Tesla’s share price has looked like a rollercoaster this year. Starting 2025 at US$379, it plunged to a low of $222 in April, but has now surged to more than $430. Tesla stocks are up around 15% across the year to date.

The share price decline stemmed partly from CEO Elon Musk’s unofficial role directing the White House’s Department of Government Efficiency (DOGE) initiative, where he oversaw sweeping cuts to many federal agencies, as well as collapsing Tesla sales.

Tesla’s shares started to bounce back once Musk said he would exit DOGE, and have been sent to fresh 2025 highs after the company announced a $975 billion pay package for Musk. However, whether the company can sustain its resurgence will depend on economic headwinds and the increasingly competitive electric vehicle market.

The rally begins

Tesla’s share price began to recover when Musk said in late April that he would step back from his role at DOGE.

After Musk said he would largely exit the White House from May and instead shift his focus to Tesla, the company’s stocks climbed by 5% in after-hours trading. By the time Musk fully left his United States government role, shares had rebounded to less than 5% below Tesla’s position at the start of 2025.

The company’s share price began to sink upon U.S. President Donald Trump’s inauguration in January. Sales plummeted in countries like Germany, France, and Australia in the following months, and the U.S. saw frequent protests at Tesla dealerships.

While Tesla board chair Robyn Denholm has pushed back against the idea that Musk’s political affiliations significantly contributed to the decline in the company’s sales, polls show his work with DOGE led to a drop in consumer perceptions of Tesla. “Could there be some impact? There could be, but there were other factors as well,” said Denholm.

U.S. consumer favourability towards Tesla dropped by 27% following Musk’s White House involvement, according to a June Electric Vehicle Intelligence Report.

Brand positivity also fell across partisan lines after Musk’s June feud with Trump depressed Republican interest in the company, with Tesla’s net favourability dropping to a record low of negative 10.

September’s new heights

Another factor in Tesla’s rebounding share price has been the $975 billion pay package offered to Musk in September, followed by Musk’s first major purchase of Tesla stock since 2020.

Under the pay package plan, 12 sets of shares would be granted to Musk if the company reached certain market capitalisation targets. The maximum payout would represent around 423 million additional shares.

The first market capitalisation target would be $2 trillion, around 1.5 times Tesla’s current capitalisation of $1.37 trillion. The final threshold would be $8.5 trillion in capitalisation, and would leave Musk with around a 29% stake in the company.

According to Denholm, the pay package is intended to keep Musk “motivated and focused on delivering for the company”. It has yet to be approved by the company’s shareholders.

Tesla offered Musk a similar $56 billion payment plan based on reaching certain benchmarks in 2018, though it was struck down by the Delaware Court of Chancery last year. The court ruled that the payments were excessive, though Tesla has appealed.

Musk also bought 2.5 million Tesla shares on 12 September, worth almost $1 billion. This is his first open-market purchase since February 2020, and increases his stake in Tesla by about 0.5%. Musk owned 13% of Tesla as of December, per LSEG.

The company’s share price rose by more than 7% after his purchase was reported, and reached year-to-date highs of $470 on 2 October. Musk's personal wealth crossed the $500 billion mark for the first time on 1 October.

More challenges ahead

Whether Tesla can sustain its resurgent share price will likely depend on its response to technological issues, economic pressures, and declining brand loyalty.

Goldman Sachs raised its price target for Tesla from $300 to $395 in September, which would indicate a possible decline of around 9% from current levels over the next 12 months.

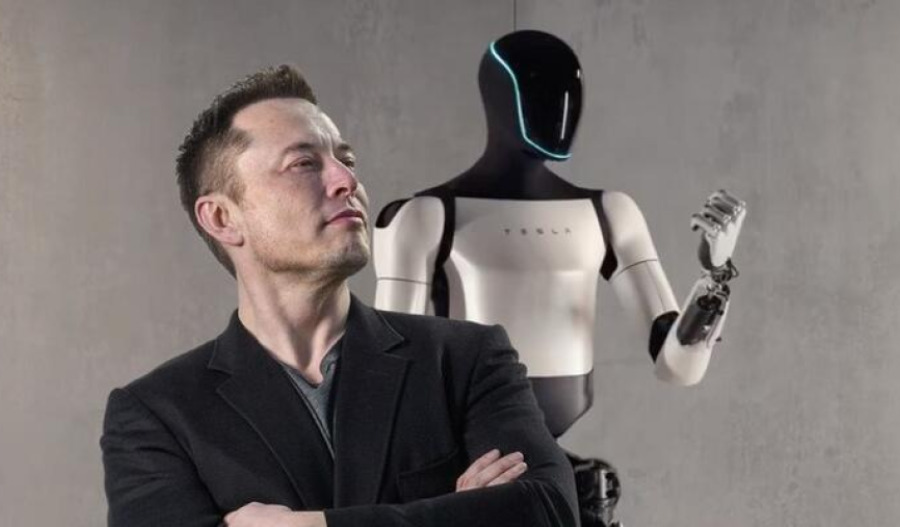

“If Tesla can have outsized share in areas such as humanoid robotics and autonomy, then there could be upside to our price target, although if competition limits profits (as is happening with the ADAS [advanced driver assistance systems] market in China) or Tesla does not execute well, then there could be downside,” wrote Goldman Sachs analyst Mark Delaney.

The company is also facing investigations and recalls due to faults in its technology. The U.S.’ National Highway Traffic Safety Administration said in September that it had opened a preliminary probe into 2021 Tesla Model Ys after reports of failures in its electronic door handles.

Price increases on Tesla’s vehicles could further depress sales. The U.S.' $7,500 tax credit for electric vehicle buyers ended on 30 September, with Tesla deliveries hitting a new record last quarter ahead of the expiry date.

In August, Tesla raised the price of its most expensive Cybertruck model by $15,000 in the U.S., and prices could rise again amid supply chain disruptions from U.S. tariffs. The company said in July that tariffs would limit its vehicle supply in the U.S. during the third quarter, and its production during that period dropped by around 13,350 vehicles year-over-year.

Additionally, brand loyalty to Tesla has declined as other electric vehicle challengers emerge. Tesla’s brand loyalty was 52.1% in mid-2025, per an S&P Global report, falling from 67% in 2022-2023.