National Australia Bank (NAB) reported a slight decline in its unaudited December quarter cash earnings, citing higher credit impairments on business loans as a key factor.

Australia’s second-largest bank by market capitalisation posted fiscal first-quarter unaudited cash earnings of A$1.74 billion, marking a 2% drop from the 2H24 average.

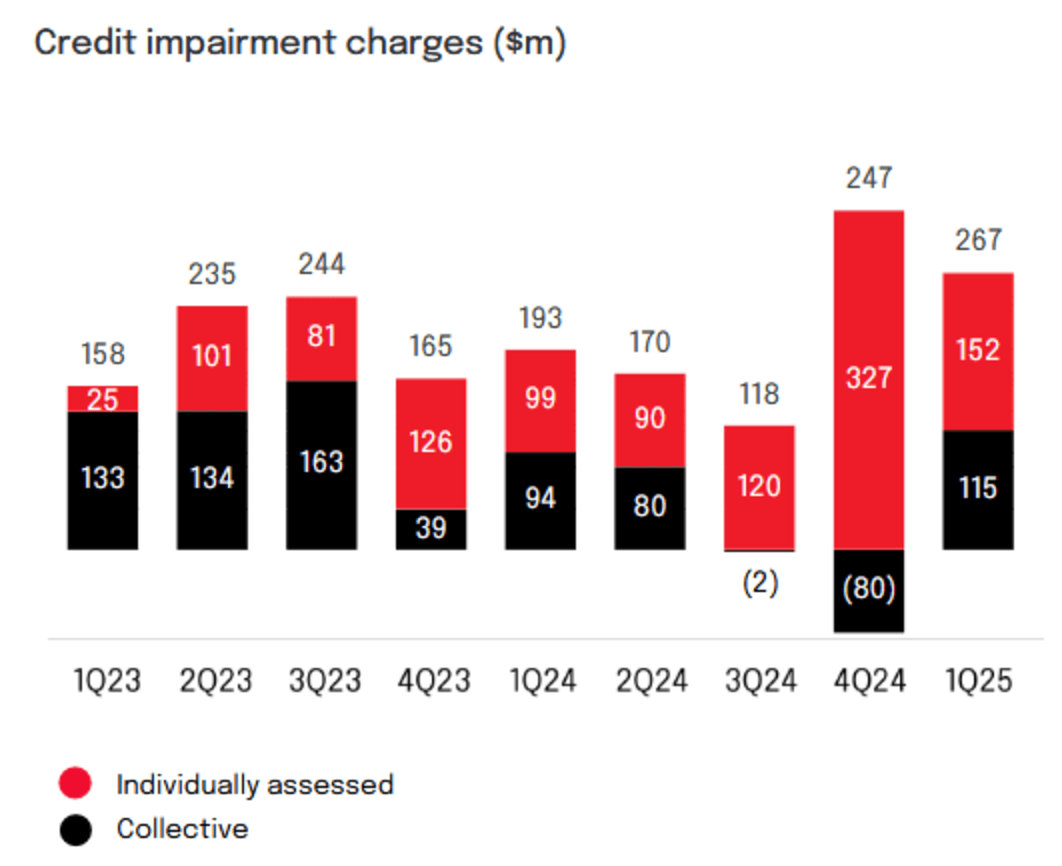

Revenue rose 3% over the same period, with underlying profit increasing by 4%. However, these gains were offset by a higher credit impairment charge of $267 million, including $152 million in individually assessed charges - primarily related to Australian businesses and unsecured retail portfolios.

"The economic outlook is improving but cost of living and interest rate challenges persisted," said Chief Executive Officer (CEO) Andrew Irvine. "While most customers are proving resilient, we have maintained prudent balance sheet settings to allow us to support customers while keeping our bank safe."

NAB also reported a slight decline in net interest margin, attributing the dip to funding costs, competitive lending conditions, and deposit trends, though partially offset by higher interest rates.

Despite these challenges, NAB remains committed to its full fiscal-year target of over A$400 million in productivity savings, with operating expenses expected to rise by less than 4.5%.

Irvine noted: "We remain optimistic about the outlook and are well placed to manage our business for the long term and deliver sustainable growth and returns for shareholders."

The news follows the Reserve Bank of Australia's (RBA) first cash rate reduction since 2020, as policymakers cautioned against expectations of further near-term reductions.

At the time of writing, National Australia Bank (ASX: NAB) stock was trading at A$39.51, down 2.5% from Monday's close of $40.52. The stock reached a day low of $39.42 and a day high of $40.73. National Australia Bank's market cap stands at $121.45 billion.