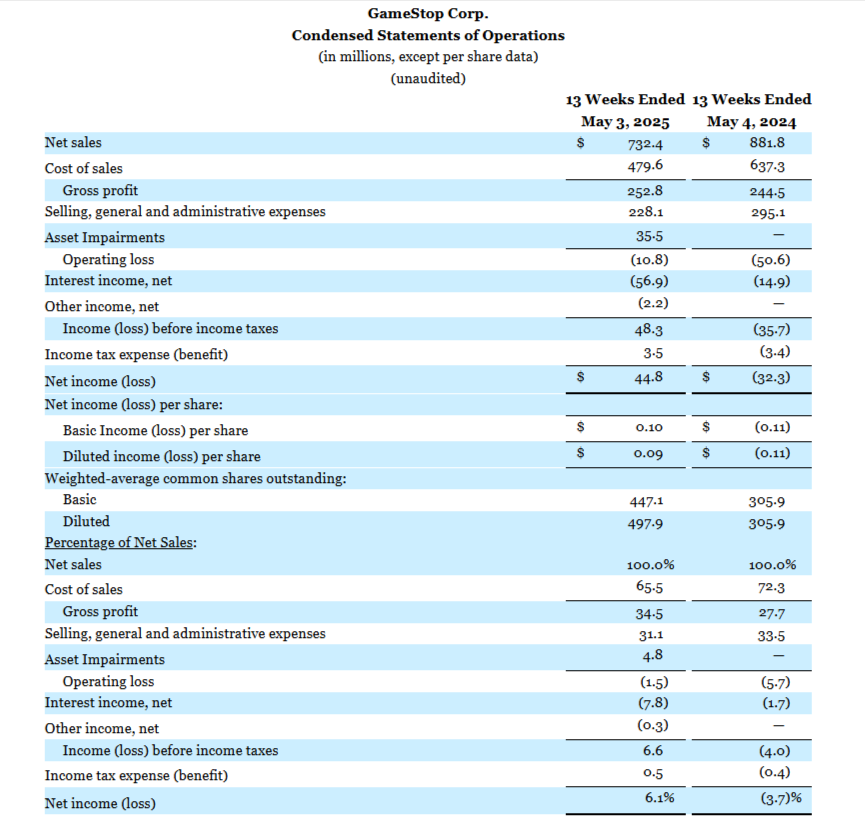

American video game, consumer electronics, and gaming merchandise retailer GameStop Corp. (NYSE: GME) posted first-quarter revenue of $732.4 million (A$1.125 billion), a 17% decline from the prior year, as the company navigates restructuring efforts and shifts in its business model.

The company also missed analyst expectations of $754.2 million.

Texas-based GameStop’s results highlight its ongoing transformation, balancing cost-cutting with new investment strategies to navigate a shifting retail landscape.

Profitability Improves Despite Revenue Decline

While sales fell, operating losses narrowed to $10.8 million, significantly improving from $50.6 million a year ago. Excluding $35.5 million in impairment charges, adjusted operating income reached $27.5 million, reversing last year’s $55 million adjusted loss. Net income surged to $44.8 million, compared with a $32.3 million loss in Q1 2024.

Financial Strength and Strategic Moves

GameStop ended the quarter with $6.4 billion in cash and marketable securities, a sharp increase from $1 billion last year. The company also divested its Canadian operations on May 4, signaling a focus on its core markets.

Bitcoin Investment Sparks Interest

In a bold move, GameStop purchased 4,710 Bitcoin between 3 May and 10 June, 2025, as part of its evolving treasury strategy. The investment aligns with the company’s broader push into digital assets, following similar moves by firms like MicroStrategy.

At the time of writing, the GameStop Corp (NYSE: GME) stock prices was $30.15, down 19 cents (0.63%) and a further $1.07 (3.55%) after hours to settle at $29.08. Its market cap was around $13.49 billion.

All financials are in US dollars.