Welcome to our live blog coverage of earnings season!

This is the time of year when publicly traded companies report their financial results, giving investors and analysts a glimpse into their performance and future outlook. We'll bring you real-time updates, analysis, and commentary on the latest earnings reports from major companies across various sectors. Stay tuned as we break down the numbers, highlight surprises, and provide insights into what these results mean for the market.

______________________________________________________________________________________

Summary

- Chinese tech company Baidu Inc reports mixed results in Q4

- Wall Street finishes mixed; S&P 500 hits fresh record

- Economists expect RBA to continue to lower Australia’s cash interest rate

- Iluka Resources profit down 33%

- Goodman Group records $4 billion capital raising after an increase in half-year profit

- NAB Q1 earnings dip

- James Hardie income drops, but reaffirms guidance

- Cleanaway Waste Management Limited reported gross revenue up 3.7% to $1.9 million

______________________________________________________________________________________

8:35 am (AEDT):

Good Morning everyone, Sienna Martyn here to kick off the blog for Thursday!

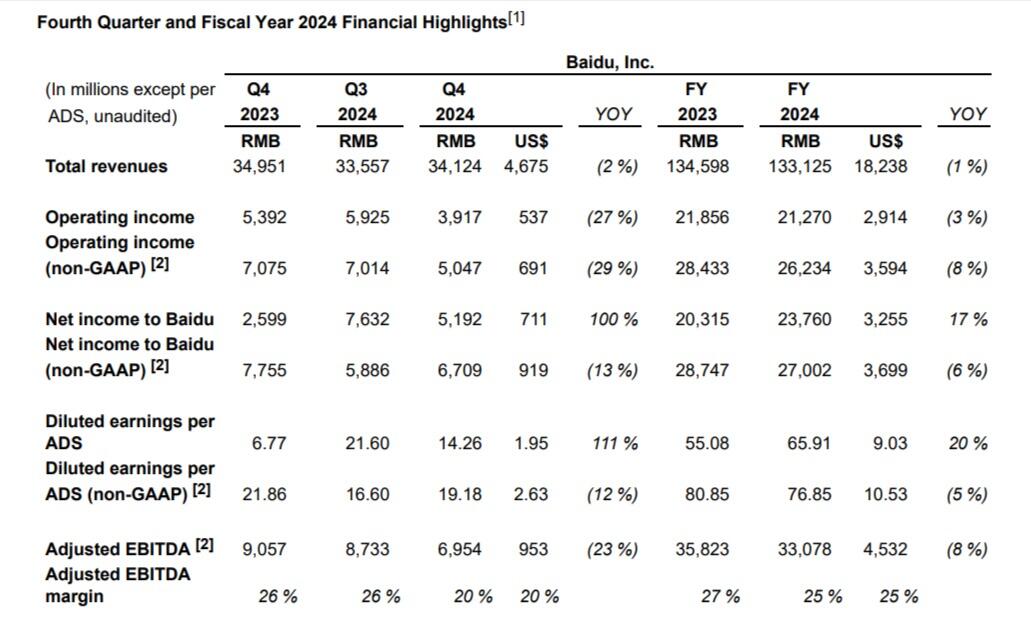

First up today, let's take a look at the Chinese multinational tech company Baidu Inc (HKG: 9888) which reported a mixed performance in Q4.

Total revenue fell 2% YoY to ¥34.1 billion ($4.68 billion), while Baidu Core revenue increased 1% YoY to ¥27.7 billion.

While the company's AI Cloud business showed strong growth with a 26% YoY revenue increase.

“2024 marked a pivotal year in our ongoing transformation from an internet-centric to an AI-first business,” said Robin Li, Co-founder and CEO of Baidu.

"With our strategic foresight increasingly validated, we expect our AI investments to deliver more significant results in 2025."

Net income attributable to Baidu increased 100% YoY to ¥5.2 billion and the company also returned US$356 million to shareholders in Q4, bringing total repurchases to over US$1 billion in 2024.

8:57 am (AEDT):

Major United States benchmark averages ended mixed on Tuesday (Wednesday AEDT), with the S&P 500 closing at fresh record highs.

The Dow Jones Industrial Average finished flat at 44,556.4, the S&P 500 added 15 points, or 0.2% to 6,129.6, while the Nasdaq Composite added 14.5 points or 0.1% to 20,041.3.

Energy stocks outperformed, led by Halliburton and Valero Energy which gained 2.2% and 2.1%, respectively.

The tech sector also saw modest gains, but losses in consumer discretionary and communication services weighed on the broader market.

Meta Platforms fell 2.8%, while Amazon dropped 0.9%.

Oliver Gray has the full story.

9:08 am (AEDT):

Economists expect the Reserve Bank of Australia (RBA) to keep lowering Australia’s official cash interest rate despite hawkish RBA comments aimed at hosing down these expectations.

The RBA cut the cash rate by 25 basis points (bp) to 4.10% on Tuesday, as was widely expected, but in a news conference, RBA Governor Michele Bulloch did her best to reset hopes that there was more to come.

“Today’s decision does not imply that further rate cuts along the lines suggested by the market are coming,” Bulloch told journalists.

She said the market had been “too confident” in pricing more easing of monetary policy and that the labour market remained “tight”.

Take a look at the full story by Garry West.

9:20 am (AEDT):

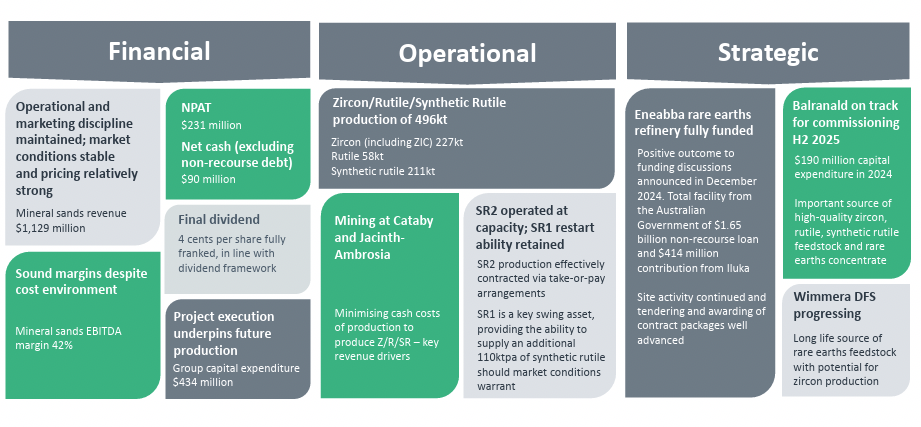

Iluka Resources Ltd (ASX: ILU) reported a 33% drop in full-year profit to A$231 million from $343 million in 2023.

The mineral sands miner reported that revenue was also down 9% to $1.13 billion.

Operating cash flow was also down 27% to $252 million compared to $347 million in 2023.

Iluka will pay a final dividend of 4 cents a share, the same as Q4 in the previous year.

Managing Director Tom O'Leary explained that while markets remained stable allowing the company to maintain operational and pricing discipline and achieve sound margins, global macroeconomic conditions in 2024 dictated lower activity levels in the construction and real estate sectors.

This drove customer buying behaviour in the zircon and titanium markets, which was also affected by higher costs during the year.

Check out the full story here.

9:30 am (AEDT):

Industrial property developer Goodman Group (ASX: GMG) has announced a A$4 billion capital raising after unveiling an increase in half-year profit.

The company said it would issue 119.4 million new securities at $33.50 each, a 6.9% discount to the closing price on Tuesday, through a fully underwritten pro-rata institutional placement.

Goodman, which develops warehouses, distribution centres and business parks in several countries, said it would also undertake a non-underwritten security purchase plan for eligible securityholders to raise up to $400 million.

The company also said operating profit rose 8% to $1.22 billion in the six months to 31 December 2024, and operating earnings per security (OEPS) increased by 7.8% to 63.8 cents.

Directors declared an unchanged unfranked interim dividend of 15.0 cents per share to be paid on 25 February to shareholders on record on 31 December.

Founder and CEO Greg Goodman said the company expected to maintain 9% OEPS growth for FY25 which includes the impact of the equity raising and without it growth guidance would have been increased to 10%.

Goodman shares (ASX: GMG) had finished at $35.98, up 75 cents (2.13%) on Tuesday, capitalising the company at $68.78 billion.

Full story here from Garry West.

9:41 am (AEDT):

National Australia Bank (NAB) reported a slight decline in its unaudited December quarter cash earnings, citing higher credit impairments on business loans as a key factor.

Australia’s second-largest bank by market capitalisation posted fiscal first-quarter unaudited cash earnings of A$1.74 billion, marking a 2% drop from the 2H24 average.

Revenue rose 3% over the same period, with underlying profit increasing by 4%. However, these gains were offset by a higher credit impairment charge of $267 million, including $152 million in individually assessed charges - primarily related to Australian businesses and unsecured retail portfolios.

The news follows the Reserve Bank of Australia's (RBA) first cash rate reduction since 2020, as policymakers cautioned against expectations of further near-term reductions.

At the time of writing, National Australia Bank (ASX: NAB) stock was trading at A$39.51, down 2.5% from Monday's close of $40.52. The stock reached a day low of $39.42 and a day high of $40.73. National Australia Bank's market cap stands at $121.45 billion.

Take a look at Oliver Gray's full story here.

9:50 am (AEDT):

James Hardie Industries saw net sales and income fall last quarter, but has reaffirmed its guidance for the rest of its fiscal year.

Its net sales last quarter were US$953.3 million, down 3% year-over-year. The company said this was due to lower volumes in North America and the Asia Pacific, though it was offset partly by higher average prices.

“We delivered strong business and financial results in the third quarter, and our year-to-date performance shows that we have a strong handle on our business as we continue to scale the organisation and invest to grow profitably,” said James Hardie CEO Aaron Erter.

“Our teams are focused on safely delivering the highest quality products, solutions and services to our customers, and we are executing on our strategy to outperform our end markets.”

Net income was US$141.7 million, falling 2% year-over-year from $145.1 million.

Diluted earnings per share were US$0.33, unchanged from one year ago.

Harlan Ockey has the full story.

10:02 am (AEDT):

The rollercoaster FY25 is the gift that keeps on giving for Mineral Resources Ltd (ASX: MIN) this time announcing an $807m H1 loss driven by the company's over-extension into lithium.

And the news comes after the recent resignation of its billionaire founder and managing director Chris Ellison after he was found to have committed tax fraud and pocketed company money after a two-year investigation by the board.

The WA mining services provider-cum-minerals producer and refiner - a long-term success story - has been hit with wave after wave of bad news in the past 18 months.

Check out Cameron Drummond's story to find out more.

10:12 am (AEDT):

Garry West reports that Australian shares are expected to be little changed when trading resumes on Wednesday with Wall Street providing little guidance.

The main United States stock market indices failed to set a clear direction although the S&P 500 closed at a new high on Tuesday (Wednesday AEDT).

The Dow Jones Industrial Average finished flat, the S&P 500 added 0.2% and the Nasdaq Composite gained just 0.1%.

The main Australian benchmark had finished 0.7% down at 8,481 points on Tuesday as seven of the 11 sectors ended lower, on a day when the Reserve Bank of Australia delivered a long-awaited cut in official interest rates.

10:19 am (AEDT)

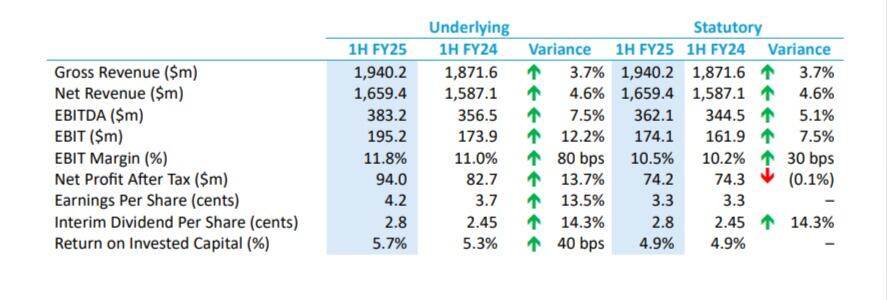

Cleanaway Waste Management Limited (ASX: CWY) today reported gross revenue up 3.7% to $1.9 million and net revenue up 4.6% to $1.7 million.

The company says this was driven by volume growth and disciplined price management across the Group.

Profit from operations (statutory EBIT) up also went up 7.5% to $174 million while, underlying NPAT and EPS were both up more than 13% which the company said is reflecting disciplined price and cost management.

Chief executive Mark Schubert said the result was driven by volume growth, pricing discipline and tight cost control.

It expanded margins on the back of higher prices, increased volumes in some segments and operational efficiency gains.

He said the company is on track to deliver at the midpoint of its underlying $395 million to $425 million earnings guidance, with a step-up expected in second-half earnings

10:59 am (AEDT):

Stock futures remained largely unchanged on Tuesday night after the S&P 500 notched a fresh record high in the previous session.

By 10:25 am AEDT (11:25 pm GMT) Dow Jones Industrial Average, S&P 500 and Nasdaq 100 futures saw minimal movement, each trading within a range of 0.1%.

Shift4 Payments fell 10% after announcing a US$2.5 billion acquisition of Global Blue.

International Flavors & Fragrances declined 4% after forecasting full-year 2025 revenue between $10.6 billion and $10.9 billion.

Toll Brothers also slid 5.3% after issuing weaker-than-expected delivery guidance for the second quarter.

11:12 am (AEDT):

Moving to the New York Stock Exchange now where Arista Networks, Inc. (NYSE: ANET) surpassed analyst expectations in Q4 and issued strong guidance for 2025.

The company is an industry leader in data-driven, client-to-cloud networking for large AI, data centres, campus and routing environments.

In Q4 the company recorded revenue of $1.9 billion, an increase of 6.6% compared to the third quarter of 2024 along with an increase of 25.3% from the fourth quarter of 2023.

"We delivered exceptional financial performance in Q4, exceeding our guidance on all key metrics. These results generated over 95% year-over-year growth in operating cash flow for the quarter,” said Chantelle Breithaupt, Arista’s CFO.

“Our strong balance sheet and robust cash position allow us to navigate economic uncertainties while continuing to invest in our long-term growth.”

The company delivered an outlook for 2025 with revenue expected between $1.93 billion to $1.97 billion and a non-GAAP gross margin of approximately 63%.

However, in extended trading, Artista Networks Inc.'s share price dropped 5.75% despite the strong results.

11:32 am (AEDT):

Stockland Corporation Ltd (ASX: SGP) reported a jump in first-half profit, with Statutory profit surging 140% year on year to $245 million.

Net tangible assets per share lifted from $4.12 to $4.14 half over half.

However, pre- and post-tax funds from operations (FFO) of $251 million were down 5.6% on the prior corresponding period.

The property development company said that the results are above expectations and reaffirmed full-year guidance.

Stockland said its results reflect "strong contributions" from its logistics portfolio and higher land lease communities settlements.

“In the past six months we’ve progressed our strategic priorities, and we now have multiple drivers of sustainable growth across our business,” said managing director and Chief Executive Officer, Tarun Gupta.

“We were pleased to complete the acquisition of 12 actively trading master planned communities late in the half. The transaction strategically restocks our pipeline at a favourable point in the residential cycle and positions us to accelerate production.”

11:55 am (AEDT):

Now on the NASDAQ, Bumble Inc (BMBL) reported mixed Q4 and full-year results.

Total revenue for 2024 increased 1.9% to $1.2 million, with revenue from the Bumble App up.5% to $866 million, however, total revenue decreased 4.4% to $262 million.

Additionally in Q4 total paying users increased 5.3% to 4.2 million, while Average Revenue per Paying User (ARPPU) decreased to $20.58 from $22.64.

The online dating company reported operating earnings of $37.0 million and Adjusted EBITDA of $72.5 million.

In 2024, the company recorded an operating loss of $700.5 million.

Bumble is set to offload Fruitz and Official apps in the first half of 2025, with Q1 revenue guidance between $242-248 million.

At the time of writing this Bumble Inc shares were trading at US$8.10 down 4.3% from the previous day’s close.

12:20 pm (AEDT):

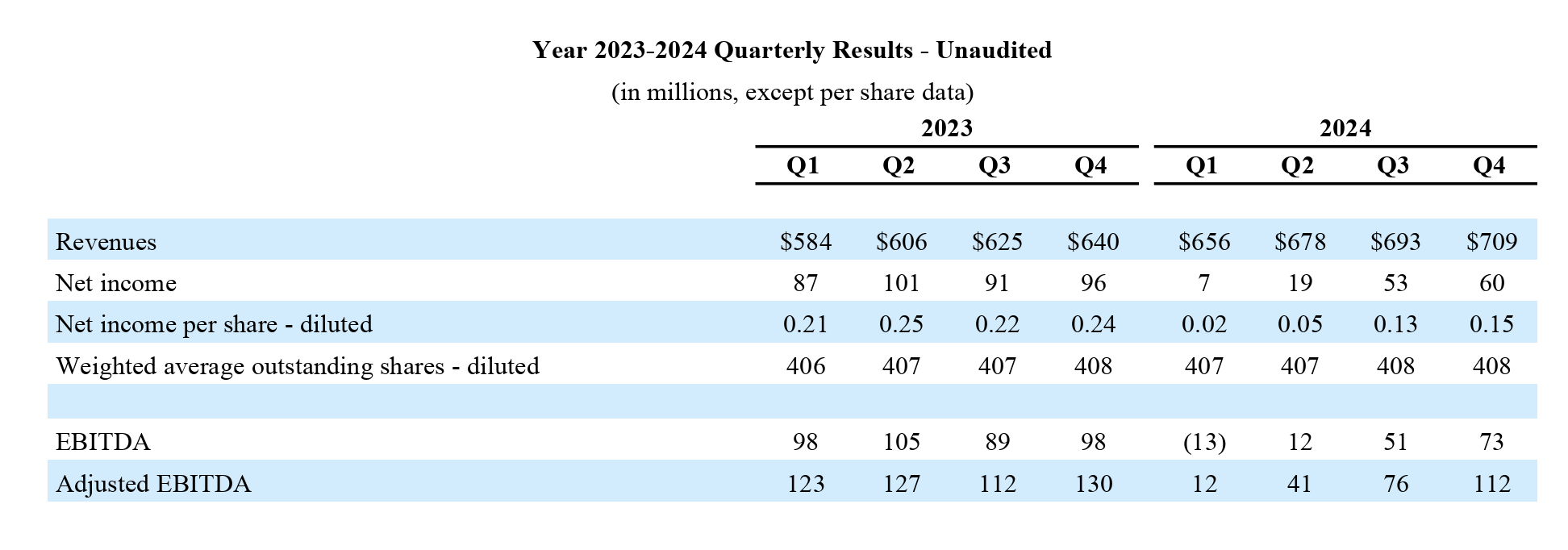

Property analytics and marketing service CoStar Group Inc (NASDAQ: CSGP) reported revenue of US$709.4 million, up 10.8% YoY.

Revenue beat the Zacks Consensus Estimate of $701 million by 1.2%

The company reported EPS at $0.26, compared to $0.33 in the year-ago quarter also topping consensus estimates by 18.2%

While CoStar disappoints with FY 2025 revenue outlook of $2.99 billion to $3.02 billion versus the analyst consensus of $3.08 billion

“We expect adjusted EBITDA for the full year of 2025 in the range of $375 to $405 million, a margin of 13% at the midpoint of the range. For the first quarter of 2025, we expect adjusted EBITDA in the range of $25 million to $35 million,” said Chris Lown, CFO of CoStar Group.

In after-hours trading, CoStar Group shares were trading at $72.80, down 3.53% following the result announcement.

12:48 pm (AEDT):

International Flavors & Fragrances Inc. (NYSE: IFF) reported on Tuesday a loss of $46 million in its fourth quarter.

The company reported $2.77 billion in revenue for Q4 representing a year-over-year increase of 2.5%.

The reported revenue was up 3.94% over the Zacks Consensus Estimate of $2.67 billion.

On a per-share basis, the New York-based company said it had a loss of 18 cents. Earnings, adjusted for non-recurring costs, were 97 cents per share compared to $0.72 a year ago.

CEO Erik Fyrwald said the company will continue to recognise ongoing macroeconomic uncertainties, and is confident in strategy and ability to navigate the challenges.

“I'm pleased with the significant progress we’ve made over the past year yet believe that we still have more work to do to realise IFF's full potential. In 2025, we'll strategically increase our investment in R&D, commercial capacity and technology as we aim to continue to strengthen IFF,” said Fyrwald.

1:35 pm (AEDT):

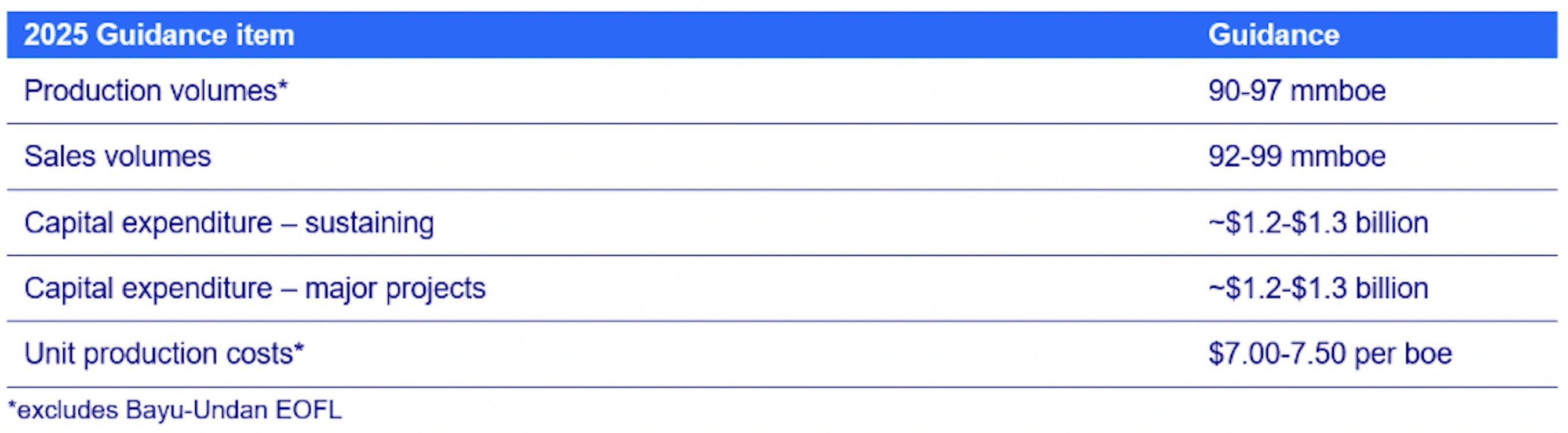

Energy company Santos (ASX: STO) has delivered a 14% downturn in net profit after tax (NPAT) to US$1.22 billion for the 2024 financial year (FY24).

The company, which produces and sells oil and gas in Australia and the Asia Pacific, said underlying profit fell 16% to $1.20 billion (A$1.89 billion) on revenue which dropped 9% to $5.38 billion as sales volumes fell 5% to 91.7 million barrels of oil equivalent.

Santos said earnings before interest, tax, depreciation, amortisation and exploration expenses (EBITDAX) decreased 9% to $3.706 billion and free cash flow from operations dived 13% to US$1.9 billion compared with FY23.

Directors declared an unfranked final dividend of US 10.3 cents per share to be paid on 26 March to shareholders registered on 26 February, which brings the total cash return to shareholders for 2024 to 23.3 cents per share, down from 26.2 cents in 2023.

Santos said FY25 guidance remained unchanged.

By 12.45 pm AEDT (1.45 am GMT) Santos (ASX :STO) shares were trading at A$6.70, down 19 cents (2.76%) after ranging between $6.66 and $6.90, and valuing the company at $21.81 billion.

Garry West has the full story.

1:52 pm (AEDT):

U.S. Semiconductor maker Micron Technology's (NASDAQ : MU) shares were on a heater yesterday after it unveiled its new 4600 PCIe Gen5 NVMe Solid State Drive (SSD) - the company’s first Gen5 drive and designed to allow for advanced performance AI models, gamers, creators and professionals.

It is designed to double the performance of its predecessor, the G9 TLC NAND, and comes with super fast read (14.5 GB/s) and write speeds (12.0 GB/s).

The new SSD is created with cutting-edge AI applications in mind, reducing model load times by up to 62% in comparison to previous generations and reckons uptake of the Gen5 model will grow rapidly in 2025 and 2026.

Micron vice president and general manager for client storage Prasad Alluri said it will be capable of loading large language models in less than one second.

“As AI inference runs locally on the PC, the transition to Gen5 SSDs addresses the increased need for higher performance and energy efficiency,” Allrui said.

Check out Chloe Jaenicke's full story here.

2:10 pm (AEDT):

Shares in Intel Corp (NASDAQ: INTC) were up 16.1% yesterday at US$27.39 - the stock’s best trading day since March 2020 - after media reports suggested both chip designer Broadcom (AVGO) and Taiwan Semiconductor Manufacturing (TSM) were weighing up bids to take out different parts of the embattled chipmaker.

According to the Wall Street Journal, Broadcom is eyeballing the company’s chip design and marketing segment, while TSMC is more interested in a stake or complete control of Intel’s factories.

While news led other chipmaker stocks higher on Tuesday, Broadcom and TSMC shares were down 2.2% and 1.3% respectively.

Yesterday’s share price rally followed Intel's 6% rise last week after Vice President JD Vance suggested America will protect AI technologies from foreign adversaries and promised that more AI chips would be made on U.S. soil.

However, Vance’s comments are at odds with recent Trump administration comments which are said to have encouraged TSMC to make a takeover offer for Intel.

Find out more from Mark Story.

2:33 pm (AEDT):

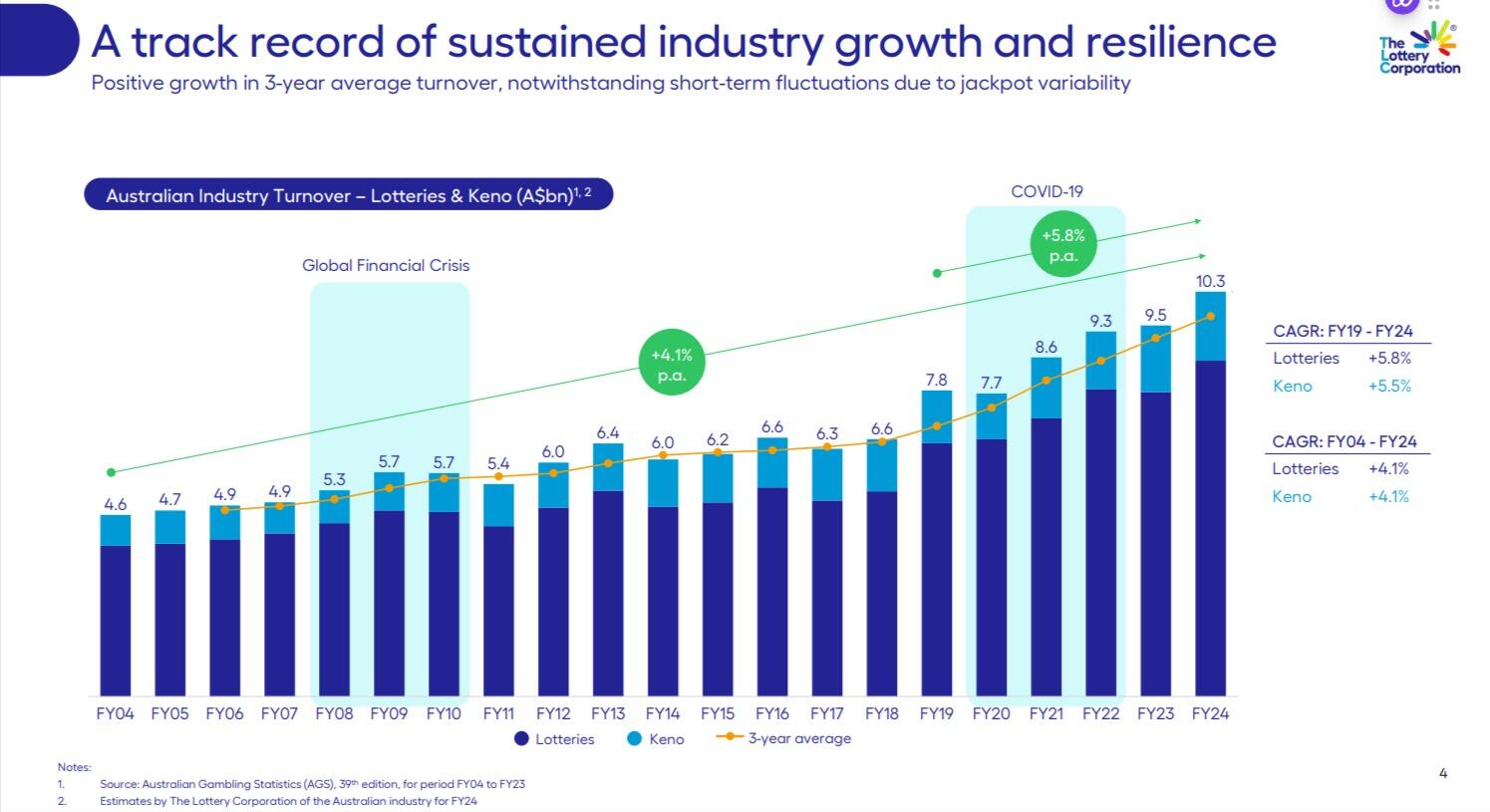

Lottery Corporation Ltd (ASX: TLC) this morning reported a “resilient” performance in the first half of FY25 despite facing below-average jackpot outcomes, with revenue decreasing by 5.6% to A$1.8 billion and a 9.9% decline in net profit after tax (excluding one-offs) to A$175.7 million.

The gambling company emphasised its strong balance sheet and cash flow, enabling an interim dividend of 8.0 cents per share.

Lottery Corp says this is a result of modest revenue growth in the Keno business, which was offset by weaker revenues in the key Lotteries segment due to below-average jackpot outcomes.

The company also reported a significant growth in active registered Lotteries customers to a record 4.75 million people.

“Lotteries continue to be very popular among Australian adults, underpinned by a low-spend, mass participation model,” said Managing Director & CEO, Sue van der Merwe.

“This was evident in the second half with the record $200 million Powerball jackpot generating queues in retail outlets and sparking conversations in homes and workplaces.”

At the time of writing shares in the company were trading at $5.10 up 3.66% from yesterday’s close at $4.92. Lottery Corporation Ltd’s current market cap is A$11.37 billion.

2:50 pm (AEDT):

Constellation Energy Corporation (NASDAQ:CEG) reported fourth-quarter earnings that surpassed analyst expectations while also affirming its full-year 2025 guidance.

The largest producer of emissions-free energy in the U.S. posted adjusted earnings per share of $2.44 for Q4, exceeding consensus estimates of $2.19 while revenue for Q4 came in at $5.38 billion, topping estimates of $4.75 billion.

For 2025 the energy company expects adjusted earnings of $8.90-$9.60 per share, compared to the analyst consensus of $9.43.

"For the second consecutive year since forming our new company, Constellation has outperformed the top end of its guidance range – a testament to the combined value of our commercial and generation businesses, which were firing on all

cylinders in 2024," said CFO Dan Eggers.

The earnings highlighted strong operational performance, with the company’s nuclear fleet achieving a 94.6% capacity factor for 2024.

The company did not deliver an earnings call, but provided a management call on January 10.

At the time the company announced a proposed $16.4 billion acquisition of private natural gas and geothermal provider Calpine in one of the biggest U.S. power industry deals.

3:06 pm (AEDT):

Medtronic PLC (NYSE: MDT) Q3 fiscal 2025 earnings that beat analyst estimates, while revenue fell short of expectations.

Revenue came in at US$8.29 billion, slightly below the $8.33 billion analysts estimate.

Earnings per share of $1.39 surpassed the analyst consensus of $1.36.

The medical device maker sees continued strength in key segments and provides a positive outlook with expected FY25 organic revenue growth in the range of 4.75% to 5%.

"We delivered strong earnings this quarter, with significant improvements in both our gross margin and operating margin on the back of our ninth quarter in a row of mid-single digit organic revenue growth," said Geoff Martha, Medtronic chairman and CEO.

Despite mainly positive results prices dropped following the announcement.

At the time of writing this, the company’s shares were trading at US$86.07 down 7.26% from $ 92.81 at the previous close.

3:40 pm (AEDT):

Occidental Petroleum Corp (NYSE: OXY) reported better-than-expected fourth-quarter earnings and announced it reached its near-term debt reduction target as the company has been focused on cleaning up its balance sheet and reducing debt in recent quarters.

Q4 EPS grew 8% to 80 cents beating analysts' expectations of 68 cents, with sales totalling $6.84 billion, down 4.6% compared to the same time a year ago.

Occidental Petroleum delivered 1.463 million barrels of oil equivalent per day in Q4.

The company has delivered better-than-expected earnings 3 quarters in a row breaking a string of 5 consecutive quarterly earnings declines.

Shares are up 1.62% at the time of writing this.

4:00 pm (AEDT):

That's all from me today - thanks for following along with our Live Earnings Blog here at Azzet!

Tune in tomorrow with Chloe Jaenicke and Harlan Ockey who will take you through results from big names like Fortesque, Telstra, Tab Corp, Star Entertainment, Bega Cheese and many more…