Shares in Meta Platforms (NASDAQ: META) jumped after it announced a 35% increase in net income for the first quarter (Q1) of the 2025 financial year.

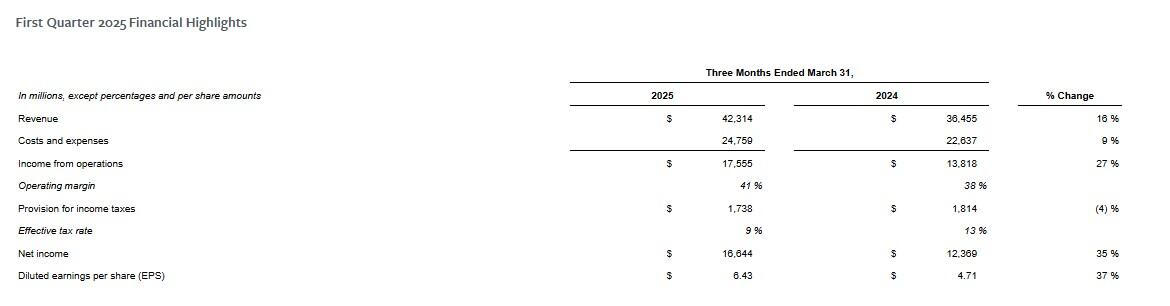

Meta, the parent company of Facebook, Instagram and WhatsApp, said net income was US$16.664 billion (A$26.06 billion) in the three months ended 31 March, compared with $12.369 billion in the previous corresponding period.

Diluted earnings per share (EPS) rose 37% to $6.43 as the operating margin widened to 41% from 38% and revenue increased 16% to $42.31 billion (19% on a constant currency basis).

“We've had a strong start to an important year, our community continues to grow and our business is performing very well," founder and CEO Mark Zuckerberg said in a press release.

"We're making good progress on AI glasses and (artificial intelligence research and development arm) Meta AI, which now has almost 1 billion monthly actives.”

Meta AI glasses are eyewear designed to integrate artificial intelligence and augmented technologies to offer a seamless experience between the digital and physical worlds.

The company said daily users of its apps increased 6% to 3.43 billion on average for March 2025, advertising impressions across its ‘family’ of apps rose 5%, and the average price per advertisement was 10% higher than a year earlier.

Commenting on the outlook, Chief Financial Officer Susan Li said META expected revenue to be $42.5-$45.5 billion in the second quarter, and expenses to be $113-118 billion (down from the previous outlook of $114-119 billion), capital expenditures to be $64-72 billion (up from $60-65 billion) and the tax rate to be 12-15% in FY25.

Li also said Meta expects to modify its subscription for no ads model due to the European Commission’s (EC) recent decision that the model was not compliant with the Digital Markets Act (DMA), which could worsen the user experience in Europe and have a significant impact on its European business and revenue by Q3.

“We will appeal the EC's DMA decision but any modifications to our model may be imposed before or during the appeal process,” Li said in the release.

The results were better than expected with analysts forecasting EPS of $5.23 per share on revenue of $41.34 billion, according to a FactSet poll.

Meta shares closed $5.44 (0.98%) at $549.00 on Wednesday (Thursday AEST) but climbed $26.30 (4.79%) to $575.30, which capitalises the company at $1.39 trillion, in after-hours trading once the result was announced.