The United States economy contracted in the first quarter of 2025, fuelling fears of a technical recession and a broader global economic slowdown.

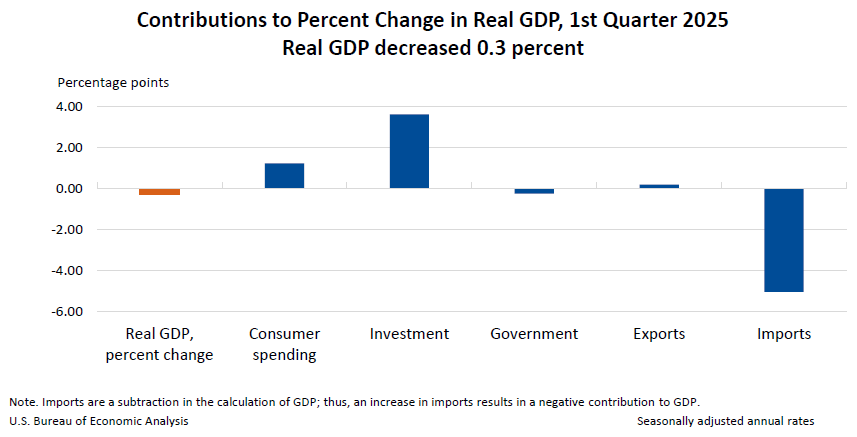

Gross domestic product (GDP) declined by 0.3% between January and March, reversing a 2.4% expansion recorded in the final quarter of 2024, according to official government figures released Wednesday.

This marks the first quarterly contraction since early 2022 and places the nation on the cusp of a technical recession, which is typically defined by two consecutive quarters of negative growth.

However, the decline was primarily due to higher imports and lower government spending, and was partly offset by gains in investment, consumer spending, and exports.

Imports surged at an annualised rate of 41.3% - the steepest increase since Q3 2020, during the height of pandemic-induced supply chain disruptions. This import spike overwhelmed a modest export gain, producing a significant trade imbalance that shaved 4.83 percentage points from GDP - one of the largest single-quarter drags on record.

The data reflected economic activity before Trump’s “Liberation Day” announcement, in which he imposed sweeping tariffs on imports from U.S. trading partners. The new duties include a dramatic increase in tariffs on Chinese goods, reigniting tensions with Beijing and triggering a trade war.

“This is Biden’s Stock Market, not Trump’s,” the president said on his Truth Social platform. “The contraction has NOTHING TO DO WITH TARIFFS, only that he left us with bad numbers, but when the boom begins, it will be like no other. BE PATIENT!!!”

In a separate release, data from the Bureau of Labor Statistics showed that wages and salaries rose 0.8% in Q1, compared to a 1.0% increase in the previous quarter.

Meanwhile, the Personal Consumption Expenditures (PCE) price index - excluding food and energy - was flat in March after rising 0.5% in February.

Consumer spending, which drives more than two-thirds of the U.S. economy, rose at a 1.8% rate in Q1, decelerating from a 4.0% pace in Q4 2024.

The increase was concentrated in March, when spending jumped 0.7%, largely driven by early motor vehicle purchases.