Ferrari N.V. has kicked off 2025 with a roaring start, posting robust financial results in the first quarter as demand for high-performance luxury vehicles remains resilient.

“Another year is off to a great start” said Benedetto Vigna, CEO of Ferrari. “In the first quarter of 2025, with very few incremental shipments year on year, all key metrics recorded double-digit growth, underscoring a strong profitability driven by our product mix and continued demand for personalisations. This confirms – once again – our strategy of ‘quality of revenues over quantity’. We continue to enrich our product offering – in line with our plans – with six new models this year, which include the newly launched 296 Speciale, 296 Speciale A and the much-anticipated Ferrari elettrica through a unique and innovative unveiling. We are very excited about what lies ahead.”

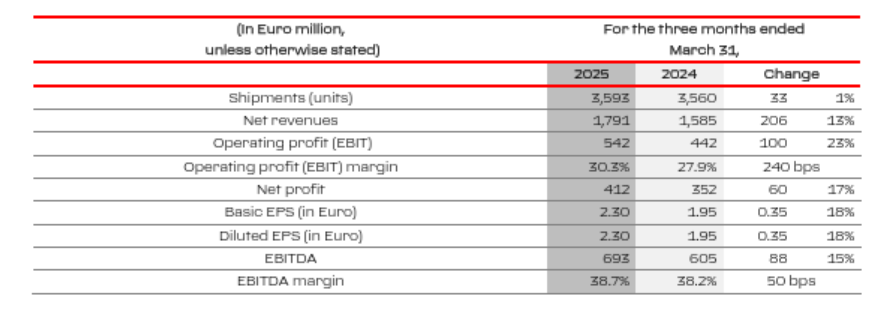

The automaker reported €1.79 billion (A$3.14 billion) in net revenue, marking a 13% year-on-year increase, while net profit surged 18% to €412 million.

Analysts had expected first-quarter net profit to come in at €410 million (A$718.38 million), according to a Reuters poll.

Strong operational performance fuelled an EBITDA margin of 38.7%, underscoring Ferrari’s pricing power and brand exclusivity. The results position Ferrari as a standout in the broader luxury automotive sector, where premium brands continue to thrive despite macroeconomic uncertainties.

The Italian marque maintained its tightly controlled production strategy, shipping 3,593 vehicles, a 1% rise over the previous year. While deliveries soared in the EMEA region (+8%), mainland China saw a decline (-25%), reflecting shifting consumer sentiment and tariff concerns. Hybrid models now constitute 49% of Ferrari's lineup, signaling a gradual shift toward electrification while maintaining the prestige of internal combustion engineering — a strategy echoed across the ultra-luxury automotive space.

Diving into segment performance, car and spare parts sales climbed 11.1% to €1.54 billion, bolstered by a strong mix of high-margin models and customisation options. Beyond vehicle sales, sponsorship and commercial revenues skyrocketed 32.1% to €191 million, showcasing Ferrari’s prowess in brand monetisation, a strategy mirrored by peers like Lamborghini and Aston Martin in expanding lifestyle ventures. Favourable currency movements added €14 million, reinforcing Ferrari's global pricing strength.

Profitability metrics remained solid, with EBIT up 22.7% to €542 million, despite higher racing and brand investment expenses. Industrial free cash flow hit €620 million, further reducing net industrial debt to just €49 million, signalling Ferrari's disciplined financial management. The company’s aggressive share repurchases, totaling €424 million, underscore confidence in long-term value creation.

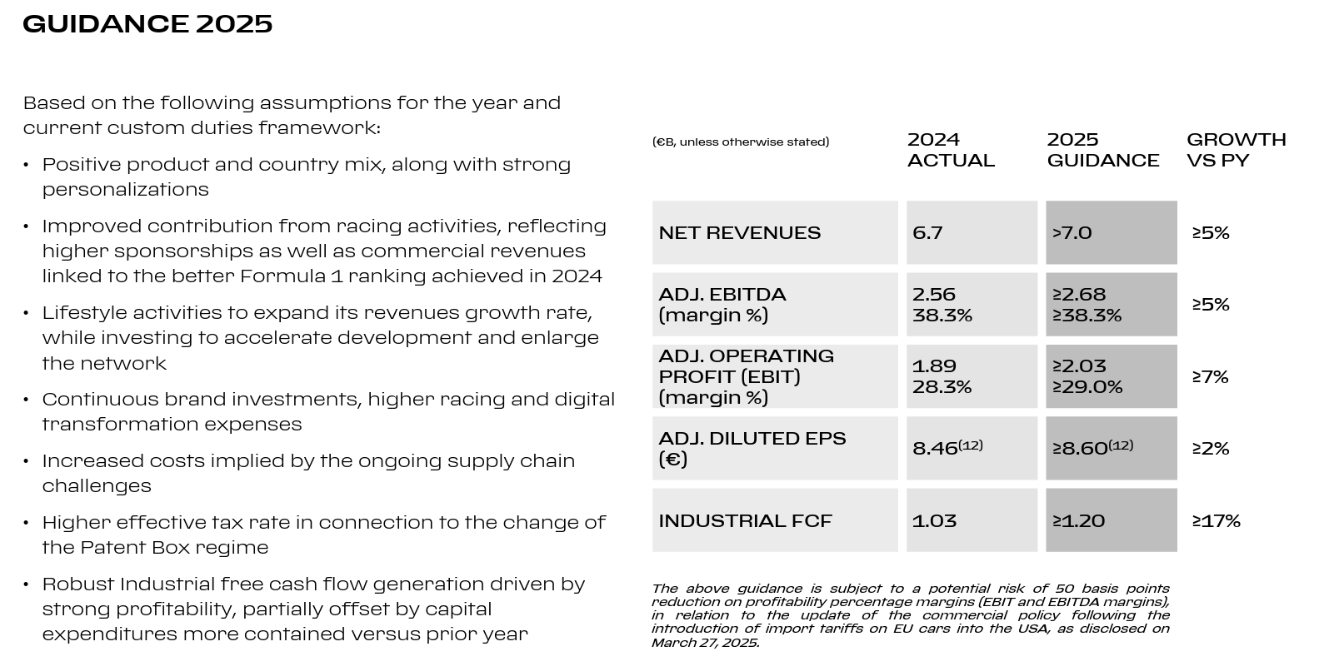

Looking ahead, Ferrari has raised its 2025 guidance, targeting over €7 billion in net revenue, with adjusted EBITDA exceeding €2.68 billion. However, potential tariff shifts loom as a risk for global expansion. As the broader luxury automotive sector leans into exclusivity and electrification, Ferrari remains a frontrunner, balancing tradition with innovation in an evolving high-net-worth consumer landscape.

At the time of writing, Ferrari NV's (BIT: RACE) stock price was €417, up €6.70 (1.63%) today, with a market cap of approximately €81.13 billion.

Related content