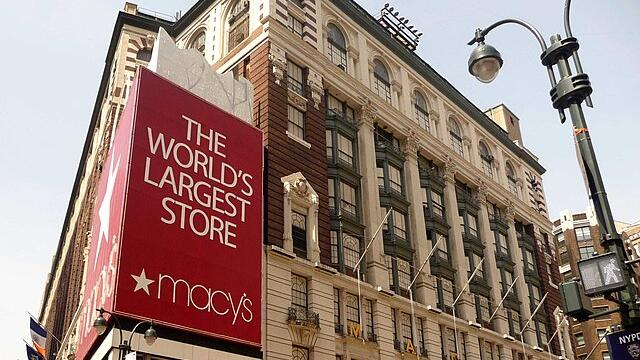

Macy’s has reported a 61% fall in net income for the third quarter (Q3) of 2025 despite beating its sales and earnings guidance.

The American department store group said net income dropped to $11 million in the 13 weeks ended 1 November from $28 million in the previous corresponding period, and diluted earnings per share (EPS) fell to four cents from 10 cents on revenue, which was barely changed at $4.913 billion.

Macy’s said net sales of $4.7 billion, sales growth of 3.2% on a comparable owned-plus-licensed-plus-marketplace basis and adjusted diluted EPS of nine cents exceeded prior guidance.

The company also upgraded annual guidance for adjusted EPS to between $2.00 and 2.20 from $1.70 to $2.04 and for net sales to be between $21.475 billion and $21.625 billion from $21.15 billion to $21.45 billion.

“Our third quarter sales were the strongest in 13 quarters, reflecting the acceleration of our Bold New Chapter strategy and demonstrating that the meaningful enterprise-wide changes we’ve made are resonating with customers,” Chairman and Chief Executive Officer Tony Spring said in a statement.

“As we enter the holiday season, we are well-positioned with compelling new merchandise and an omni-channel customer experience that delivers both inspiration and value. With a strategy rooted in hospitality, our teams are focused on driving long-term, profitable growth.”

Adjusted EPS was 9 cents compared with estimates of a 14-cent loss, helped by demand at Macy's upscale Bloomingdale's label and the high-end beauty chain Bluemercury, Reuters reported.

Macy's (NYSE: M) shares ended 25 cents (1.1%) lower at US$22.46 on Wednesday (Thursday AEDT), capitalising the company at $6.03 billion (A$9.13 billion).