As of May 2025, both the United States and global economies are facing unprecedented levels of federal debt, raising concerns among economists, policymakers, business leaders and international institutions.

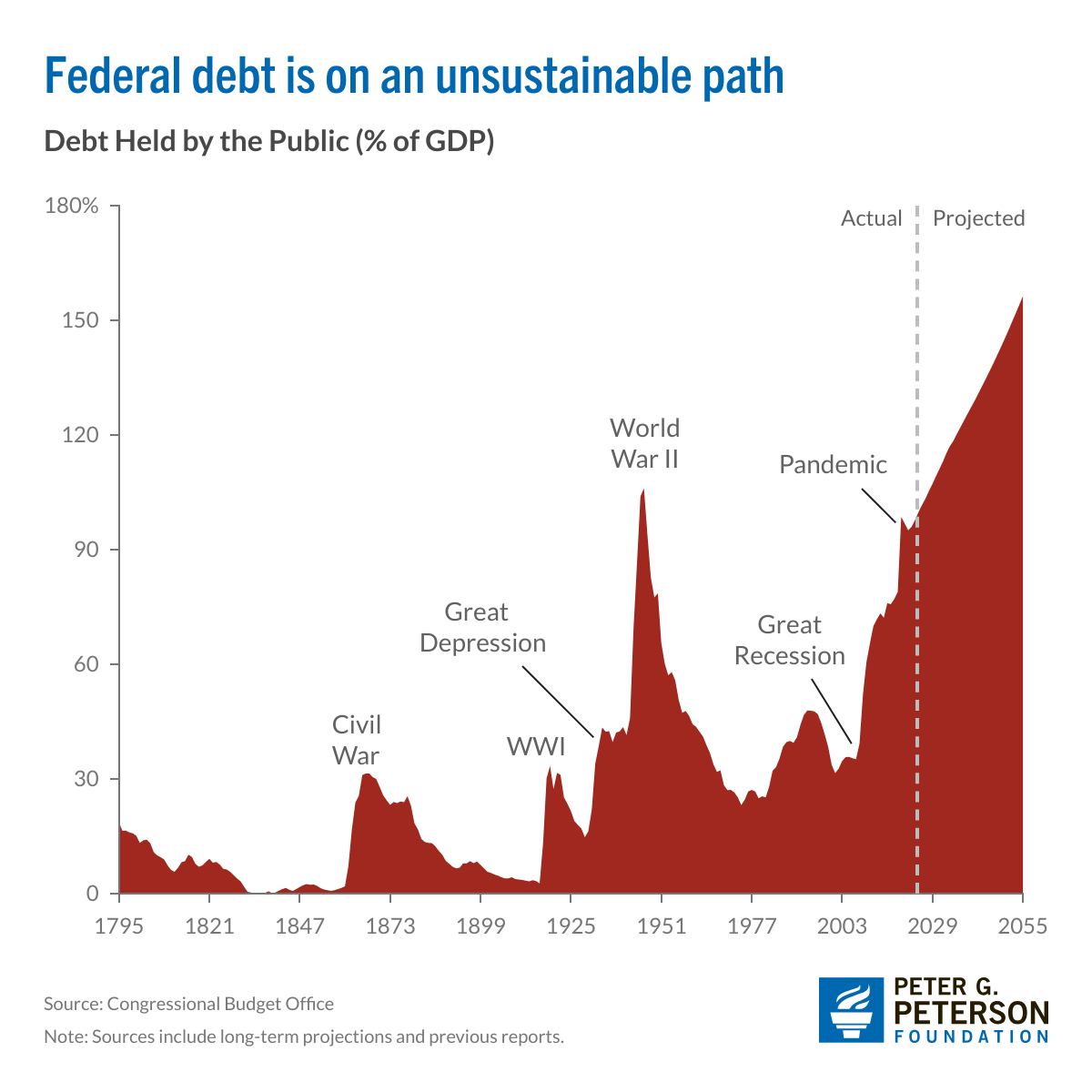

The U.S. Congressional Budget Office (CBO) projects that the federal debt held by the public will reach 156% of the nation's gross domestic product (GDP) by 2055.

The CBO attributes the surge in debt to widening budget deficits, which are expected to average 6.3% of GDP over the next 30 years - significantly higher than the 3.8% average over the past 50 years.

Drivers of US Debt Growth

Key drivers of the U.S. debt trajectory include increased spending on mandatory entitlement programmes such as Social Security and Medicare, as well as interest costs on existing debt.

By 2055, net interest outlays are projected to reach 5.4% of GDP, reflecting the compounding effect of sustained primary deficits.

According to data from the Federal Reserve Bank of St. Louis, total public debt as percent of GDP spiked to 132% as of 2020.

Business leaders across the U.S. have voiced growing concern about the debt trajectory. The Peter G. Peterson Foundation reported that many executives are sounding the alarm, warning that unchecked deficits could erode economic competitiveness, increase inflationary pressures, and limit the government’s ability to invest in the future.

Global Debt Trends Mirror US Risks

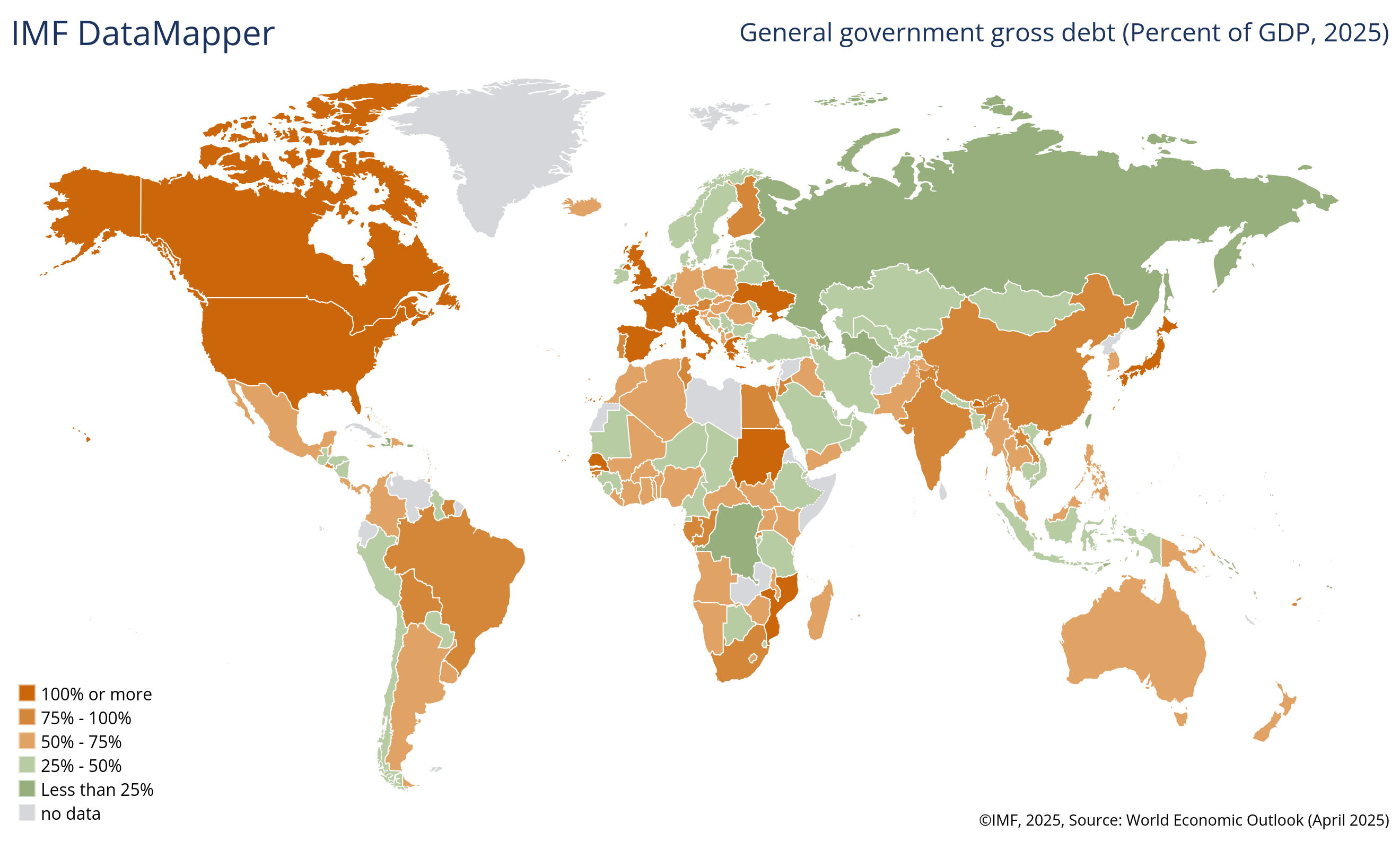

Globally, the International Monetary Fund (IMF) warns of a similar trajectory. In its April 2025 Fiscal Monitor report, the IMF projected that global public debt could rise to 117% of GDP by 2027 under a severely adverse scenario.

Contributing factors include the economic fallout from recent tariff escalations, ongoing inflationary pressures, and sluggish post-pandemic recoveries in major economies.

In a recent blog post, the IMF stressed that governments must “put their fiscal house in order”, urging policymakers to pursue medium-term consolidation strategies and rebuild fiscal buffers.

Mounting Trade and Inflation Pressures

Recent trade tensions, particularly between the U.S. and China, have further complicated global debt dynamics, as slowing growth threatens to limit government revenues, making it harder to service and reduce debt.

The IMF recently downgraded its global growth outlook, citing persistent inflation, geopolitical instability, and uncertainty over interest rate trajectories as the key risks.

The Fund also called for central banks - particularly the U.S. Federal Reserve - to retain independence in monetary policy decisions, stressing the importance of credibility in managing inflation expectations.

Meanwhile, Moody’s downgraded the U.S. credit rating from Aaa to Aa1, citing “a lack of effective policy action” and warning that rising spending, interest costs, and political gridlock threaten debt sustainability.

Debt Troubles in Major Economies

Beyond the United States, other major economies are wrestling with high debt burdens. Japan remains the most indebted developed economy, with government debt hitting a record ¥1.32 quadrillion (US$8.67 trillion) by the end of 2024, driven by decades of fiscal stimulus and an aging population.

China, meanwhile, faces its own debt reckoning. In April, Reuters reported that Fitch Ratings downgraded the country’s sovereign credit outlook, citing mounting fiscal risks and a lack of transparency around local government debt. Trade disputes and slowing growth have further eroded investor confidence.

Economic Risks and Investor Concerns

The consequences of surging debt are wide-ranging and potentially severe. High debt levels constrain a government’s fiscal space, leaving it less able to respond to future recessions or crises.

Persistent deficits can also crowd out private investment, slow economic growth, and raise borrowing costs as investors demand higher yields for perceived risk.

Moreover, prolonged high debt ratios could lead to credit rating downgrades, reduced confidence in sovereign bonds, and financial instability.

Countries that fail to stabilise debt could face fiscal dominance, where debt considerations start to dictate central bank actions, undermining monetary independence and inflation control.

Conclusion

Rising debt-to-GDP ratios in both advanced and emerging economies have prompted widespread warnings from economists, credit agencies, and multilateral institutions.

If left unaddressed, these mounting debt burdens could undermine long-term economic stability, limit future policy options, and increase the risk of financial crises.