Mining chief Tony Rovira is back in the critical minerals space with Lycaon Resources (ASX : LYN) and its flagship Stansmore project in WA’s West Arunta, having been appointed to the board as a non-executive director.

The junior says Rovira will bring his past expertise with nickel and lithium exploration and development to the table - as well as $360,000 of his own money through a share placement - to assist in driving the development of Stansmore and look for acquisition opportunities.

Lycaon chair Adrian Di Menna says Rovira brings extensive technical and leadership experience in the mining industry that will be invaluable to the company.

“Tony’s proven success leading Azure Minerals demonstrates his ability to deliver outstanding outcomes for stakeholders, and I look forward to working closely with him as we continue to progress the company’s existing assets and assess potential new project acquisition opportunities,” Di Menna said.

From lithium to niobium

Rovira put WA’s Pilbara region back on the radar for lithium exploration with kingmaker Mark Creasy’s Azure Minerals, proving up the developing Andover deposit that was originally pegged for nickel sulphide prospectivity.

Yet results from a behemoth 110,000m drilling campaign ended up showing high grades of Li2O across a huge 9km x 5km wide pegmatite swarm within the tenement and culminated in the sale of the company for $1.7 billion cash last year.

For Rovira, that was a $24 million payday in realised stock value, as lithium major SQM and Gina Rinehart's Hancock Prospecting swooped in to takeover Azure and its potentially world-class Andover.

Could the guru that developed Jubilee Mines’ world-class Cosmos and Cosmos Deep nickel operations and discovered Andover’s lithium endowment do the same with niobium, rare earths and IOCG mineralisation at Lycaon’s Stansmore tenements?

Critical minerals in the West Arunta

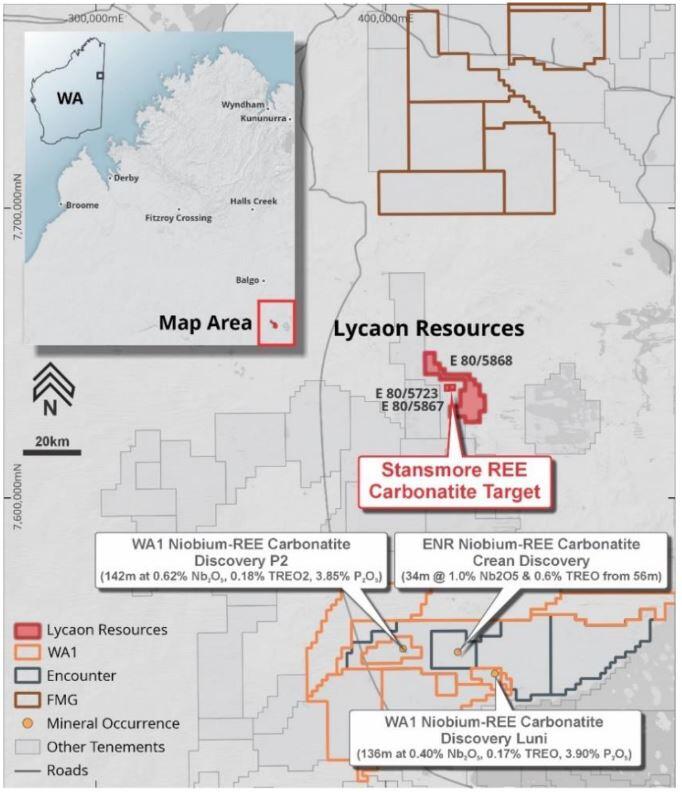

An emerging mining district is taking shape in the northeastern fringes of the Pilbara, after WA1 Resources (ASX : WA1) made the largest discovery of niobium the world has seen for at least 70 years - the 200Mt Luni deposit.

Niobium is all abuzz at the moment as refined niobium pentoxide is in high demand for its use in a range of high-value applications including high performance alloys, superconductors, electronics and a range of other new tech.

The $900m WA1 went from minnow to hero with a >6000% share price rise in under two years as it revealed Luni’s impressive niobium endowment and Lycaon is taking the same path in its search for the critical mineral.

The 173km2 Stansmore lies 90km north of WA1’s Luni and Encounter Resources’ (ASX : ENR) Crean discoveries and a maiden drilling campaign has just wrapped up.

Results, due this quarter, will give a cleaner indication of the projects’ critical mienrals potential and Rovira’s appointment could help move things forward at pace.

Shares jumped on the news of Rovira's board appointment, rocketing an impressive 77% to close at 16c a share today.