Shares in beleaguered casino operator Star Entertainment Group (ASX: SGR) were down around 2% heading into lunch on warnings of “material uncertainty” over its ability to continue as a going concern.

After reporting a 15% drop in revenue in the December quarter $299 million, the company told the market this morning it is continuing to explore possible liquidity solutions to stay afloat.

Meanwhile, Star's directors – who are looking to safe harbour provisions that protect themselves from legal liability or other penalties - continue to seek external advice in relation to their ongoing duties.

While the December quarter earnings loss of $8 million (excluding significant items) was an improvement on the $18 million earnings loss for the previous quarter, the announcement excluded significant items, which will be disclosed in Star’s first half FY25 results announcement.

Slowdown, Brisbane closure and fines take their toll

Management attributed continued weakness in the operating performance to the ongoing challenging consumer environment, the impact of the closure of its old casino precinct in Brisbane, a slowdown in spending caused by mandatory identification cards, cash limits in Sydney and the cost of remediation.

However, on a more positive note, operating expenses fell 18% to $52m due to lower corporate costs, reduced activity and Treasury Brisbane casino which was permanently closed on 25 August 2024.

After spending $108 million in the three months to December 31 trying to keep its doors open, the group has only $79 million left in the bank—less than the $100 million it has paid in fines for license breaches.

Company may not survive beyond March

Based on the speed at which the company is currently burning through money, Star has sufficient cash to last another month and a half.

Despite Star’s CEO Steve McCann calling on the NSW and Queensland governments to waive taxes, both governments have signalled their unwillingness to provide any additional fiscal support.

An eventual collapse of Star – which would be the largest corporate collapse since Virgin Australia - would put the jobs 9,000 staffers across the casino, hotel and retail on the line.

Within a recent note to clients, Morningstar analyst Angus Hewitt suggested that without a lifeline 'the company would be lucky to make it to February 28'.

Given the attractiveness of Star’s recently opened $3.6 billion Queen's Wharf project in Brisbane, plus the group’s other casino venues in Sydney and on the Gold Coast, the entity may not find it difficult to attract suitors.

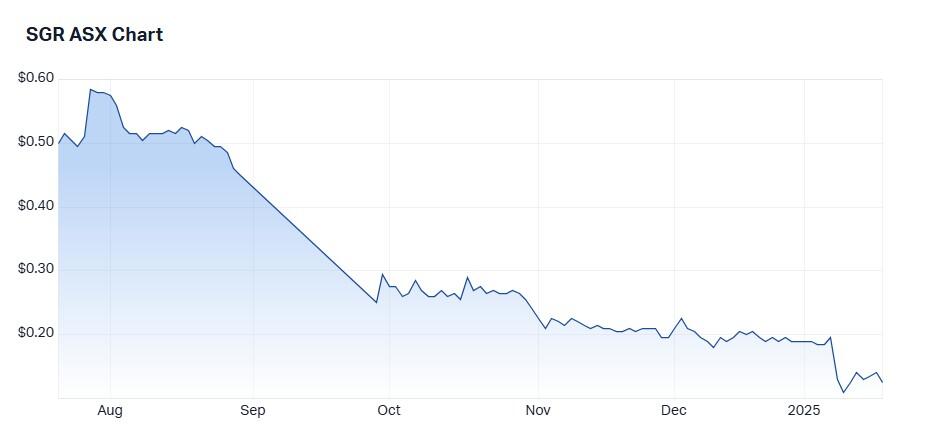

Star Group has a market cap of around $365 million and its share price is down 74% in 12 months.

Consensus recommendation is Sell.