Iluka Resources' full-year profit fell 33% to $231 million amid subdued mineral commodity demand.

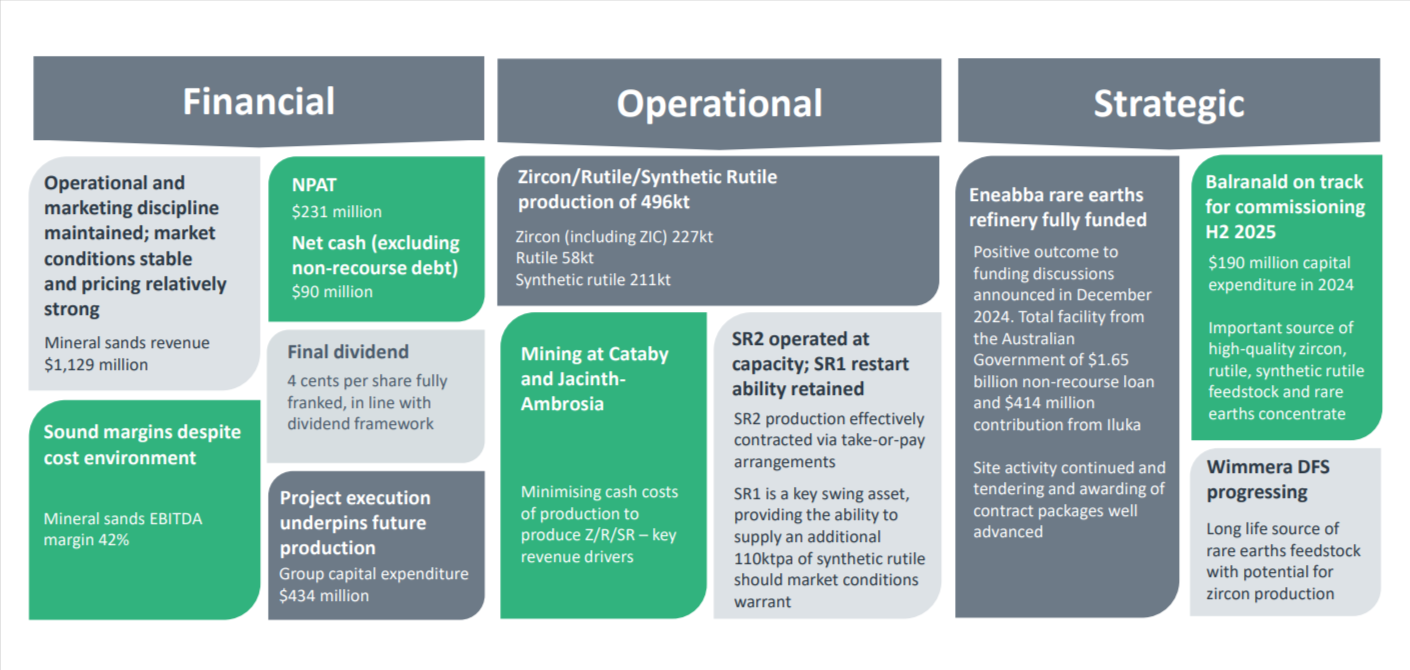

According to the company, revenue fell 9% to $1.13 billion from $1.43 billion in the year to December, with net profit dropping to $231 million from $343 million. In line with last year's dividend, the company will pay a final dividend of 4 cents per share.

While the markets remained stable in 2024, global macroeconomic conditions dictated lower activity levels in the construction and real estate sectors, which influenced Iluka's customer buying behaviour in the zircon and titanium markets, it said. In addition, costs increased during the year.

Managing director and CEO Tom O'Leary said: "We further progressed the transition underway in the company’s mineral sands business and delivered funding certainty for our rare earths diversification. Global macroeconomic conditions dictated activity levels in the construction and real estate sectors, which in turn drove customer buying behaviour in both the zircon and titanium markets."

Iluka’s separated zircon sand sales volumes were higher than expected at the beginning of the year and concentrate sales reflect available production.

"The sales contracts we have in place for synthetic rutile [continue] to provide a high degree of revenue certainty, underpinning production from our main synthetic rutile asset, SR2," O'Leary said.

The implementation of tariffs on Chinese imports in Europe and other regions – considered favourable to Iluka’s customers – is expected to impact trade flows from H1 2025, O'Leary said.

He said several pigment producers anticipate improved market conditions in 2025, which would be positive for titanium feedstock demand.

"Inflation in Australia was persistent throughout the year, which impacted our cost environment. By electing to run our mines at capacity, we optimised unit costs and maintained Iluka’s ability to service the premium zircon market, where demand is strong. The company has built an ilmenite inventory to ensure feedstock is available for a future restart of our swing synthetic rutile asset, SR1, when market conditions warrant," O'Leary said.

O'Leary said Iluka's new mine development at Balranald was well advanced and on track for commissioning in H2 2025.

"Over a 10-year mine life, Balranald will provide 60ktpa of natural rutile, 50ktpa of high quality zircon and concentrate feedstocks to support the production of synthetic rutile and rare earths. Each of these commodities [is] crucial in the context of declining industry supply," O'Leary said.

"Progress was also made on the Wimmera project, where our definitive feasibility study is focused on the WIM100 deposit – one of several multi-decade sources of rare earths and zircon that Iluka is looking to develop in Western Victoria," O'Leary said.

At an earlier stage of development, Iluka declared a resource estimate for the Goschen South deposit, further demonstrating the long-life potential of this region.

In December, Iluka announced an expansion of the Australian Government’s $1.25 billion non-recourse loan facility to $1.65 billion to deliver the Eneabba rare earths refinery.

"This strategic partnership represents one of the most significant government investments in a critical [mineral] project globally," O'Leary said. "Iluka’s objective is to deliver sustainable value and we expect our rare earths business to underpin this over several decades.

"With the capital structure for Eneabba now certain, the principal drivers of realising that value are project delivery, operational performance, market development and maturing additional feedstock options to secure longevity. These are our key priorities in rare earths."

At the time of writing, Iluka's (ASX: ILU) share price was $4.68, with a market cap of approximately $2 billion.

Related content