Housing affordability in Australia has never been worse, with home prices rising nearly 50% since 2020.

According to a new report by Cotality, it would now take a decade to save a standard 20% deposit for a house in most capital cities.

Since the pandemic, Cotality head of research Eliza Owen said around A$280,000 was added to the median dwelling value.

“This surge was fuelled by pandemic-era monetary stimulus and record-low interest rates that supercharged borrowing capacity and demand, even as housing supply lagged well behind household formation,” she said.

“The past five years combined extraordinary demand drivers with supply constraints, creating an extraordinary boom in both home values and rents.”

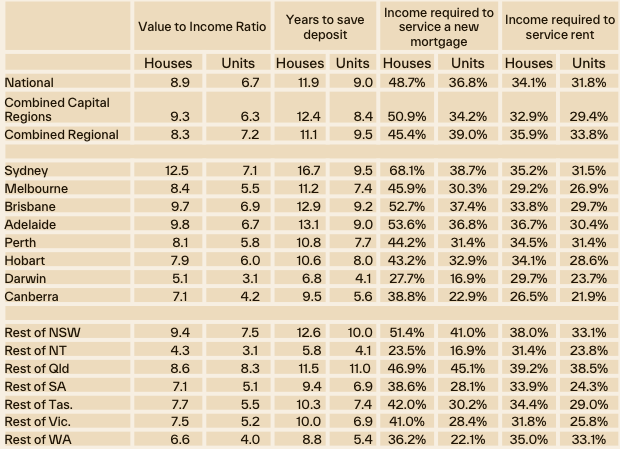

The report found that the average household needs to save around 45% of its income to service a new mortgage.

Sydney remains the most expensive and unaffordable city where the average household needs to dedicate 68% of their income to paying off the average mortgage of a house and 39% of their before-tax pay for a mortgage on a unit.

Conditions have severely deteriorated across Adelaide, Brisbane and Perth.

Canberra, Hobart and Melbourne have been bright spots with mild improvements in affordability, but most areas continue to face mounting entry barriers and rising rental costs.

Darwin is the most affordable capital city, with Darwin and the rest of the Northern Territory being the only major regions where less than 30% of income is required to service a new mortgage.

The report comes as the federal government comes under increasing pressure to find ways to accelerate the supply of new homes to ease housing prices.

Despite interest rate cuts by the RBA of 0.75 percentage points, taking the cash rate from 4.35% to 3.6% this year, demand has only increased, doing little to ease the pain.