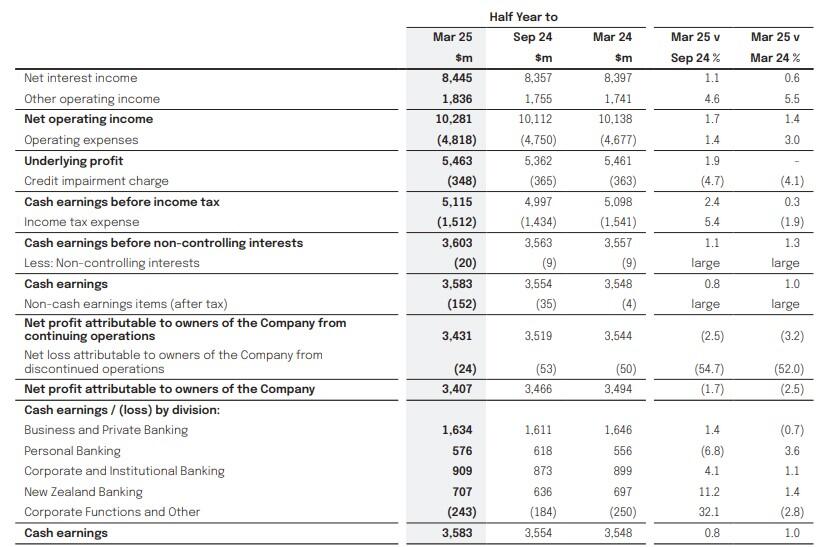

NAB, one of Australia’s Big Four banks, said net profit after tax fell 2.5% to A$3.407 billion (US$2.215 billion) on revenue which rose 1.1% to $10.282 billion in the six months ended 31 March 2025.

Cash earnings, which it considers a better measure of underlying performance, rose just 0.8% to $3.583 billion as underlying profit growth and lower credit impairment charges were partially offset by a higher effective tax rate.

Cash earnings exclude amortisation of intangible assets, treasury and market earnings volatility and large litigation or remediation costs.

Directors declared a fully franked interim dividend of 85 cents per share to be paid on 2 July to shareholders on record on 13 May, compared with 84 cents in H1 of FY24.

"We are managing our business well in continued challenging operating conditions,” CEO Andrew Irvine said in an ASX announcement.

The net interest margin (NIM) was stable at 1.70% but, if the markets and treasury business was excluded, it would have declined by three points as a result of deposit impacts, higher wholesale funding costs and lending competition.

He said NAB was executing its “refreshed strategy”, focused on driving stronger customer advocacy, greater speed and simplicity and ongoing modernisation of our technology.

The bank was making good progress on its key priorities of continuing to drive deposits performance, improving proprietary lending, and growing business banking.

Home lending drawdowns via proprietary channels increased 25%, retail transaction account openings via branches were 32% higher, NAB had grown its share of small and medium enterprise business lending, and initiatives to address customer pain points were driving a strong lift in customer advocacy in these areas.

“We are optimistic about the underlying growth outlook for the Australian and New Zealand economies. However, escalating global trade tensions are a key source of uncertainty,” Irvine said.

National Australia Bank (ASX: NAB) shares closed 55 cents (1.53%) lower at $35.30 on Tuesday, capitalising the bank at $108.11 billion, but may be supported in a weaker market when trading resumes on Wednesday as cash earnings were above analysts’ expectations.