Corporate America's crypto experiment is facing a reality check. After years of investors paying ~US$2.80 for every $1 of cryptocurrency sitting in corporate treasuries, people are beginning to ask themselves - why not just buy it directly?

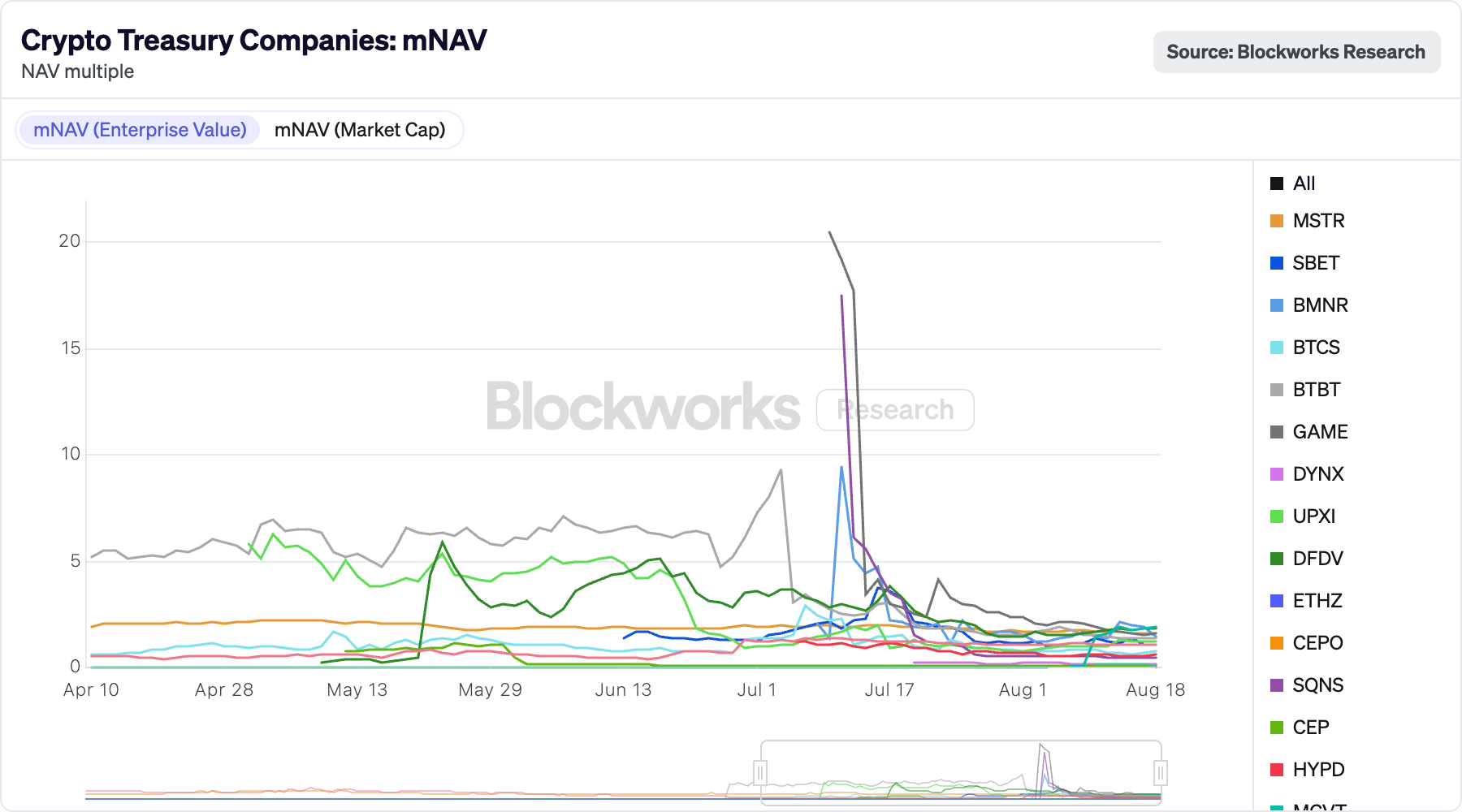

Crypto treasury stocks recently fell toward the intrinsic value of their underlying holdings - and so too did a metric called mNAV (market multiple of Net Asset Value) across both Bitcoin and Ethereum-linked companies during July and August:

Bitcoin Treasury Companies:

- Strategy (MSTR): down 16%

- Metaplanet (MTPLF): down 62%

- Semler Scientific (SMLR): down 12%

Ethereum Treasury Companies:

- SharpLink Gaming (SBET): down 14%

- BitMine Immersion Technologies (BMNR): down 7%

The fall was quite dramatic - and a potential wake up call to investors. That's because the danger, analysts say, is that when that multiple hits 1.0, the investment thesis collapses.

Upexi, a Solana treasury company, already trades below parity - meaning investors can buy the stock for less than the crypto it holds.

SharpLink dropped 14% and BitMine fell 7% - on the back of both companies issuing equity to fund crypto purchases.

The business model involves buying cryptocurrency with shareholder capital and charging management fees to do so.

Dilution mechanism

The treasury company process works by convincing investors to pay premiums for stock, then issuing more shares to buy cryptocurrency.

BMNR raised US$250 million through this type of private investment, causing its stock to soar 1,300% and until Wall Street's latest market dump, was trading 17.23x its book value.

Meanwhile, SharpLink raised US$425 million and added 58.7 million shares to its existing count of 659,680 - an increase of 8,893% - the stock tanking when those shares hit the market back in June.

Looking over the past month, mNAVs have compressed across the board, with the sector averages peaking at 4.3 times before declining.

Companies in this space are issuing new shares faster than they accumulate cryptocurrency, diluting existing shareholders.

Case in point: Strategy (formerly MicroStrategy) and SBET's underperformances highlight this gap between stock performance and underlying crypto holdings.

Direct access trading (DAT) - a system that allows a client to trade without a middleman - depends heavily on BTC volatility, which fuels convertible debt and equity issuance.

"With volatility muted, issuance capacity and mNAV growth may remain under pressure," VanEck Senior Investment Analyst Patrick Bush said.

When Bitcoin volatility falls, these companies struggle to raise capital, premiums compress and the stocks plummet.

Dangers of the parity threshold

An mNAV of 1.0 creates what analysts call a “death spiral" - and at that point, investors face corporate governance risk, management fees and dilution without justification; versus direct Bitcoin ownership through ETFs.

"It's a meme effect that has nothing to do with investment prowess or good corporate strategy," Stanford finance professor Darrell Duffie told Fortune.

It gives a sortof unwritten license for companies to boost share prices by announcing Bitcoin purchases regardless of any business fundamentals.

Unlike internet companies that created productivity gains, treasury companies offer cryptocurrency exposure with corporate overhead and when SBET's shares became tradeable after its PIPE funding, the stock declined as supply increased - a pattern repeating across the sector.

Capriole Investments show that a third of the 156 publicly listed Bitcoin treasuries now trade below the 1.0 mNAV - valuing the company at less than their Bitcoin is worth.

“There are structural reasons that suggest we may continue to see mNAVs dropping for some treasury companies,” Carlos Guzmán, VP of research at GSR, told DL News.

The alarm bells rang back in June in Coinbase's monthly outlook, suggesting that market stresses could force companies to liquidate their Bitcoin holdings indiscriminately to pay off debt - potentially creating a negative feedback loop of selling pressure that drives down both cryptocurrency and stock prices.

Ethereum's difference

Yield generation represents the main factor that might sustain mNAV premiums above 1.0 - and as with most crypto's, is often built on good marketing and community hype.

The use case over Bitcoin is that Ethereum treasury companies have an advantage through staking.

SBET has staked portions of its ETH holdings, and generated 322 ETH from staking as of July 8, thus creating value beyond price appreciation.

ETH treasuries command higher mNAV premiums because the staking generates 3.2-14% yields, providing mathematical justification for corporate overhead.

Staking allows Ethereum companies to increase cryptocurrency per share without issuing dilutive equity - an advantage that may diminish as ETH staking becomes available through direct protocols.

The numbers…

Public BTC treasuries collectively hold 951,000 BTC, with Strategy trading at 1.63 times the value of its Bitcoin holdings, and the MSTR/IBIT ratio has fallen to 5.43 - both down from earlier this year.

Among ETH strategic reserve companies, SBET and BTCS trade within the range of 2-2.5 times mNAV. while BMNR and BTBT tend to trade at higher multiples.

Spot Bitcoin ETFs provide institutional exposure without corporate overhead - different to institutional custody like Blackrock's ETHA, which offers direct cryptocurrency ownership without dilution.

Only those with premium survive

Venture capital firm Breed warns that only companies maintaining strong mNAV premiums whilst growing Bitcoin-per-share can survive. Others may face acquisition, collapse, or trading below net asset value.

Those with 1.5x multiples face what VanEck warns could be “further mNAV compression” if "a prolonged low-volatility regime limits capital-raising ability".

To make things worse, low Bitcoin volatility restricts these 'treasuries' ability to raise capital through convertible debt or equity.

That's because the model requires premium valuations to function - without them, the mathematics favour direct cryptocurrency ownership.

As mNAV premiums compress toward parity, only the operators with competitive advantages beyond simple cryptocurrency accumulation will likely justify their existence…

…or will these treasury companies become the next FTX, rocking the crypto space in its entirety?