Australia's Prime Minister Anthony Albanese has revealed plans for the federal and state governments to throw a $2.4 billion lifeline to rescue the troubled South Australia Whyalla steelworks, which was pushed into administration following an emergency yesterday.

The Whyalla Steel Works Bill amendments permit the state government to enter the steelworks, access accounts, and make a first charge on government debts.

KordaMentha has been appointed the administrator of OneSteel Manufacturing, which owns and operates the Whyalla steelworks and is part of the GFG corporate group.

It’s understood the decision to put the steelworks in administration followed the state government’s doubt over GFG’s ability to pay its bills and secure funding needed for the ongoing operation of the steelworks and the deteriorating financial position of the company’s chairman Sanjeev Gupta.

$2.4 billion support package

It’s understood GFG owes the government tens of millions of unpaid royalties and around $15 million to SA Water.

Premier Peter Malinauskas has reassured the market that state government intervention was by no means a bailout for Gupta or for the steelworks which produce around 75% of the country's structural steel.

Albanese echoed Malinauskas' sentiments this morning.

Only days after throwing an additional $80 million at ailing regional airline, Rex, Albanese framed today’s announced $2.4 billion Whyalla support package as an investment in the nation rather than a bail out for Gupta or GFG.

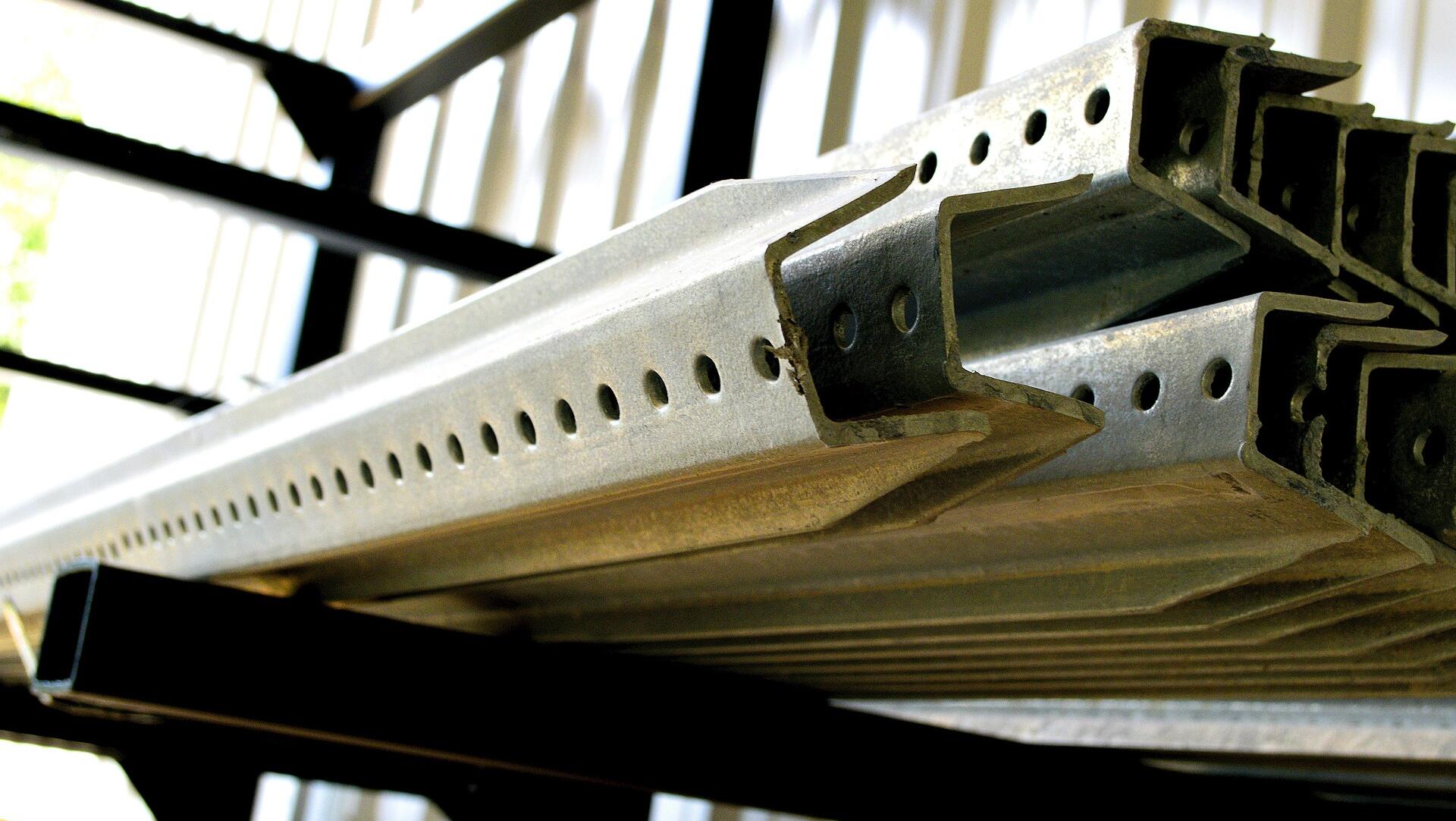

"There's no industry that is more important for our nation than steelmaking, and here in Whyalla 75 per cent of Australia's structural steel is made right here," he told a media conference.

The support package, split between immediate, short-term and long-term spending plans, and jointly funded by the state and federal governments could save around 3,100 direct and indirect jobs that depend on the key smelter.

The bulk of the money, $1.9 billion, will be set aside for new infrastructure under a new owner.

The three main elements of the rescue package include:

1) Immediate on-the-ground support: $100 million

- Creditor assistance payment $50 million.

- Infrastructure upgrades are $32.6 million.

- Jobs Matching and Skills Hub are $6 million.

2) Stabilising the steelworks: $384 million

The state and federal governments co-invest $384 million to fund Whyalla Steelwork’s operations during administration to ensure workers and contractors get paid.

3) Investing in steelworks' future: $1.9 billion

State and federal governments to work with a new owner to invest in upgrades and new infrastructure critical to ensuring the steel facility has a sustainable long-term future.

To fund the plans, the government is setting up a $1 billion green iron investment fund, half of which would go to Whyalla, with the rest "available for other projects as well".

Australia and NZ Bank (ASX: ANZ) chair Simon Birmingham has reiterated plans to work closely with Whyalla’s creditors, many of whom are owed millions.

Meanwhile, London-based Sanjeev Gupta, who purchased the plant in 2017 for $700 milliom - with a promise to transform it into a “green steel” plant – has claimed that the seizure of his Whyalla steelworks was “unexpected and unprecedented” and “the wrong course of action” for the troubled plant’s creditors and workers.

It’s understood Gupta will seek legal advice on how to protect his other companies, who account for over half of Whyalla’s creditors.

However, within an internal memo to executives of his corporate group GFG Alliance, Gupta admitted that his days at Whyalla are ending.