Morgan Stanley’s Q2 2025 earnings release reveals robust performance which reinforces its appeal to global luxury investors seeking stability and scale.

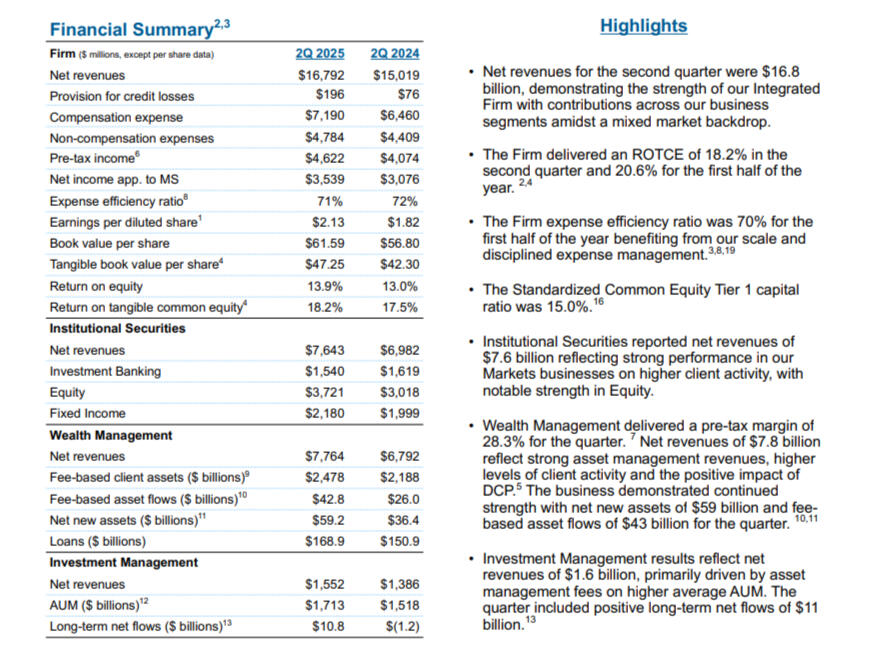

Morgan Stanley posted US$16.8 billion in net revenue, up 12% year-over-year, with EPS of $2.13 and a Return on Tangible Common Equity (ROTCE) of 18.2%.

The bank reported net income of $3.5 billion ($5.38 billion) for the second quarter, ahead of analyst expectations of US$3.2 billion.

Ted Pick, Chairman and Chief Executive Officer, said, "Morgan Stanley delivered another strong quarter. Six sequential quarters of consistent earnings – $2.02, $1.82, $1.88, $2.22, $2.60 and $2.13 – reflect higher levels of performance in different market environments. Institutional Securities saw strength and balance across businesses and geographies."

The firm’s Wealth Management division continues to dominate, adding $59 billion in net new assets and $43 billion in fee-based flows, pushing total client assets to $8.2 trillion.

"We announced an increase [in] our quarterly common stock dividend to $1 per share with flexibility to deploy incremental capital. The management team is executing across the Integrated Firm, acting as a trusted advisor to clients and driving durable growth and long-term returns for our shareholders," Pick said.

Institutional Securities and Investment Management also delivered solid growth, with notable strength in equity trading and long-term net flows of $11 billion.

Morgan Stanley’s second-quarter results underscore its position as a premier wealth platform for high-net-worth clients.

With $8.2 trillion in client assets and a 28.3% pre-tax margin in Wealth Management, the firm is executing a high-efficiency, high-touch strategy that blends digital scale with bespoke advisory.

Institutional Securities saw a 23% surge in equity revenues, while Investment Management benefited from rising AUM and strong inflows into fixed income and alternatives.

The firm’s $1 dividend and $20 billion buyback authorisation signal confidence in long-term capital deployment.

At the time of writing, the Morgan Stanley (NYSE: MS) share price was US$139.79, down $1.87 (1.32%). After hours, it traded at $139.60. Morgan Stanley has a market cap of around $223.59 billion.