The Intel Corp share price has fallen almost 22% since the computer chip maker issued its fourth quarter results for the 2025 financial year (Q4 FY25) and earnings guidance on Friday.

Intel (NASDAQ: INTC) shares closed US$2.53 (5.60%) lower at $42.54 on Monday (Tuesday AEDT), capitalising the company at $212.2 billion (A$405.7 billion), bringing the falls over two days to 21.8% and slicing the gains from a near doubling in price over the last year.

"The rally had been largely driven by 'the dream' rather than the near-term reality or fundamentals," TD Cowen analysts were quoted as saying in a Reuters story.

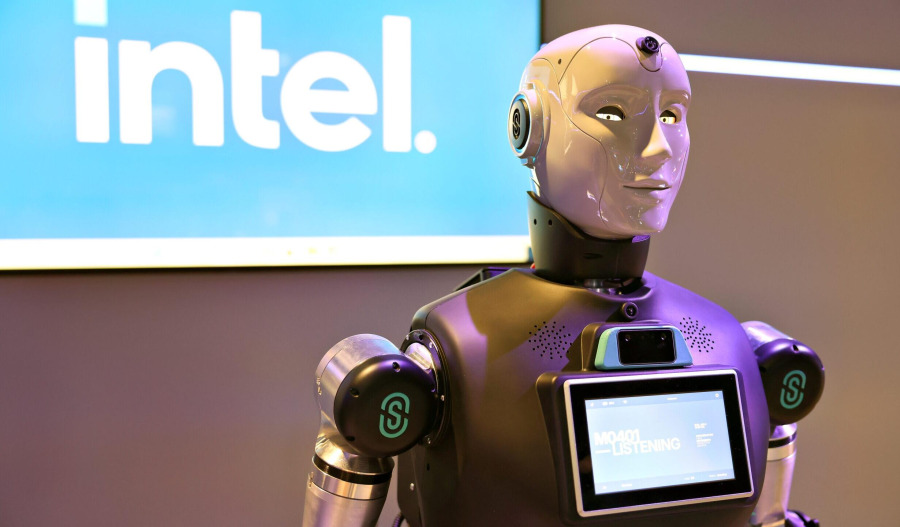

Intel has been benefitting from a surge in demand for chips used alongside advanced graphics processors in data centres, and also from investments by the United States Government, SoftBank (9984.T) and Nvidia (NASDAQ: NVDA), the world’s largest company.

Although it has been maximising production at its factories, Intel has struggled to meet strong artificial intelligence (AI)-driven demand for data-centre chips due to supply constraints, disappointing investors hoping for a corporate turnaround.

The net loss widened to US$600 million in the three months ending 27 December from $100 million in the previous corresponding period, and earnings per share (EPS) dropped to a loss of 12 cents from a one cent loss, on revenue which fell 4% to $13.7 billion.

For the full 12 months, the net loss narrowed to $300 million from $18.8 billion, and EPS dropped to a six cent loss from a $4.38 loss as revenue was flat at $52.9 billion.

"The server cycle seems real, but the company appears to have woefully misjudged it with its capacity footprint caught massively off guard," Bernstein analysts wrote.

Chief Financial Officer David Zinsner said Intel exceeded its Q4 expectations for revenue, gross margin and EPS even as it navigated industry-wide supply shortages.

“We expect our available supply to be at its lowest level in Q1 before improving in Q2 and beyond,” he said in a press release.

Intel also issued Q1 FY26 profit and revenue forecasts that were below expectations, with revenue at $11.7 billion to $12.7 billion and EPS at a 21 cent loss.

Zinsner said demand fundamentals remained healthy across Intel’s core markets.

CEO Lip-Bu Tan said Intel was working aggressively to grow supply to meet strong customer demand.

“We delivered a solid finish to the year and made progress on our journey to build a new Intel,” he said.