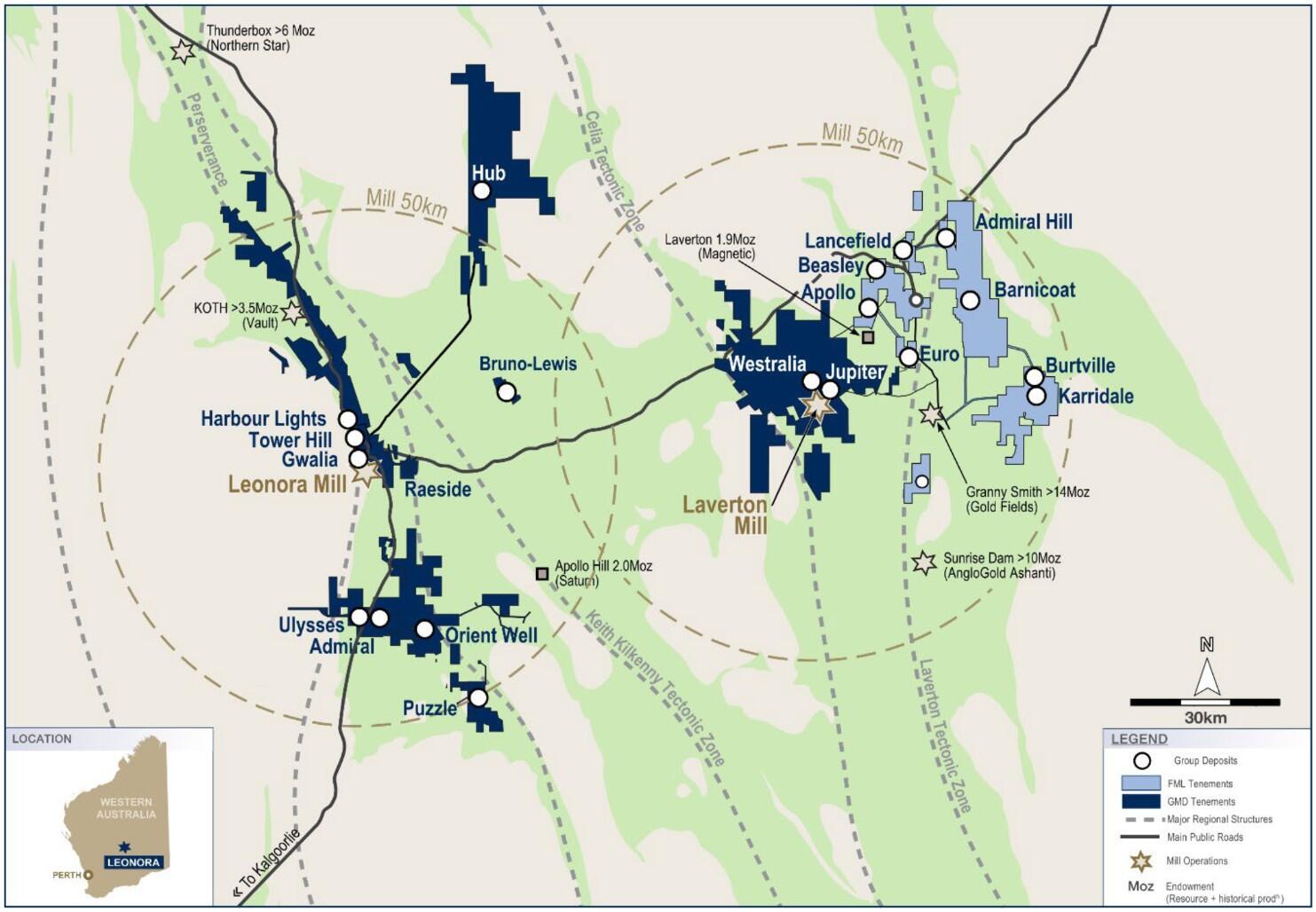

Well on the way to its target of churning out 325,000oz of gold per annum (ozpa) by 2029, Genesis Minerals (ASX: GMD), led by gold guru Raleigh Finlayson, has agreed to buy Focus Minerals' (ASX: FML) Laverton project in the northern WA Goldfields for $250 million in cash.

Focus's Laverton has a 4Moz at 1.7 grams per tonne (g/t) resource and the deal will consolidate the two companies' Laverton assets and feed into Genesis' rebooted 3Mtpa Laverton mill.

“This is the perfect bolt-on acquisition,” Finlayson said.

“It delivers a substantial 4Moz resource with immense exploration upside right next to our Laverton mill.

“It offers supplementary open pit and underground ore to our Laverton mill and in the process gives us flexibility regarding the most efficient pairing of deposits and processing infrastructure between Laverton and Leonora.

“With more ore available at Laverton, our flagship Tower Hill deposit can potentially be processed at Leonora resulting in significantly lower operating costs."

Genesis has come a long way since it bought an 80% stake in Dacian Gold for ~$111m back in 2023, which came with the Mt Morgans processing plant and Jupiter open pit mine.

Later that year it purchased the Gwalia underground mine, Tower Hill project and Leonora processing plant from St Barbara for $631 million and paid >$50 million to purchase Kin Mining.

Those acquisitions have provided the miner with a strong global mineral resource, and upside exploration and expansion potential.

Its M&A moves are reminiscent of the eventual $2.2 billion merger between Red 5 and Silver Lake Resources that consolidated to form Vault Minerals (ASX : VAU) in 2024.

Fast-forward to today, and Vault is now a strong mid-tier goldie on track to produce up to 430,000oz of gold for FY25 from its 12.4 million ounce and growing resources base.

It's also spending in-house, with an $80 million upgrade to its King of the Hills processing facility and $68 million on waste stripping.

Goldfields abuzz

It's not the first - and undoubtedly won't be the last - M&A announcement this year for the WA Goldfields region. Billions have been spent in the first five months already.

With bullion up 27% YTD, trading at US$3,358/oz and punching through all-time highs seemingly every week, shuttered, developing or expanding projects in WA's Goldfields are catching the attention of a plethora of capital investment and miners looking to expand their asset bases.

Earlier in the year South African gold major Gold Fields wihich approved a $296 million renewable energy project for its St Ives mine and just recently bought the Gruyere gold mining operation from JV partner Gold Road Resources for $3.7 billion.

$2.7 billion market-capped Westgold Resources (ASX : WGR), nine months after buying out Karora Resources for $1.2 billion, is rumoured to be opening its coffers acquisitively again - which makes sense considering it has three active and hungry mills to fill.

New Murchison Gold, Monument Mining and Meeka Metals are three juniors near the miner's operations that could be in the crosshairs.

In April, Westgold completed the sale of its Lakewood Mill south of Kalgoorlie to small cap miner Black Cat Syndicate (ASX : BC8) for $85 million.

Juniors attracting attention

Also in the news today, Horizon Minerals (ASX : HRZ) is raising $30 million in a two-tranche placement to fund drilling and the refurbishment of its Black Swan processing plant.

Back in April, mining boffin Tim Goyder's Minerals 260 (ASX : MI6) raised $220m capital for its $166m purchase of Norton Goldfields’ .2.3Moz Bullabulling gold project near Kalgoorlie.

Fun fact: Norton is 100% owned by Chinese resources behemoth Zijin Mining.

Arika Resources secured a $5 million investment for its exploration prospects in the Laverton district earlier this month, while Auric Mining (ASX : AWJ) raised $6.6 million and is concentrating on near-term gold development opportunities in the Goldfields, focusing on projects that ceased production when gold prices were significantly lower.

Brightstar Resources too (ASX : BTR). The gold junior is funding broad exploration campaigns by digging out small satellite deposits and processing them through Genesis' nearby mill.

The junior is going from strength to strength and has an $18 million debt facility it's using for a big exploration drive and pay back in bullion from its near-surface gold deposits.

In a similar mining model, Western Gold Resources (ASX : WGR) is looking to develop its 3.25Mt Gold Duke project. Stage 1 will see 447,000t mined at 2.55g/t gold for 34,000oz of gold.