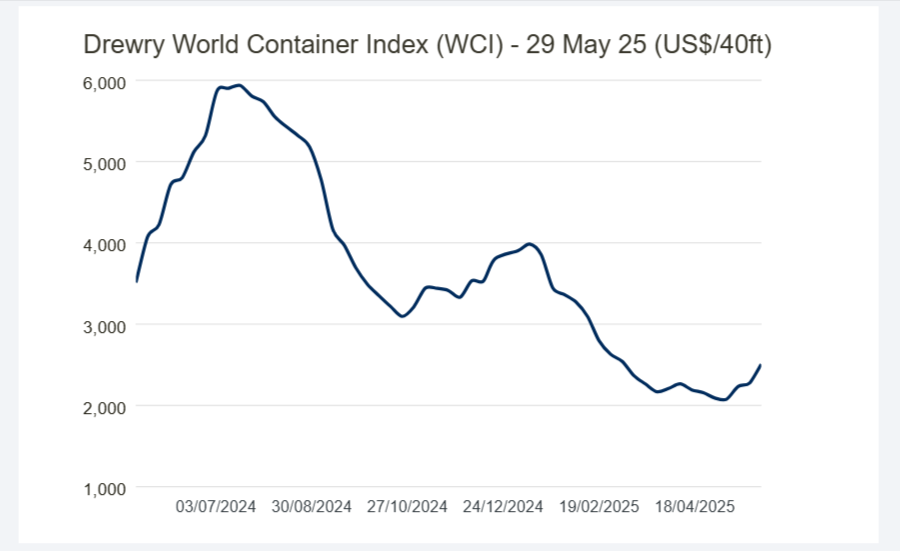

Drewry’s World Container Index (WCI) surged 10% this week, reaching US$2,508 (A$3,855.73) per 40-foot (12.192-metre) container on 29 May.

This marks a 21% increase over the past three weeks, driven by United States President Donald Trump’s temporary suspension of import tariffs, which revived transpacific shipping volumes after a prior collapse.

Freight rates from Shanghai to Los Angeles jumped 17% in the past week to $3,738 per container, reflecting a 38% increase since 8 May.

Similarly, spot rates to New York climbed 14% in the past week and 42% over three weeks, while rates from Shanghai to Rotterdam and Genoa rose 6% and 3%, respectively.

This double-digit rise in the composite index is the first since July 2024, reversing the downward trend that began in January.

Short-term strengthening in global container shipping’s supply-demand balance has been fueled by renewed U.S.-bound traffic, but underlying market conditions remain volatile.

Drewry’s Container Forecaster anticipates a weakening supply-demand balance in the second half of 2025, which is expected to drive spot rates lower.

The trajectory of freight rates will depend on legal challenges to Trump’s tariffs and uncertainties surrounding U.S. penalties on Chinese vessels, which could disrupt capacity planning.

Despite the recent rebound, structural risks persist, with trade policy uncertainty and regulatory shifts influencing rate volatility.

Market ability to sustain elevated pricing will hinge on macroeconomic conditions, carrier capacity adjustments, and geopolitical developments.

Investors should monitor policy decisions and trade flows, as these factors will shape the container shipping outlook for the remainder of the year.