Elders was positive about the outlook for the second half of the 2025 financial year (H2 FY25) after posting a big increase in net profit for the first half (H1) due to acquisitions, higher livestock prices and strong cost management and despite dry conditions in parts of Australia.

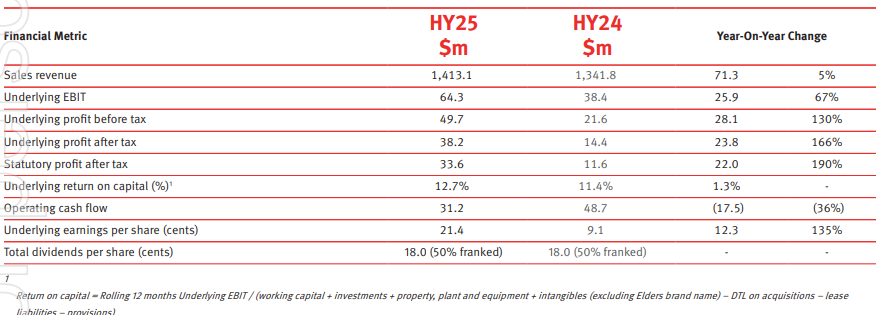

The 186-year-old agribusiness announced increases in underlying earnings before interest and tax of 130% to $49.7 million (US$32.3 million), underlying profit after tax of 166% to $38.2 million and statutory profit after tax of 190% to $33.6 million.

This was struck on a 5% lift in revenue to $1.413 billion in the six months to 31 March 2025.

Directors declared a 50% franked interim dividend of 18.0 cents per share, to be paid on 27 June to shareholders registered on 4 June, which was unchanged from the previous corresponding period although underlying earnings per share grew 135% to 21.9 cents.

“Elders’ HY25 performance saw a recovery from a challenging prior corresponding period, with most products and services achieving an uplift year on year,” the company said.

It said higher livestock prices were a key driver, improving sentiment and production margins in the livestock industry.

CEO Mark Allison said the performance was affected by prolonged dry conditions in some key cropping regions but balanced by high demand and prices for livestock.

He said livestock prices and demand were expected to remain strong, and a return to average seasonal conditions for the 2025 winter crop was forecast.

“These are all positive indicators for our business going into the second half," Allison said in an ASX announcement.

Key Real Estate Services acquisitions and strict cost management supported improved earnings, but the Retail Products gross margin declined due to ongoing dry conditions in some parts of the country, which could push demand for some winter crop inputs to H2.

Margins improved for Wholesale Products, Agency Services, Real Estate Services, Financial Services and livestock related products.

Elders said an average winter crop was forecast as a late start to sowing in parts of the country was partially mitigated by the group’s extensive geographical presence.

Favourable conditions were expected across many areas, while the prolonged dry period in South Australia and parts of Victoria had prompted widespread dry sowing.

At the time of writing Elders (ASX: ELD) shares were trading 22 cents (3.33%) lower at $6.38, capitalising the company at $1.2 billion.