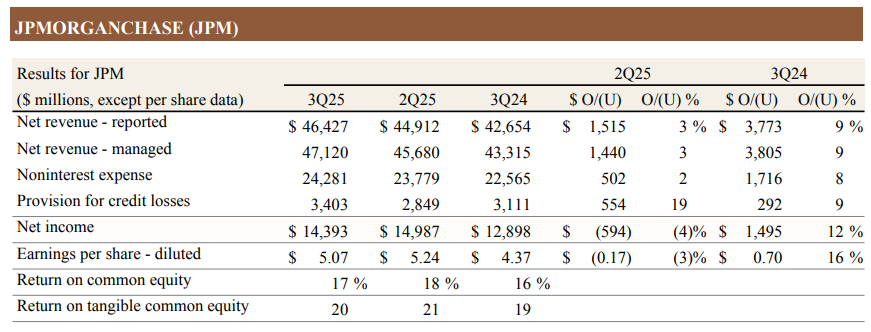

The world’s largest bank, JPMorgan Chase, has announced a 12% increase in net income to US$14.393 billion (A$22.18 billion) for the third quarter of the 2025 financial year (Q3 FY25).

Diluted earnings per share (EPS) rose 16% to $5.07 as revenue grew 9% to $46.427 billion in the three months ended 30 September 2025.

Net interest income rose 2% to $24.1 billion while non-interest revenue soared 16% to $23.0 billion.

JPMorgan Chase also raised its full-year forecast for net interest income for FY25 to $95.8 billion from $95.5 billion.

The bank made a $170 million charge in Q3 over its exposure to bankrupt auto dealer Tricolor, which Chairman and CEO Jamie Dimon said was “not our finest moment”.

“When something like that happens, you could assume that we scour every issue, every universe, everything,” he said on a conference call.

EPS exceeded analysts' estimates of $4.84, but the share price (NYSE: JPM) closed $5.89 (1.91%) lower at 302.08, capitalising the bank at $830.65 billion, before inching up to $302.15 in after-hours trading.

Dimon said the firm reported strong results in Q3 with each line of business performing well.

He said investment banking fees from the Commercial and Investment Bank division rose 16% as equity capital markets and mergers and acquisitions activity picked up against a supportive backdrop.

JPMorgan Chase continued to benefit from higher client activity and demand for financing in its Markets division with record Q3 revenue of almost $9 billion.

“While there have been some signs of a softening, particularly in job growth, the U.S. economy generally remained resilient,” Dimon said in a media release.

“However, there continues to be a heightened degree of uncertainty stemming from complex geopolitical conditions, tariffs and trade uncertainty, elevated asset prices and the risk of sticky inflation.”