Spotify Technology has announced a big lift in earnings for the first quarter (Q1) of the 2025 financial year but its share price dived as the results were below expectations.

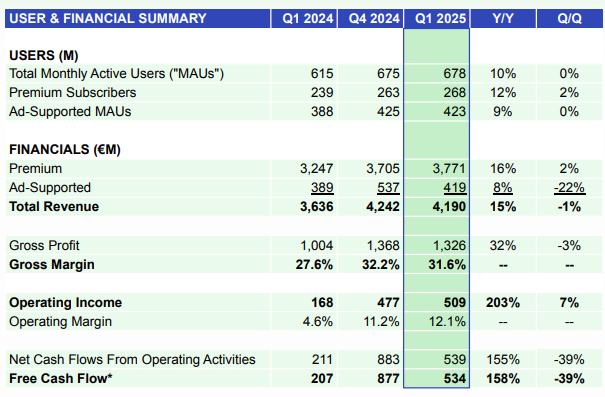

The digital music, podcast and video streaming service said operating income jumped 203% to a record €509 million (A$906 million) in Q1 but this was below guidance due to €76 million in social charges.

Spotify said gross profit rose 32% to €1.36 billion as gross margin improved by 400 basis points to 31.6% on revenue which increased 15% to €4.2 billion, which was in-line with expectations.

Subscribers increased 12% to 268 million as monthly active users (MAUs) jumped 10% to 678 million, in line with expectations for a seasonally-small quarter.

“Today, we announced our first quarter 2025 earnings, starting the year off strong by outperforming across key metrics, including the highest Q1 subscriber net adds since 2020 and a record high operating income,” the company said in a media release.

“We are pleased with our performance in Q1, as nearly all of our KPIs (key performance indicators) were in-line [or] ahead of guidance.”

Founder and CEO Daniel Ek said the underlying data was very healthy with high engagement, strong retention and its ‘freemium’ model, giving people the flexibility to “stay with us even when things feel more uncertain”.

“So yes, the short term may bring some noise, but we remain confident in the long-term story, and the direction we’re heading in feels clearer than ever,” Ek said.

“Overall, we continue to view the business as well-positioned to deliver growth and improving margins in 2025 as we reinvest to support our long-term potential.”

However Spotify shares fell as its second-quarter profit forecast of €539 million, which includes €18 million in payroll taxes, was below estimates of €557.5 million and its Q1 operating profit was below estimates of €518.2 million.

At the time of writing Spotify (NYSE: SPOT) shares had fallen $6.79 (1.4%) to US$588.21 (A$919.08) after trading between $540.10 and $590.86, capitalising the company at $120.71 billion.