It's been revealed that on 12 September, Elon Musk dropped US$1 billion (A$1.5 billion) on Tesla shares like most people buy a coffee, sending the stock up 4% and wiping out the company's year-to-date losses. Musk's Tesla shopping spree involved 2.57 million shares at US$372-396 each - his biggest stock purchase ever and first significant buy since February 2020.

The timing conveniently coincides with Tesla's board proposing the most audacious pay package in corporate history - a potential US$1 trillion compensation deal that could crown Musk as the world's first bona fide trillionaire.

Tesla Chair Robyn Denholm called him a "generational leader" while defending the pay package as essential talent retention.

Trillion-dollar math

Musk's current wealth, according to Bloomberg's Billionaires Index, stands at roughly US$419 billion - split between Tesla (37%), SpaceX (that US$145 billion stake), and ventures like xAI.

The proposed Tesla compensation would more than double his wealth; however, the company must first reach a US$2 trillion market cap milestone before Musk sees a single share, almost 2X its current US$1.3 trillion value.

Each subsequent milestone opens at higher valuations, building to US$8.5 trillion - bigger than Meta, Microsoft, and Alphabet combined - and includes:

- 20 million Tesla vehicles delivered (they managed under 2 million in 2024)

- 1 million robotaxis cruising the streets

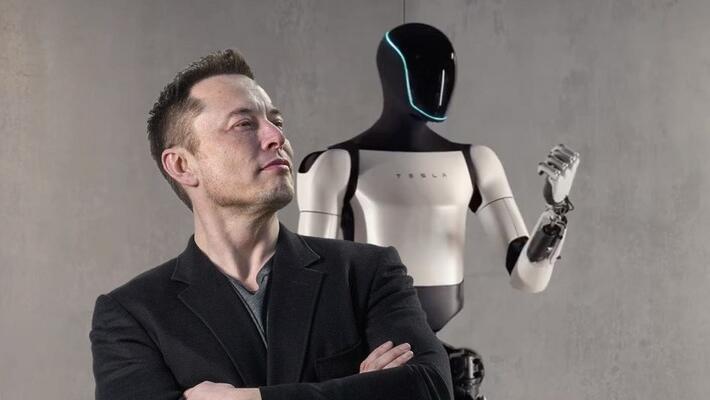

- 1 million Optimus robots in service

Basically, if Tesla hits $8.5 trillion market cap by 2035 while delivering millions of robots and robotaxis, Musk pockets 423.7 million additional shares after first transforming Tesla from a car company into the world leader in everything AI and robotics.

From carmaker to robot creator

Musk has also recently declared "80% of Tesla's value will be Optimus" and predicted the humanoid robot business could generate over $10 trillion in revenue long-term.

This completely reframes Tesla from "that electric car company" to "the company that will replace human labour with robots".

ARK Invest estimates humanoid robots represent a US$24 trillion global opportunity, with half of that in manufacturing.

Morgan Stanley projects a US$5 trillion market potential, and Citi goes even higher at $7 trillion.

At Tesla's current price-to-sales multiple, Optimus needs just $301 billion annual revenue to justify a $4 trillion valuation, representing just 6% of Morgan Stanley's projected total addressable market.

ARK predicts 90% of Tesla's enterprise value will come from robotaxis by 2029, with Tesla maintaining fat 80% take rates compared to Uber's current 20-30%.

Yet while those lofty goals are being worked towards Tesla's car business is having a mare, with vehicle sales dropping 13% in the first half of 2025, causing quarterly profits to nosedive from $1.39 billion to $409 million.

European sales cratered 40% in July as Musk's political adventures damaged the brand, Chinese competition is intensifying (BYD isn't messing about), tariff and production constraints affect everything, and those U.S. EV tax credits vanished earlier this month.

But if Musk actually pulls off autonomous driving, mass-produced humanoid robots and AI infrastructure at scale, none of that will matter, and Tesla would likely become the most valuable company in history.

Tesla shareholders vote on the compensation package during the 6 November annual meeting, with approval looking likely given their track record of backing Musk's targets - especially since shareholders only win if the company's value explodes.