According to reports referenced by major Australian ETF issuer Betashares, AI capex-related debt issuance will be the big story for credit markets in 2026 with a dramatic surge in tech-related bond issuances driving a gradual widening in credit spreads as the market absorbs this supply.

Based some projections, annual AI-related capex will grow fivefold by the end of the decade with hyperscaler companies and AI labs demanding unprecedented amounts of debt financing for their planned infrastructure buildouts.

Based on the observations of BetaShares head of fixed income Chamath De Silva, capex-related issuance is already having an impact at the margin, with the technology and communications sectors currently underperforming.

As a result, spreads are widening on a relative basis, in both U.S investment grade and high yield parts of the market.

AI-related capex to soar

Given that U.S. yields have increased over the last five years, and annual AI-related capex is expected to grow from US$400 billion to over US$2 trillion by 2029, De Silva has raised alarm bells over the bond market's capacity to handle the expected spike in issuance.

"We believe that the biggest constraint to the capex spending commitments being reached is not the debt market yet, but rather energy and power," De Silva said.

"The cost of debt capital is still low in absolute terms, credit spreads tight, and big cap tech's balance sheet health is still very good. For these reasons, we see no major barriers for a significant levering up by the hyperscalers."

However, what remains unclear, De Silva reminds investors is whether debt markets have either the willingness or capacity to finance a technological revolution with a revenue model that remains unproven.

Mounting pressures

Meantime, while AI-linked issuance is clearly rising at a meaningful click, Darpan Harar Ninety One's portfolio manager and co-head developed markets specialist credit also reminds investors that it still represents a much smaller share of global credit markets than their weight in equity indices.

“We expect dispersion to increase within credit markets, with clearer winners and losers in AI-exposed areas - particularly in the leveraged finance markets where the tech/software sector is a larger share of the market,” said Harar who agrees credit markets are facing mounting pressure from every angle.

In addition to concerns that the bond market can handle the spike in issuance, while maintaining quality standards, other mounting pressures being witnessed by Harar include compounding refinancing needs from previous debt cycles, increased competition U.S. Treasury issuance.

"The expected surge in bond issuance, partly driven by AI-related capex, is likely to weaken the strong technicals that have supported markets such as US$ investment grade for some time," Harar said.

"Against that backdrop, we expect higher levels of dispersion both between and within sectors… overall, a more dispersed environment favours credit managers with a bottom-up, global and unconstrained approach."

Record start

Meantime, while AI-related borrowing has helped absorb heavy supply across the U.S., Europe and Asia, global bond issuances soared in the first week of January reaching around US$230 billion.

With companies and governments moving quickly to secure funding, the bond market is currently experiencing the busiest start to a year on record.

Closer to At home, Commbank (ASX: CBA) was first out of the starting blocks, raising $5 billion in a senior unsecured deal with bids of more than $9.2 billion:

• A three-year floating rate tranche priced at 3-month Bank Bill Swap Rate (BBSW) + 60 basis points, raising $1.7 billion

• A five-year fixed rate tranche with a 5.040% coupon equivalent to 74 basis points over semi quarterly swap, raising $1.5 billion

• A five-year floating rate tranche priced at 3-month BBSW + 74 basis points, raising $1.8 billion

In other corporate bond news:

• Canadian pension fund, ACPPIB Capital was the first to issue a kangaroo (global issuer in A$)

• AusNet has mandated a hybrid 30-year, non-call 10 deal.

• Banco Santander issued a $1 billion new five-year senior preferred kangaroo.

o A $450m floating rate tranche with a coupon of 3-month BBSW +97 basis points.

o A $550m fixed rate tranche with a 5.218% coupon.

• Newcastle Greater Mutual Group issued a $500m five-year floating rate note with a coupon of 3-month BBSW + 113 basis points

• Overseas Chinese Banking Corporation in a three-year, senior unsecured floating rate note

• Rabobank is taking indications of interest for a new floating and or fixed five-year deal with price guidance of 82 basis points over swap.

Australian securitisation market

After two very strong years, Ken Hanton, Independent Fixed Income Specialist can see no reason for a material pull-back in the Australian securitisation market.

However, if there is going to be a pull-back he expects it to be driven more by factors affecting global fixed income markets than domestically generated ones.

Hex expects non-ADI residential mortgage backed securities (RMBS) and asset backed security (ABS) issuance to again be strong in 2026 ($56bn issued in 2024 and $62bn in 2025).

“My starting point is that total public issuance has a good chance of falling somewhere in the $75bn – $80bn range,” he noted.

“While a lot of markets look to be fully priced, and a global pull-back will happen at some point, such an environment could mean that issuance comes out below the lower end of this range and the spread differential between AAA and BBB rated notes might widen as well.”

Regardless of whether 2026 is a stronger year for bank issuance or not, he expects Australia to remain a globally relevant securitisation market in 2026.

Looking back

With 95 RMBS and ABS deals priced in the Australian public market totalling an A$ equivalent of $76 billion (excluding refinance notes) 2025 turned out to be another very strong year for the Australian securitisation market.

By collateral type there were 53 public RMBS deals in 2025 for total AUD equivalent issuance of $52.9 billion versus 62 deals for $59.2 billion in FY24.

There were also 42 public ABS deals in 2025 for $23.1 billion versus 38 deals for $18.5 billion, which is comfortably a new all-time record for the market.

Meanwhile, Senior AAA rated prime RMBS spreads (in the public primary market) ended 2025 around 15bps tighter than where they started the year, while non-conforming spreads ended the year around 25bps tighter.

Looking forward

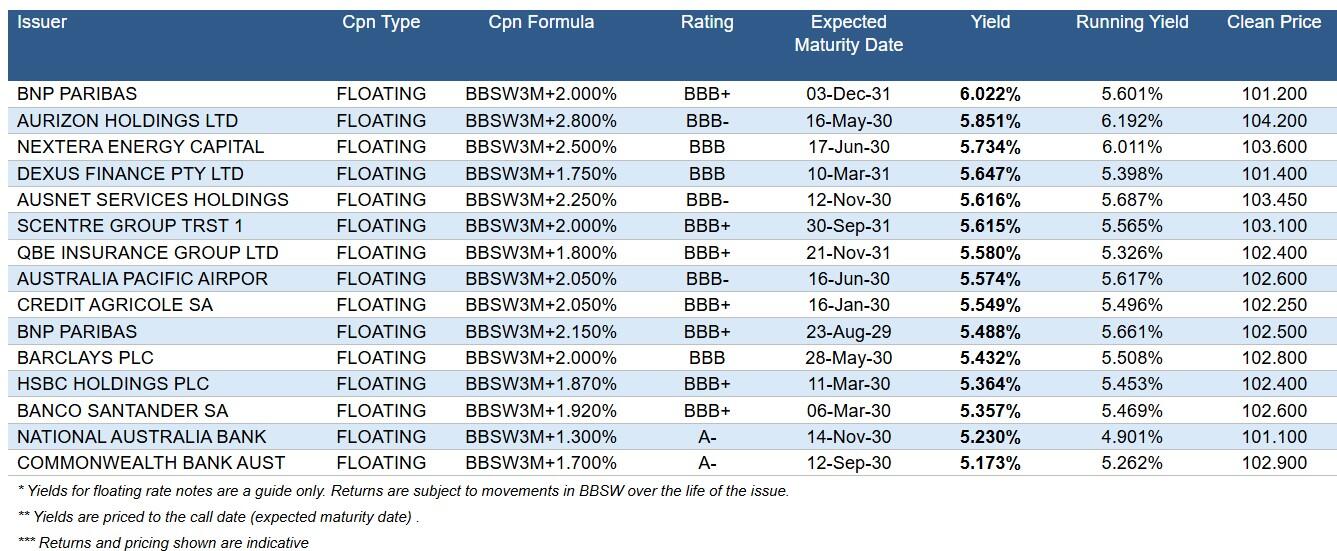

In light of significant economic developments both here in Australia and across global markets, Ellen Allardice associate director, IAM Capital Markets expects to see elevated client demand for floating-rate notes.

She expects many investors capitalising on capital growth from their longer dated fixed rate bonds, while increasing exposure to bonds like those listed below.

These floating rate securities are issued by high quality, investment grade issuers and offer compelling running yields (income).

They also insulate portfolios from the downside risks associated with fixed-rate bond price volatility.

Since their income is set at a margin above the 3-month BBSW (currently c.3.74%), the income also benefits in a rising interest rate environment.

Bonds like these offer strong liquidity in the secondary market, and align with portfolios seeking resilient income, capital stability and reduced interest-rate sensitivity.