Only days after state and federal governments rejected calls from embattled Star Entertainment Group for a lifeline, the Albanese government has stumped up more cash to ensure troubled foreign-owned regional carrier, Rex Airlines continues flying.

The Federal Government will become the principal creditor to Rex by acquiring $50 million of debt from Hong Kong private equity firm PAG Asia Capital — a figure that equates to around 80% of the troubled regional carrier’s market cap.

Recent Federal Government manoeuvres to bail out Rex follow revelations late last year that the tiny airline had donated up to $100,000 in free flights to help the major political parties. It's often suggested that these parties exploit the airline’s strong regional bias to win votes in the bush.

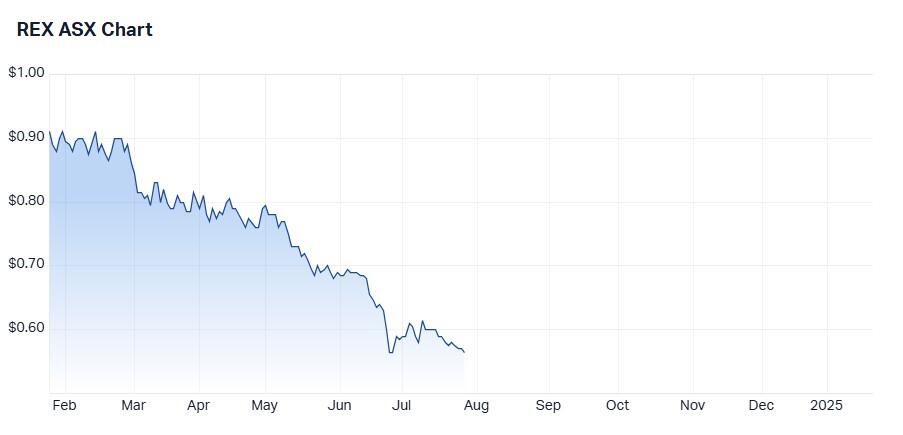

Rex, which is suspended from trading on the ASX right now, entered administration last July with debts of $500-plus, and all major city operations flown by the airline's Boeing 737s were grounded.

The Government’s $50 million bailout follows an additional $20 million PAG provided to safeguard Rex. This is responsible for flying about 5% of Australia’s domestic passengers.

Despite Australian Securities and Investments Commission (ASIC) investigations into Rex’s questionable disclosure governance last year, the Government still tipped in $80 million in cash as a funder of last resort. It’s understood that ASIC’s inquiry into alleged deceptive misconduct against four former Rex directors is ongoing.

Who really benefits?

Given that Rex is a major carrier of fly-in, fly-out (FIFO) workers, it could be argued that by propping up the airline, all the Government is doing is subsidising the ferrying of miners to and from work for mining companies.

While Rex made money before the pandemic, it has struggled to maintain profitability ever since.

Admittedly, in the last year it made a profit of $14 million. However, on closer inspection the entire profit was due to a fair value contribution from a stake it had bought in another airline.

Remove that contribution and Rex will make a pre-tax loss of $31.7 million in 2023.

Fire sale

What the Government’s latest round of funding for Rex has done is ensure the airline remains an ongoing concern. This is while the administrator, EY Ernst and Young Australia, proceeds with the sale.

For now, the Federal Government's bailout has helped Rex can keep functioning and regional Australians can still book Rex flights.

Meanwhile, the Rex administrator says the failed airline would have been wound up if the Federal Government had not injected $130 million into the company. This would have left dozens of regional towns without crucial flights.

If documents filed with the administrator are any guide, the chances of Rex finding a buyer are probably worse than beleaguered casino operator Star Entertainment lining up a suitor to buy it.

Last December EY warned that without government support and “because of the unlikelihood of any proposal for the purchase of the regional business”, the airline’s creditors would likely wind it up.

To repay creditors, EY has already sold parts of Rex’s business, including the Pel-Air air ambulance service. This was purchased by Toll Holdings for $47 million.

EY warned that despite interest in buying the airline, no credible bidder had materialised. Without government support and “because of the unlikelihood of any proposal for the purchase of the regional business”, the airline’s creditors would likely wind it up, EY said.

Unsurprisingly, rival regional airlines, including Hamilton-based Sharp Airlines which competes with Rex on some routes, are angry with the government bail-out of Rex creditors - arguing that they could step into the carrier’s routes if a buyer can’t be found.

Is new buyer for Rex more critical than finding a new buyer for Star?

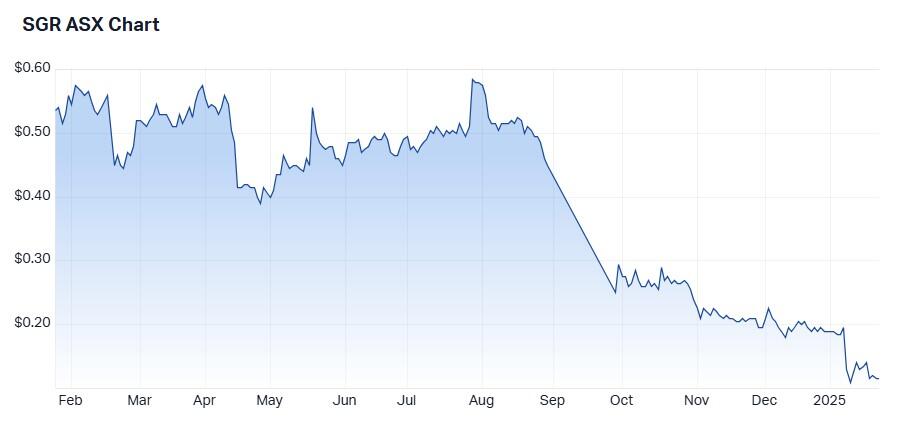

While Star Entertainment has yet to enter into administration, there appears to be no interest from either the state or federal governments to ensure this outcome does not take place.

Star has a market cap of around $330 million and employs a lot more people than Rex which has a $63 million market cap and employs around 1000 people Australia-wide.

Star is burning through its last stash of cash fast and posted a FY24 statutory net loss of $1.6 billion million (after significant items).

However, there is an argument on some level for state governments to follow their federal counterparts' lead.

At the very least they could help Star find a suitable buyer and save around 9,000 jobs.

At the time of writing, the Star Entertainment Group Ltd (ASX: SGR) share price was $0.12, with a market cap of around $316.15 million. Regional Express Holdings Limited's (ASX: REX) current share price is $0.57.