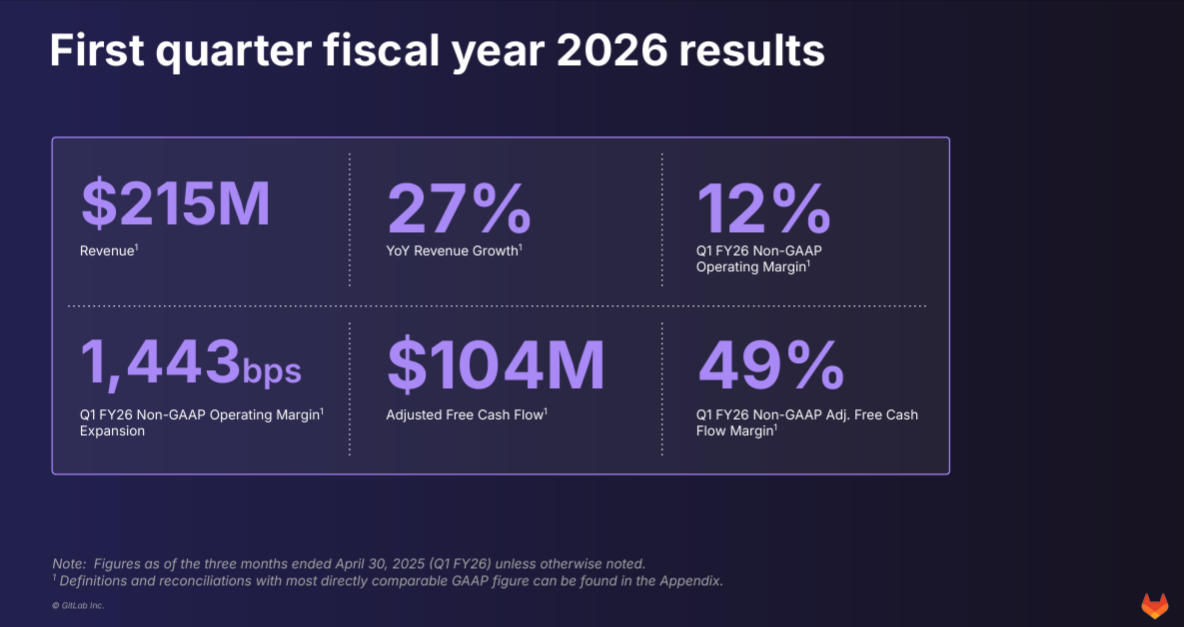

GitLab Inc. posted Q1 FY 2026 revenue of $214.5 million, marking a 27% year-over-year increase, as the company continues to expand its AI-driven DevSecOps platform.

The American company owns GitLab, an open-source DevOps software package that develops, secures, and operates software.

Earnings per share came in at $0.17, exceeding analysts’ consensus estimate of $0.15 per share.

GitLab's AI-driven platform offers features such as automated code suggestions, vulnerability detection, and continuous integration and deployment, which streamline software development. Its advanced machine learning algorithms enhance code quality by identifying potential issues before they become critical. Additionally, the platform provides actionable insights and recommendations to improve team collaboration and productivity.

The San Francisco-based firm’s strong financial performance and AI-driven innovation position it as a key player in the evolving DevSecOps landscape.

“First quarter fiscal year 2026 results underscore the power of our AI-native DevSecOps platform to help customers deliver mission-critical software. We’re giving every developer the AI-driven edge they need to innovate faster and more efficiently,” said Bill Staples, GitLab chief executive officer.

"As AI transforms development practices, our unified platform enables organisations to integrate these capabilities within a framework that helps maintain enterprise controls and deliver the required scalability and security.”

“I am pleased with our team’s execution which resulted in 27% revenue growth in the first quarter, significant year-over-year operating margin expansion, and record adjusted free cash flow,” said Brian Robins, GitLab chief financial officer.

“GitLab’s platform approach continues to drive momentum across the business, and, with our GitLab 18 release, we offer the most comprehensive, intelligent DevSecOps platform [on] the market.”

The GitLab 18 release introduces several key features that are aimed at enhancing AI capabilities and the user experience. Notably, it includes enhanced AI-driven code review tools that provide real-time feedback and suggestions, significantly reducing development time. Additionally, the release boasts improved security features, such as advanced threat detection and automated compliance checks. This ensures that software projects remain secure and compliant throughout their development lifecycle.

Profitability and Cash Flow Strengthen

Despite a GAAP operating margin of -16%, GitLab achieved a non-GAAP operating margin of 12%, reflecting improved efficiency. Operating cash flow surged to $106.3 million, while adjusted free cash flow hit $104.1 million, underscoring strong liquidity.

Customer Growth and Market Expansion

GitLab's customer base expanded, with 10,104 clients generating over $5,000 in annual recurring revenue (ARR), up 13% year-over-year. High-value customers — those exceeding $100,000 in ARR — grew 26%, reinforcing GitLab’s enterprise adoption.

Strategic Innovations and Industry Recognition

The company launched GitLab 18, integrating AI-powered DevSecOps enhancements, and announced GitLab Duo with Amazon Q, embedding autonomous agents into its platform. GitLab also secured FedRAMP Authority to Operate for government clients and was named a Leader in the Forrester Wave™: DevOps Platforms, Q2 2025.

Financial Highlights

- Revenue: $214.5 million, up 27% year-on-year

- Earnings per share (EPS): $0.17, beating the $0.15 forecast

- Non-GAAP gross margin: 90%

- Non-GAAP operating income: $26.1 million, compared to a loss of $3.8 million last year

- Adjusted free cash flow: $104.1 million, representing a 49% margin

Gitlab Inc's (NASDAQ: GTLB) stock price was $48.51, down 13 cents (0.27%) at the close. It traded after hours at $42.40, down $6.11 (12.60%). It has a market cap of around $8.01 billion.