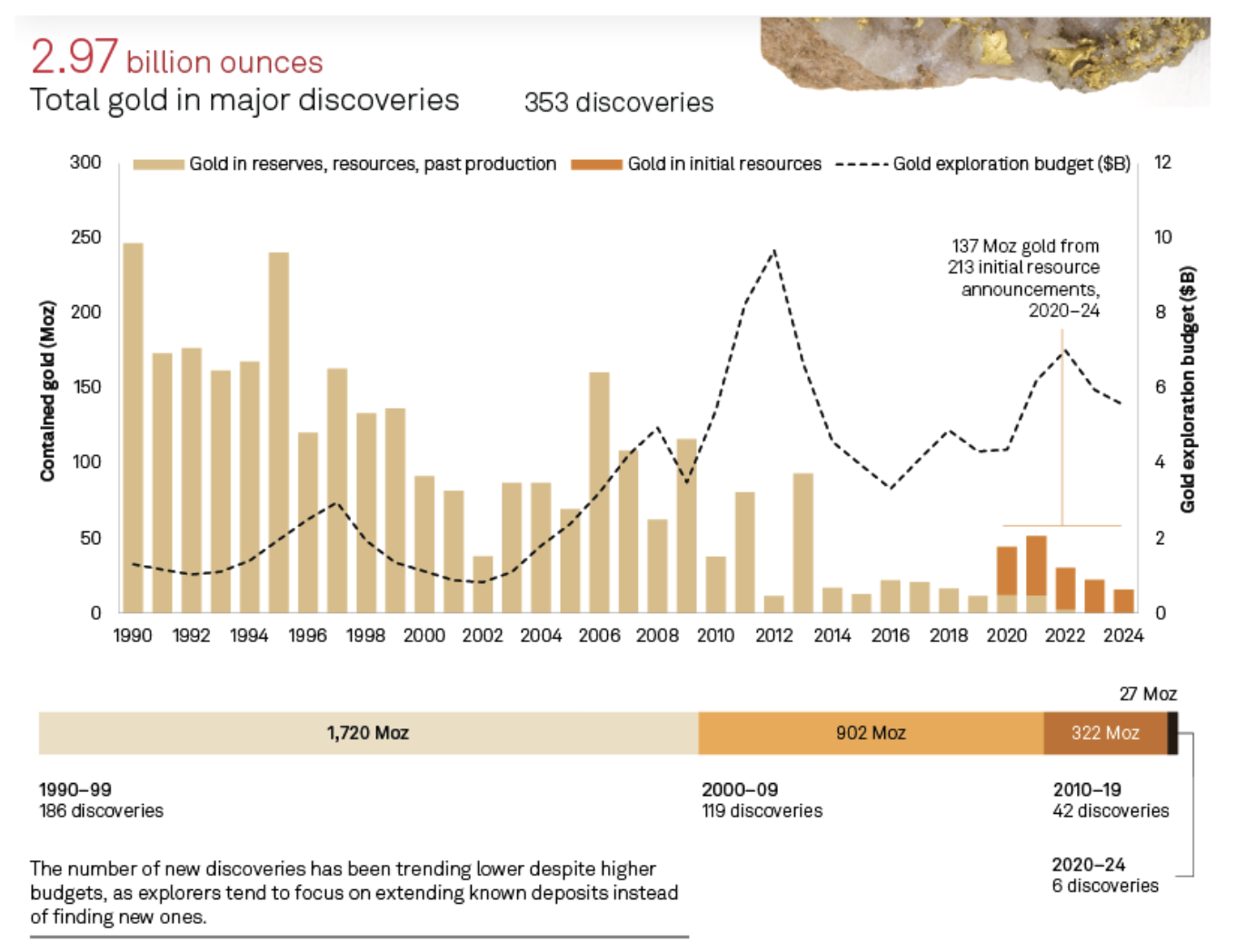

The global gold inventory has hit 3 billion ounces across 353 major deposits - yet miners haven't found a single significant discovery in two years. And exploration budgets are actually shrinking - despite gold's run past US$3,000.

No major gold discoveries happened in 2023-24; and since 2020, only six major discoveries have been made, contributing 27 million ounces (Moz), or 3% to production.

This discovery drought somehow coincides with gold's extraordinary performance. Spot gold first hit US$3,000/oz in March, and J.P. Morgan is forecasting an average of $3,675/oz by Q4 2025 and climbing toward $4,000 by mid-2026.

Industry has been slow to respond. Gold exploration budgets declined 7% to $5.55 billion in 2024. Global spending across all non-ferrous metals dropped 3% to $12.5 billion.

Juniors getting squeezed out

The exploration decline stems from financing difficulties among junior mining companies - the very companies that traditionally drive discovery efforts.

Funds raised by junior and intermediate mining companies fell 12% in 2024 to $10.3 billion, the lowest in five years, forcing companies to scale back early-stage projects.

"Juniors often lead the charge in finding new deposits," as S&P Global's Mark Ferguson notes.

The shift is obvious in exploration allocation. Grassroots or early-stage exploration within total budgets hit just 19% in 2024 - down from 50% in the mid-1990s.

Companies are playing it safe, focusing on known deposits rather than venturing into uncharted territory.

“While part of this decrease is attributable to the natural progression of assets from early-stage exploration to production, explorers have become more risk-averse over the past couple of decades,” S&P says.

“They have increasingly focused on known assets, which are safer yet offer lower potential rewards compared to riskier, more rewarding ventures - a shift contributing to fewer discoveries over the years.

“By excluding announcements of new zones at discoveries already included in our list, we identified 213 initial resource announcements containing a total of 137 Moz of new gold in 2020–24.

“Notably, only 93 of these announcements, or 44%, are from greenfield assets, while the remainder come from newly discovered zones or deposits within existing projects, highlighting the industry's preference for exploring known assets.”

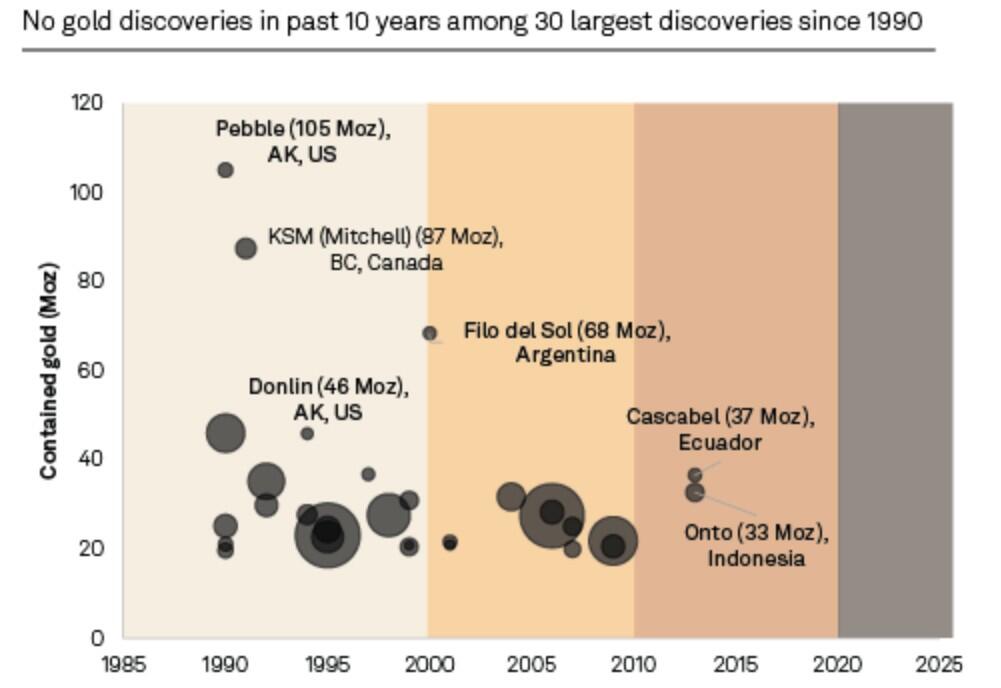

S&P research says recent gold discoveries have become increasingly scarce and smaller, with an average size of 4.4 Moz in 2020-24, down from 7.7 Moz in 2010-19.

Moreover, none of the discoveries made in the past 10 years have ranked among the largest 30 gold discoveries.

“It is important to note that while significant recent discoveries are limited, reserves and resources tend to grow over time.”