Azzet updates on three resources stocks that reported fourth-quarter results today.

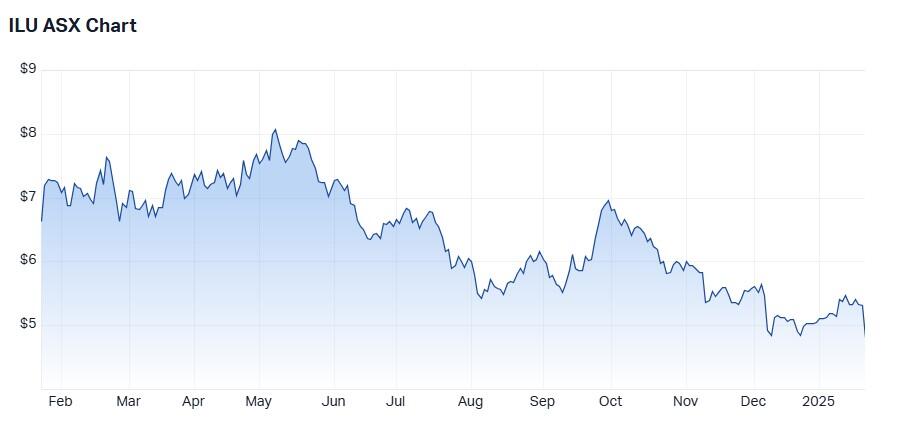

Iluka tanks on underwhelming Q4 update

Shares in critical minerals company Iluka Resources (ASX: ILU) were down around 9% heading into lunch (AEDT), following a mixed quarterly report that the market clearly didn’t like.

While mineral sands revenue was up 25%, the result was 17% below Citi’s forecast and overall mineral sands revenue fell 8.9% to $1,128 million for the 12 months.

The miner's failure to beat expectations was also evident throughout other key elements of the result. For example, Aggregate zirconium, rutile and synthetic rutile sales volumes were up 4% to 136,000 tonnes, but they came in 12% below Citi’s forecast.

While rutile pricing was a beat by 7%, the realised zirconium price was 11% below consensus.

The company expects pricing to be weaker in March and guided to flat zircon/rutile/synthetic rutile (Z/R/SR) production calendar 2025 with unit cash costs up on first production from Balranald in the second half, but with no finished goods output.

An expected 3% increase in the miner’s total cash cost of production suggests earnings will be even lower than revenue in FY 2024.

“On a positive note, unit cash costs of production of $1,290/t were below guidance, reflecting slightly higher finished goods production and cost minimisation initiatives. Balranald is on track for commissioning in 2H CY25,” said Citi’s Paul McTaggart.

Iluka expects FY24 group earnings (excluding the Deterra contribution), to be between $330 million to $340 million, down significantly on earnings of $492.3 million recorded in FY 2023, however, this result did include a $27.3 million contribution from Deterra.

Management guided to relatively flat production and higher costs in FY25.

Consensus on Iluka is Moderate Buy.

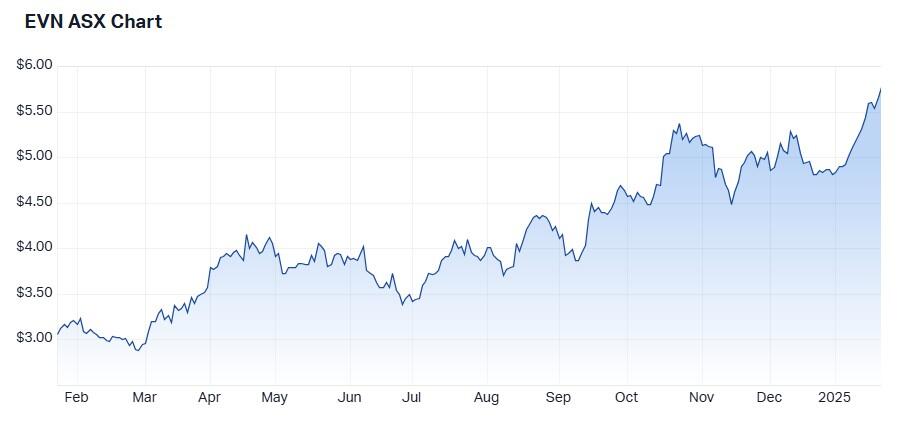

Evolution Mining jumps on record breaking quarter

Shares in Evolution Mining (ASX: EVN) were up around 2% at noon (AEDT) following revelations that the ASX200 gold stock had delivered record operating and net mine cash flow of $561 million (up 31%) and $263 million (up 53%), respectively.

Management attributed its record cash flow to the benefits of a low cost position in a higher metal price environment. Over the quarter the average gold sales price of $4,069 per ounce.

“Our cash flow materially increased by 54% in the December quarter, reflecting the safe delivery of low cost production and the benefits derived from the high metal price environment,” said the company’s managing director and chief executive officer, Lawrie Conway.

“Our growth projects have progressed very well with the Mungari expansion project now about nine months ahead of schedule and costs 6% below original budget. The excellent exploration results announced today, will serve to enhance our high margin portfolio.”

The result was achieved with an all-in sustaining cost (AISC) of $1,543 per ounce (US$959 per ounce which the company reminded investors is one of the lowest in the sector.

Gold production for the three months ending 31 December was 194,793 ounces, a minor quarter-on-quarter increase and is in line with consensus estimates.

The company is on track to achieve its production guidance in FY 2025 which includes 710,000 ounces to 780,000 ounces of gold and 70,000 tonnes to 80,000 tonnes of copper at an AISC of $1,475 to $1,575 per ounce.

Consensus on Evolution Mining is Hold.

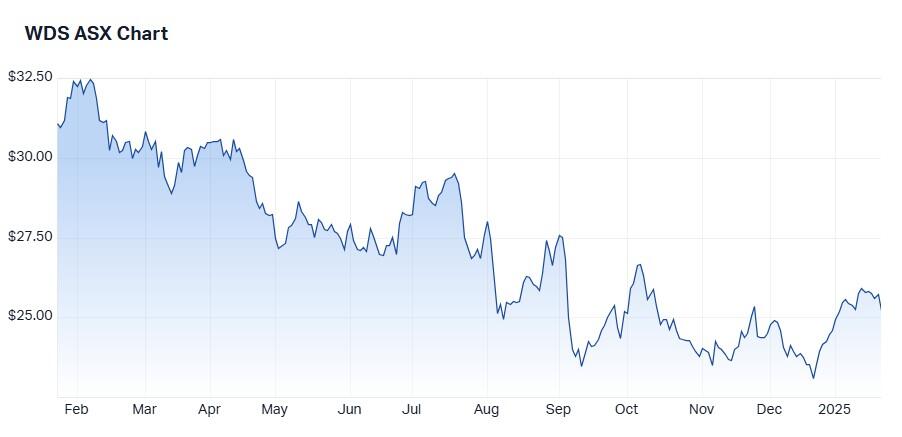

Woodside slips on lower quarterly revenue

Shares in Woodside Energy Group (ASX: WDS) were down around 2% at noon following the release of the energy company’s fourth-quarter report which revealed a 6% fall in revenue of $3.47 billion and a 3% dip in quarterly production over the previous period.

Management attributed much of the revenue and production fall to lower seasonal demand at Bass Strait, plus an unplanned shutdown at Woodside's Pluto project.

Helping to drive record full-year 2024 production for the company of 194 MMboe (530 Mboe/day) - at the top end of Woodside's 2024 full-year production guidance range - was the company's Sangomar project which produced 75,000 barrels of oil equivalent per day (Mboe/day).

Woodside's Scarborough Energy project ended the quarter 78% complete and remains on target for its first LNG cargo in 2026.

Meanwhile, the Trion project ended the quarter 20% complete with first oil targeted for 2028.

Other key milestones during the quarter included the sale of a 15.1% non-operating participating interest in its Scarborough Joint Venture to JERA an unlisted company jointly owned by Tokyo Electric Power and Chubu Electric Power for US$1.4 billion.

Consensus on Woodside is Moderate Buy.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.