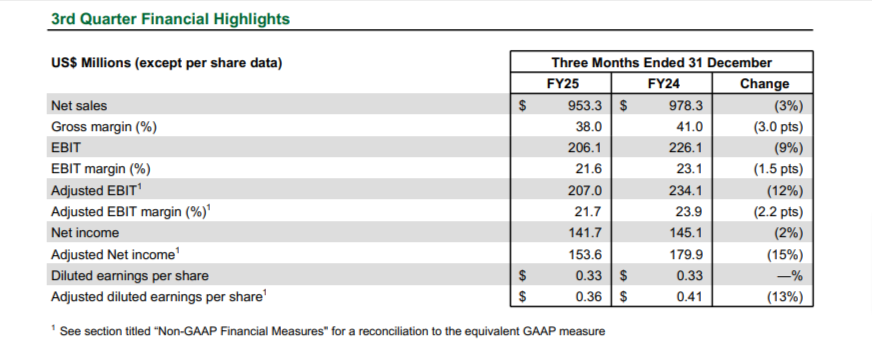

James Hardie Industries saw net sales and income fall last quarter, but has reaffirmed its guidance for the rest of its fiscal year.

Its net sales last quarter were US$953.3 million, down 3% year-over-year. The company said this was due to lower volumes in North America and the Asia Pacific, though it was offset partly by higher average prices.

“We delivered strong business and financial results in the third quarter, and our year-to-date performance shows that we have a strong handle on our business as we continue to scale the organisation and invest to grow profitably,” said James Hardie CEO Aaron Erter.

“Our teams are focused on safely delivering the highest quality products, solutions and services to our customers, and we are executing on our strategy to outperform our end-markets.”

Net income was US$141.7 million, falling 2% year-over-year from $145.1 million.

Diluted earnings per share were US$0.33, unchanged from one year ago.

James Hardie’s net sales also dropped across regions last quarter. Sales in its North America Fiber Cement division fell by 1% year-over-year, with volumes lowering by 3%.

Net sales in the Asia Pacific region declined by 5%. Volumes were down 28%, though average net sales prices were up 20%.

In its Europe Building Products division, net sales grew by 2% to reach US$359.8 million. This was largely driven by a price increase in June 2024, the company said.

Its net cash from operating activities was US$657.4 million for the first nine months of its fiscal year. This is a 12% year-over-year decrease.

The company’s guidance is unchanged. For its full fiscal year, it predicts adjusted net income of US$635 million, and volumes of at least 2.95 billion standard feet in North America.

James Hardie’s share price (ASX: JHX) closed at A$50.37, down from its previous close at %50.97. Its market capitalisation is $21.65 billion.